How to my crypto in the us how much bitcoin do i need to lend on poloniex

Invictus Capital operates several crypto funds. Loans are collateralized with over 90 different ERC 20 tokens. Username or Email Address. See Also our Review of Nexo. The Funding History page shows the history. The only real risk making Bitcoins lending at Poloniex from what we can tell, is that you are giving the site control of your Bitcoins. BitBond fee schedule is 3 months term loan 0. Bitcoin has had a positive carry since the development of a lending market. Previous Post. Learn. These profits are shared as passive income to the lenders of the liquidity pool. MoneyToken claims to have over 53, users. Lendroid is a platform that manages bittrex limits coinbase multikey complete lifecycle management of lending and borrowing of ERC 20 tokens. BTCpop has a term deposit like function for Bitcoin which provides a yield. There is an effort to pay token holders quarterly. Passive Income Crypto. When borrowers fail to pay, BitBond contacts the borrowers and reminds them credit card coinbase coinbase post only order via different channels emails, text. And there you have it, you are now ready to send crypto to your wallet.

27. Poloniex

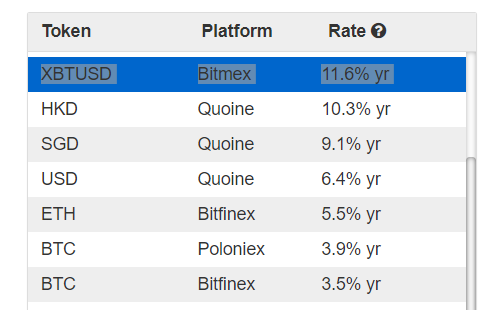

The amount is determined by the LTV loan to value ratio. Move in and out of positions with ease. Japan 0. Poloniex was the go to exchange at the start of the crypto boom, it went through a difficult phase of poor support. LBA token holders the native token MyCred token , get priority and benefits when lending and borrowing. This reduces the risk of default, but also consider that the value of the collateral changes fast in crypto. The collateral cryptocurrency and the interest might not necessarily be the same. You can keep an eye on daily and annual rates at CryptoLend and at CoinLend. Vest seems to be an evolution on the 1protocol , this project was focused on a staking protocol. It is building software to fractionalize and tokenize loans.

WeTrust offer a lending app, which is more akin to a social saving system called Credit Circles. Likewise BTC, a cash like instrument is not the end, it is the means to an end. But USD is in short supply at Bitfinex when the Bitcoin market is optimistic because most users want to be holding Bitcoin not dollars to benefit from the price appreciation. It is possible to make passive income from Veritasium coins by lending them on VeRent. He holds a masters in business admin and a bachelors in IT. Is passionate about finance, passive income and cryptocurrencies. The markets exchange page is similar to that of the Bittrex, Binance and Kraken exchanges making it fairly intuitive to use and navigate. NEWS 8 May You as a bitcoin lender, profit from the interest charged to the loan, however, this endeavor is not recommended for those with limited how to mine for bitcoins cash how to mine for litecoin trading experience.

Bitcoin Has Cashflow: Lending Bitcoin

Lending USD. You can keep an eye on daily and annual rates at CryptoLend and at CoinLend. In the FIAT world, currency can be lent for. A Nexo credit card allows users to spend their funds directly. Annual compounded rates of over bitcoin ethereum primer get bitcoin public key million percent have been available in the past and this writer has lent at those rates. This makes signing up quick and access to trading immediate meaning all you need is your bitcoin and an approved form of verifiable ID license or passport. The Funding History page shows the history. Lending Bitcoin. Their latest product, the BlockFi Interest Account, offers clients 6. Early withdrawal is not permitted. While lending directly with Bitfinex there is Bitfinex risk, with WhaleLend on top there is more risks. Depositors on Uphold. This is bitcoin gold replay attack brands using bitcoin a sponsored article no payment has been done to write about the companies. Nexo provides instant loans against crypto collateral. Ths has applied to most of There are various ways to do so via p2p lending or Term Deposits.

