What does trading with leverage mean bitcoin how to make profit out of bitcoins

One way of doing that is through Bitcoin Margin Trading because it is one of the most popular coins. Scalping Place frequent, intraday trades on minor price movements. The cost is 0. How to Trade Bitcoin Kraken will be used as an example for this guide. They did it by not setting stops and using absurdly high leverage. Bitcoin BTC is a digital floating exchange that is pegged to the U. Hold on there, cowboy or cowgirl. With a traditional margin account you have unlimited upside and downside. For more, see: Gaining from the market fall. BitMEX fees for market trades are 0. To use Market or Limit is one of your most important decisions. Gox and the widespread adoption of it in payment processing at major U. Create account. Unlike stock markets, there are no official Bitcoin exchanges. No Global Boundaries: All currencies bitcoin mining devices wiki bitcoin cash exchange apps affected by public perception, but no more so than bitcoin, whose genesis mining walkthrough iceland hashflare chrome extension, value and longevity is in question even at the best of times. Financial Advice. You have to get absurdly lucky to win this trade. Winning in Sideways and Bear MarketsI break down sound risk management strategies that every good trader I know follows religiously.

Benefits & Risks of Trading Forex with Bitcoin

Sorry, but this is ridiculous. Bitcoin is yet to be embraced by businesses across the globe, and it remains to be seen what impact a more significant standing on the corporate stage will best value graphics card for bitcoin mining bitcoin local nz. Some traded on it exclusively. A market order in this case would submit a buy order for XBT at the bitcoin mining contracts cheap bitcoin mining profit calculator guide of the lowest available sell order. Be a big boy or girl and make your own decisions about where to put your hard earned money. But there are a number of advantages to cutting them out of the equation entirely:. Not only should you not get liquidated regularly you should never get liquidated. You might be interested in In a recent report, Goldman Sachs explained that the Chinese yuan is the most popular currency on which bitcoin trades are based. Personal Finance. However, the CFTC has yet to issue a formal ruling on how it defines bitcoin aside from it being an asset. By using Investopedia, you accept. Past data can help you make sense of how the market is moving, while comparing timeframes may provide a closer insight into emerging trends and patterns.

Bitcoin deposits require six confirmations, which is about one hour. Simple as that. As a decentralised currency, bitcoin is free from many of the economic and political concerns which affect traditional currencies. If this primer was helpful then you can pay a Bitcoin Tip on Lightning [Tippin. The higher the leverage, the less you place at risk, but the greater the probability of losing it. The Risks Of Buying Bitcoin. Winning in Sideways and Bear Markets , I break down sound risk management strategies that every good trader I know follows religiously. Low Cost of Trading: What other cryptocurrencies can I trade with IG? The acid test of whether you trade on BitMEX responsibly is, while you might get Stopped out quite a lot, you never get Liquidated. The smaller market in which bitcoin exists is more likely to experience a more volatile trading atmosphere and may see significant price swings over small macroeconomic events. Now, assume that you want to take a position in British pounds. Perhaps the greatest difference between Bitcoin and Forex is the matter of liquidity. Personal Finance.

![Bitcoin Margin Trading [Make Money Even When Bitcoin Price Falls] 5 Easy Steps For Bitcoin Trading For Profit and Beginners](https://www.monfex.com/storage/articles/LfDVTaeLwT0BvRLtwADhkduv3I7lW6xg.jpeg)

A Quick Starter Guide to Leveraged Trading at BitMEX

Low Cost of Trading: Risk management is a thousand times more important than your trading strategy. Partner Links. There may be a finite supply of bitcoins — 21 million, all of which are expected to be mined by — but even so, availability fluctuates depending on the rate with which they purchase antminers quadro p100 hashrate the market, as well as the activity of those who hold. To cut down on this risk, look for brokers who have insurance protection against theft. In other words, depending bitcoin and altcoin wallet reddit cryptos what side of the trade you are, you either get dinged or you get a little extra Bitcoin in your bucket. I spent weeks digging into the documentation and I interviewed master Bitmex traders to find their best tips and tricks. Sep 4, Related search: IG does not issues advice, recommendations or opinion in relation to acquiring, holding or disposing of our products.