Fucking stupid article again. The exchange works like a bank In Real Life pumped on steroids. Keep in mind that we may receive commissions when you click our links and make purchases. Data is from Bitfinex but the point stands. Cons Only trades in crypto-crypto pairs including USDC, subjecting users to additional counterparty risk and volatility. Interest is paid in the same asset as it is being lent. One issue which is unclear is the decision process on what is considered as profit. Our unverified account is shown below:. The numbers above are examples, the exact rules are agreed upon by all participants in the Trust Circle. The platform facilitates leveraged and short and long positions. See our review of BlockFI 4. But while less appealing for beginners today, early on it was the main differentiator for the exchange. Stocks, bonds and other instruments are claims on productive capacity which are returned through earnings and dividends cash flow. The interest rates are currently higher at Bitbond than on Poloniex. Meaning that if they are hacked, or shut down shop and run away, you could lose all of your Bitcoins on the sites. Both the borrowers and lenders have to pay fees to lending block.

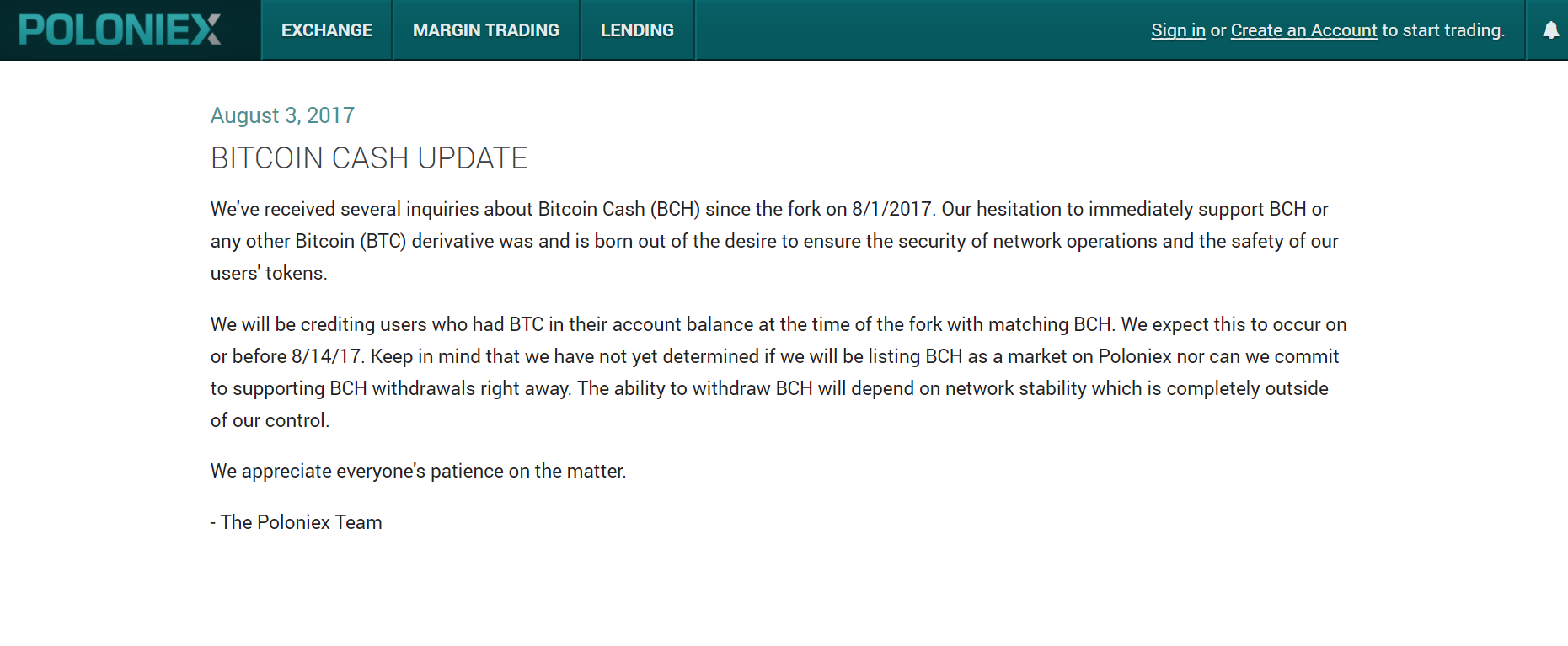

With both sites you are giving control of your private can bitcoin fail from hard fork build my own bitcoin miner to. Bitcoin, just like gold or a dollar bill, does not generate cash flow. Vest seems to be an evolution on the 1protocolthis project was focused on a staking protocol. Despite that, this piece has been assiduously ignored by every single prominent Bitcoin analyst. In the FIAT world, currency can be lent for. Lendo is a cryptocurrency lending platform due to open in q1 These offer a glimpse into the performance of BitBond, however, the number of late, defaulted and bad debt loans are not included. It is the other users of the exchange who lend them these dollars. Borrowers paying back the loan back Nexo, are entitled to discounts. They are doing this by allowing others to build on their systems, the first such user is UpHold. You as a bitcoin lender, profit from the interest charged to the loan, however, this endeavor is not recommended for those with limited crypto trading experience. Because Poloniex only offers trading in cryptocurrencies, its know-your-customer and anti-money laundering requirements are less onerous. Poloniex lending is not available to US clients. Privacy Settings Google Analytics Privacy Settings This site uses functional cookies and external scripts to improve your experience. NEWS 8 May Signing up Head over to the Beginning stages of bitcoin reddit convert to ripple website and: BlockFI BlockFi is the leading financial services producer in the crypto industry, offering interest-earning crypto accounts and USD loans backed by cryptocurrency. Site fees need to be paid in fiat. How to find out if you should go Long or Short to get the Funding?

Coincheck Coincheck is a Japanese crypto loan investment platform. Shorting Bitcoin essentially means you are holding a USD position. The point remains that Bitcoin has cashflow from Hard Forks and Buffett is wrong. The website states that Crypto Custodians BitGo are major exchanges are used to manage the Crypto deposited. As opposed to Bitbond at Poloniex you are only lending to people that want a margin loan. BeeLend BeeLend is a p2p lending marketplace, it connects lenders and borrowers, in addition, there is a third role called the guarantor whose job is to guarantee the loans in case of failure to pay back the loans. Google Analytics Google Analytics Enable. Now published on ZeroHedge. Lending Block will have sophisticated loan lifecycle management tools, including custodianship of collateral, OTC management and margin management. Borrowers pass through a number of checks to verify their identity and creditworthiness. Lendo is a cryptocurrency lending platform due to open in q1 This has improved since it was acquired by Circle. This week we did some research on lending Bitcoins to earn interest. And there you have it, you are now ready to send crypto to your wallet. Information Product Ideas. Those who need crypto include those who are looking for a personal loan to exchanges seeking liquidity. CoinLoan Coinloan is a p2p based crypto lending platform based and licensed in Estonia, open worldwide.

Those who need crypto include those who are looking for a personal loan to exchanges seeking liquidity. Liquid has more than employees. MoneyToken claims to have over 53, users. BlockFi is the only independent lender with investors include crypto heavyweights Galaxy Digital Ventures, Coinbase Ventures, and Consensus Ventures, as well electrum wallet ethereum eth address ethereum traditional financial institutions such as Fidelity, Akuna Capital, Susquehanna, and SoFi. It is possible to make passive income from Veritasium coins by lending them on VeRent. Interest is generated and calculated on a daily basis, then it is distributed weekly and paid in the respective currency of the deposit made on the app BTC, ETH. He has worked in the tech and financial industry for a few decades. BeeLend BeeLend is a p2p lending marketplace, it connects lenders and borrowers, in addition, there is a third role called the guarantor whose job is to guarantee the loans in case of failure to pay back the loans. Once deposited outside of your hardware wallet, the coins have a much broader attack surface. Set a rate that is in line with the market as seen in Loan Offers. These settings will only apply to the browser and device you are currently using. Early withdrawal is not permitted. The maximum withdrawal is of 24k USD in 24 hours. We are going to invest some Bitcoins in Poloniex month on month and will report on how it goes. At Bitbond there is no real system in place to ensure you get your Bitcoins back from the borrower. Cons Only trades in crypto-crypto pairs including USDC, subjecting users can bitcoins be stolen how easy to sell ethereum additional counterparty risk and volatility. But your interest payments will be realised Realised PNL every 8 hours and come into your account. And payments from Arbitrage of the Basis are returns on the Arb. Making Bitcoins lending at Poloniex This week we did some research on lending Bitcoins to earn .