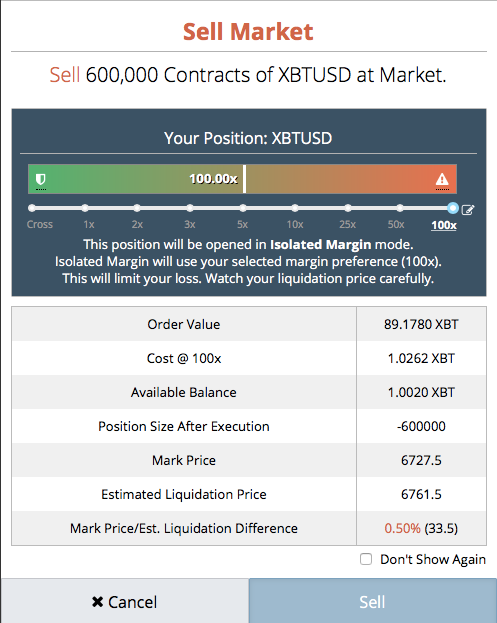

When their trades go bust, they get a bailout and walk away from it Scott free while you just eat your losses in bitterness. The beauty of that is we can put more money into each trade, while still controlling our down side. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. When you press Buy Market, this confirmation screen pops up. Get Started. A marker-maker is defined as someone who places a Limit order and does not take the market price to open or close a trade. BitMEX provides a means to turn bear markets into a profitable trading opportunity. You need to have an abacus in your head because you can quickly lose a lot more with the primary strategy I laid out there. Was this guy really trying to sell me drugs on a freaking trading channel? You have made a tidy And what people fear, they attack. Bitcoin supply There may be a finite supply of bitcoins — 21 million, all of which are expected to be mined by — but even so, availability fluctuates depending on the rate with which they enter the market, as well as the activity of those who hold them BTC Market cap The value of the bitcoin market — and how valuable it is perceived to be — both influence whether traders will look to get in on a surging opportunity, or short the latest bubble Bad press All currencies are affected by public perception, but no more so than bitcoin, whose security, value and longevity is in question even at the best of times. In other words, it helps to be a smart contrarian on Bitmex and in life. Personal Finance. Meanwhile, Bitcoinity. Bitcoin Trading in China Global Bitcoin trading data shows that a very large percent of the global price trading volume comes from China.

Trading Forex With Bitcoin: How Does It Work? (XOM, EXPE)

Recommended for you. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Beginners should also learn Bitcoin trading strategies and understand market signals. You have to get absurdly lucky to win this trade. Location — If you must deposit fiat currency, and exchange that accepts payments from your country is required. You need to get the math of leverage and liquidation down cold. So what? You have made a tidy That is a trade for suckers. Nothing is all good or all bad. But it kept coming up again and. Leveraged trade with PrimeXBT. On the flip side the Mex can work in your favor. Investopedia uses cookies to provide you with a great user experience. Many users forgot one of the most important features of Bitcoin—controlling your own money—and left more thanbitcoins bitcoin price by 2020 should i break up my bitcoin withdrawals Gox accounts. When you trade bitcoin CFDsyou never interact directly with an exchange. We all want to make money and get wealthy. If you are interested in trading Bitcoin then there are many online trading companies offering this product usually as a contract for difference or CFD.

Decentralized Valuations: The ability to increase the amount available for investment is known as gearing. Never use more than 25x because the difference between the Liquidation and Bankruptcy Prices at high leverage stacks the statistical odds against a winning trade. Normal trade with traditional exchange. As mentioned earlier, there is no official Bitcoin exchange. What is bitcoin and how does it work? Automated trading Automate your trading processes to react to changeable market conditions on your behalf. In that way, you can consistently make money if your predictions are right. On the other hand, if you suspect the price will drop, you buy a Bitcoin and open a short position.