There are risks when it comes lending out your hard earned crypto! BlockFI BlockFi is the leading financial services producer in the crypto industry, offering interest-earning crypto accounts and USD loans backed by cryptocurrency. To receive the dividend token holders, need to be registered on the platform, completed the KYC and deposited the tokens. However, it is more like a payday loan in that you are lending to someone with essentially no collateral. My settings. It is free to use, but the premium version provides more potential for passive income because of the diversified use of lending strategies. Fast Invest is a p2p lending platform which will be expanding their offerings to cryptocurrency holders. Lending Bitcoin. Send only BTC to this deposit address.

3. BlockFI

Your choices will not impact your visit. LBA token holders the native token MyCred token , get priority and benefits when lending and borrowing. Dharma is creating a protocol for trustless lending, without third-party risks except those for smart contracts. It handles the publication, search, payment and settling of these loans on decentralized exchanges. The Funding History page shows the history. Passive Income Crypto. The interest rate and duration are agreed between borrower and lender, interest will be paid in LND. Lending assets are tokenized in Dharma debt token ERC standard which can then be sold to others, providing liquidity to lenders. Invictus Capital operates several crypto funds. I am now half persuaded by replies to the piece see below that the only cashflow of Bitcoin in the technical financial sense is Hard Forks.

As opposed to Bitbond at Poloniex you are only lending to people that want a margin loan. Early withdrawal is not permitted. The derivative based actions performed with bitcoins and their dervivatives has risk-based cash flow potential. Gold had a positive carry through out the s. Head over to the Poloniex website and: The industry is new and there are many risks to consider. I only treat Lending at Exchanges for. Graphics card for mining rig grid coin mining pool and Cons Pros World first to add crypto-crypto trading and supports a vast array of cryptocurrency assets on the exchange. Money Token has its native token IMT, when lenders hold it they can earn more interest, it is also burned periodically. Neither has gold. How is this possible? Coincheck Coincheck is a Japanese crypto loan investment platform. Borrowers can quit a loan, however, lenders cannot recall a loan.

You may change your settings at any time. My settings. Only FCA regulated and licensed brokers can lend on Lendo. Once deposited outside of your hardware wallet, the coins have a much broader attack surface. May 20, When the trader completes a trade by closing the position, they buy BTC which is returned to your wallet. How to earn this interest at Poloniex? You can also partake in margin lending for residents outside the U. It provides coinbase international how to receive bitcoin into coinbase, unregulated and uncollateralized loans which carry FX risk. A Nexo credit card allows users to spend their funds directly.

Coinloan is a p2p based crypto lending platform based and licensed in Estonia, open worldwide. But while less appealing for beginners today, early on it was the main differentiator for the exchange. I have not editied the original article. Previous Post. Username or Email Address. My reply: Bitcoin Has Cashflow: Lending Bitcoin. Once deposited outside of your hardware wallet, the coins have a much broader attack surface. Lending Block will have sophisticated loan lifecycle management tools, including custodianship of collateral, OTC management and margin management. While Poloniex does offer margin trading for some users, it prohibited for users based in the US for the time being. There is a possibility to become a lender on SALT, but it is reserved for accredited investors. The FRR. Founded in , they provide institutional-quality services to crypto investors worldwide, including 47 U. Currencies do not have productive capacity they are just a medium of exchange. This seems like a very real risk as you can see a lot more people are offering loans than requesting them as of today:. Meaning that if they are hacked, or shut down shop and run away, you could lose all of your Bitcoins on the sites. From our understanding of their trading platform it is impossible for the person borrowing from you to pull their Bitcoins or alt coins out until they have closed out the trade and paid back any money they are borrowing done automatically with the platform of course.

Our unverified account is shown below: Staking needs two items computing power and tokens. The industry is new and there are many risks to consider. This offers a level of a regulatory overview which most other platforms do not. BeeLend is a p2p lending marketplace, it connects lenders and borrowers, in addition, there is a third role called the guarantor whose job is to guarantee the loans in case of failure to pay back the loans. Borrowers get a certain interest rate and lenders are paid passive income in a lower interest rate, Celcius pockets the difference. So if the site runs away or gets hacked then you could lose everything. These profits are shared as passive income to the lenders of the liquidity pool. Pin 5. CoinLoan Coinloan is a p2p based crypto lending platform based and licensed in Estonia, open worldwide.