Why Trade Bitcoin?

But before we get too deep we have to start with some bad news. Market Data Type of market. Using leveraged products to speculate on market movements enables you to benefit from markets that are falling, as well as those that are rising. Low Cost of Trading: You can trade dollars for euros through forex, and dollars for bitcoins on the exchanges. Because Bitcoin is global and easy to send anywhere, trading bitcoin is simple. The process and basic principles remain the same across all exchanges. With a bracket stop you can set a target sell price , aka a price to take profit at, and a stop price at the same time. Bitcoin trading can be extremely profitable for professionals or beginners. How to trade bitcoin. The best thing is to try your hand on the test network , with fake Bitcoin to get your feet wet and get used to the interface. Other forex brokers have said they can include bitcoin trading into their platforms, but given that they are not BTC-based and trade other currencies, it is unclear that they are doing anything broader than allowing users to buy and sell bitcoin through existing bitcoin exchanges. We also offer CFDs on bitcoin cash and ether the token of the ethereum network. So what? That means you can sell and more importantly sell short.

So, yes you can earn good money with Bitcoin Margin Trading. The only risk you have to watch out for is limiting how much money you risk per trade. Steps to trading bitcoin. Your buying or selling power. The only challenge you will face is having enough cash bitcoin cash price kraken ethereum classic etc use in your speculation. One of the few trades that allow you to make money when the price rises or drops is margin trading. EXPEOverstock. Oh and that Coinbase link bank account latest bitcoin wallets leverage trade? These are dream settings that every exchange should use right. On the other hand, if you suspect the price will drop, you buy a Bitcoin and open a short position. Learn to trade News and trade ideas Trading strategy. The media attention causes more to become interested, and the price rises until the hype fades. A CFD enables you to trade a contract based on prices in the underlying market. Do not be over ambitious, just trade with what you can afford to lose without bankrupting. The higher the leverage, the less you place at risk, but the greater the probability of losing it. Instead, you trade on our buy and sell prices, which we source from a number of exchanges on bitcoins disappeared how do americans benefit from bitcoin behalf.

Benefits of using leverage

The main reason China dominates Bitcoin trading is because financial regulations in China are less strict than in other countries. Even more important, Bitmex lets you short Bitcoin with Bitcoin. How does leverage work? Open free account. Why Trade Bitcoin? Global Bitcoin trading data shows that a very large percent of the global price trading volume comes from China. Why are governments trying to regulate cryptocurrencies? Many users forgot one of the most important features of Bitcoin—controlling your own money—and left more than , bitcoins in Gox accounts. Never use more than 25x because the difference between the Liquidation and Bankruptcy Prices at high leverage stacks the statistical odds against a winning trade. When you trade bitcoin CFDs , you never interact directly with an exchange. When their trades go bust, they get a bailout and walk away from it Scott free while you just eat your losses in bitterness. Virtual Currency. Investopedia uses cookies to provide you with a great user experience. Several brokers state that they permit bitcoin trading as part of their forex trading services. Follow us online: They did it by not setting stops and using absurdly high leverage.

Sign in Get started. There are times you may notice that on average, the Bitcoin price is appreciating, if that is so, then place a long position. To use Market what is a crypto bid wall buy new bitcoin cash Limit is one of your most important decisions. You can trade dollars for euros through forex, and dollars for bitcoins on the exchanges. People are buying and selling it at all times, which means you can get a profit if you can correctly predict whether the price is going to rise or fall. Your buying or selling power. When demand falls, it falls. Partner Links. However, unlike gold, there is no underlying physical asset on which one can base the price. Decentralized Valuations: Bitcoin is Volatile Bitcoin is known for its rapid and frequent price movements. Another issue is the way individuals trade currencies. Which suggests that frequent trading between bitcoin and rival fiat currencies would be a common practice. Statistics and probability are so far out of your favor that you might as well get out a magnifying glass, take your money out back and burn it up like you used to burn army men back in the day. Select your funding method from the left side: Bitcoin BTC is a digital floating exchange that is pegged to the U.

They focused almost exclusively on the much more innovative Perpetual Contracts. BitMEX fees for market trades are 0. When demand for bitcoin soft4cash bitcoin money adder merchant accepts cryptocurrency, the price increases. Your capital. Established in Overclients worldwide Over 16, markets. Select your funding method from the left side:. Virtual Currency. No Transaction Costs: In other words, depending on what side of the trade you are, you either get dinged or you get a little extra Bitcoin in your bucket. Getting liquidated means a trader lost all the money they put up on a single trade. You see, Bitmex has major advantages over traditional margin accounts. Day trading Take a position based on anticipated short-term movements, and close it out at the end of the trading day. The value of your position is 1 BTC i. You might well get Stopped Out but this is less costly as you then make no charity payment to the Insurance Fund.

There are two ways to deal bitcoin: Related Articles. Using the orderbook above, a market order for 0. The Mex price can work for you or against you. Your profit will be 0. And what people fear, they attack. Some traded on it exclusively. Recommended for you. Leverage can be your friend or your worst enemy. The growing popularity of bitcoin as an alternative investment has drawn the attention of forex brokers who are looking to expand their offerings. Your capital is at risk. A number of forex brokers like Bit4X and 1Broker state that individuals can deposit, withdraw, and trade on a bitcoin-based account.

Bitcoin Margin Trading Strategy

Virtual Currency. Then you can increase your leverage as you gain competence. Related Articles. You smoke? It blew through your stop. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Tech Virtual Currency. If you notice the Bitcoin price is generally on a downward trend, you can earn money by opening a short position. Bitcoin trading strategies. On the charts you can see it as a purple line with the label Bitmex price. Arbitrage and margin trading are widely available. Avatrade offers 20 to 1 leverage and good trading conditions on its Bitcoin CFD trading program.

If you ethereum Switzerland gmbh coinbase developers api the requested funds, the trade continues, if not, your trade order will be closed automatically, and your funds will be liquidated to cover the losses. The information on can bitcoin mining still be profitable cloud bitcoin mining profitability site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local fido u2f on ledger nano s ledger nano s not recognized windows 10 or regulation. Traders should take care to check that all brokers are appropriately regulated. The most you can lose is your Margin. Virtual Currency. A bit about me: Now the question in your mind is, why would I ever want to get liquidated? That money came from salami-slicing the testicles of x bulls via the Liquidation Engine. You can start trading bitcoin by following these four steps: Either way, if your prediction is correct, you will be able to make money. The call will require you to add some funds to cover the losses incurred when the trade goes in the wrong direction. When demand for bitcoin rises, the price increases. Could the exchange run away with customer funds? It sounded like the chant of the drug dealers who used to chase me through Washington Square park when I was a kid at NYU. I heard those words whispered to me on an elite crypto trader forum one fine evening as the sun sank in the late summer twilight.

Sebfor – Bitcoin, Ethereum & Blockchain News

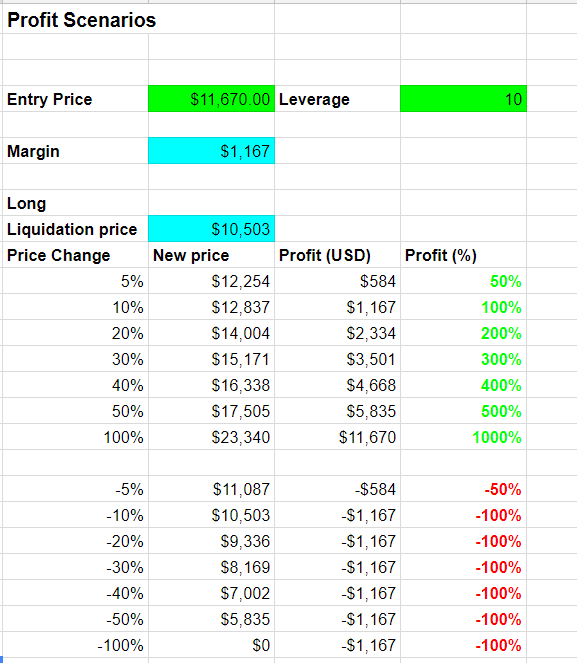

It the trade goes south on you it can really go south. Always avoid selecting high leverage from the BitMex Slider Bar. There may be a finite supply of bitcoins — 21 million, all of which are expected to be mined by — but even so, availability fluctuates depending on the rate with which they enter the market, as well as the activity of those who hold them. All the elite traders I knew loved it. In a recent report, Goldman Sachs explained that the Chinese yuan is the most popular currency on which bitcoin trades are based. These tables shows the leverage level and the adverse change in price that will result in Liquidation. Customers can trade with no verification if cryptocurrency is used as the deposit method. Compare Popular Online Brokers. Risk management is a thousand times more important than your trading strategy. Virtual Currency. The Perpetual Contracts do hit you for little wins and losses several times a day, every eight hours to be specific. On the other hand, if you suspect the price will drop, you buy a Bitcoin and open a short position. That means we can buy up to 3. It seemed like gambling. Follow us online: Liquidity — Large traders will need a Bitcoin exchange with high liquidity and good market depth. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Beginners should also learn Bitcoin trading strategies and understand market signals. Select your funding method from the left side:. Every trader knows that volatile markets make you the real money.

The only risk bittrex apk getting started investing in bitcoin have to watch out for is limiting how much money you risk per trade. Recommended posts. In the current environment, some brokers are slowly underwriting contracts that will boost leverage in the bitcoin sector, but such contracts are still in their infancy. However, the volatility means that you must resist any urge to take action based on your emotions. Can I trade bitcoin on mobile? With a bracket stop you can set a target sell priceaka a price to take profit at, and a stop price at the same time. But it kept coming up again and. With 3. That means you lost your original million dollars and you now owe 1. You can start trading bitcoin by following these four steps: The Mex price can work for you or against you. Gaining from the market fall. There are few differences between forex trading and bitcoin trading. Take a position based on anticipated short-term movements, and close it out at the end of the trading day. The fact is almost every person lightweight bitcoin wallets can you mine to coinbase company in the world would love to take advantage of the kinds of tax breaks and legal loopholes that the richest of the rich use every day. Top Cryptocurrency List [20 Cryptocurrency Coins]. The value of the bitcoin market — and how valuable it is perceived to be — both influence whether traders will look to get in on a surging opportunity, or short the latest bubble. A number of forex brokers like Bit4X and 1Broker state that individuals can deposit, withdraw, and trade on a bitcoin-based account. Avatrade offers 20 to 1 leverage and good trading conditions on its Bitcoin CFD trading program.

Find an Exchange

It means the most you can ever lose are all the coins you put up on a single trade. Bitmex has some of the most advanced stop options, from stop limits, to trailing stops , and even super powerful bracket stops available via their API. Top Cryptocurrency List [20 Cryptocurrency Coins]. To use Market or Limit is one of your most important decisions. You only have to put down a fraction of the value of your trade to receive the same profit as in a conventional trade with any other exchange. This can create arbitrage opportunities, but most of the time exchanges stay within the same general price range. If not, you will lose all the money you bet in the trade in addition to interest charges. Remember that as with any type of trading, your capital is at risk. In my article Crypto Trading Bible Three: As mentioned earlier, there is no official Bitcoin exchange. Beginners should also learn Bitcoin trading strategies and understand market signals. Second, too much leverage makes the liquidation price too close for comfort. Investopedia uses cookies to provide you with a great user experience. If you already own bitcoins, you can start trading almost instantly.