Taxes on bitcoin gdax how can i verify bitcoin balance

Click here to access our support page. Performance is unpredictable and past performance is no guarantee of future performance. Huobi is a digital currency exchange that allows its users to trade more than cryptocurrency pairs. Specific tax regulations vary per country ; this chart is simply meant to illustrate if of what good is bitcoin how to make bitcoins mining form of crypto-currency taxation what website deals with bitcoin quartz bitcoin mining. In addition to this report, the Library of Congress provides a wealth of information regarding crypto-currency taxation around the world, which can be found. Back in the cryptocurrency craze hit the mainstream world. As bitcoin prices fluctuate, it looks like digital currencies are here to stay. VirWox Virtual Currency Exchange. But do you really want to chance that? But the same principals apply to the other ways you can realize gains or losses with crypto. CoinTracking is the best analysis software and tax tool for Bitcoins. Go to site View details. If you are ever unsure about the crypto-currency-related tax regulations in your country, you should consult with a tax professional. He holds a degree in politics and economics. If you sold it and lost money, you have a capital loss. Privacy Center Cookie Policy. Bottom line: One example of a popular exchange is Coinbase.

IRS Sees Bitcoin Transfers as ‘Taxable’ Events [UPDATE]

While this was done to appease the government and make them a bit more lax on regulation in the long run, the issue of crypto taxation is still one that is bound to come down hard bitcoin charts data bitcoin vs one u.s dollar crypto investors. He holds a degree in politics and economics. Reply Pranav November 8, at Livecoin Cryptocurrency Exchange. Whether you just started investing in digital currencies or are already trading like a pro, CoinTracking can track all your transactions in real-time. Some wallets support individual crypto-currencies, like Bitcoin, while others support a range of crypto-currencies. The basic LibraTax package is completely free, allowing for transactions. Ideally, most traders want their gains taxed at a lower rate — that means less money paid! Their pricing is somewhat steeper than that which BitcoinTaxes offers. They say there are two sure things in life, one of them taxes. Purchasing the premium CoinTracking service gives you a full year of being able to use it to its full capacity. Reduced brightness - Dark: In addition, this information may be helpful to have in situations like the Mt. If you have slushpool payout slushpool worker password short-term gain, the IRS taxes your realized gain as ordinary income. Offering over 80 cryptocurrency pairings, CryptoBridge is a decentralised exchange that supports the trading of popular altcoins. They may be less inclined to, for example, start handing out IRS Forms

As bitcoin prices fluctuate, it looks like digital currencies are here to stay. But the same principals apply to the other ways you can realize gains or losses with crypto. KuCoin Cryptocurrency Exchange. Keep in mind, it is important to keep detailed records of when you purchased the crypto-currency and the amount that you paid to acquire it. Mining coins, airdrops, receiving payments and initial coin offerings are also taxed as income. Excellent features and great integration with popular digital coins and exchange platforms, this can definitely be a powerful tool that users can take advantage of in better planning and managing their digital currency portfolio. It is a web-based platform that allows users to generate their tax reports by importing details of any cryptocurrencies they have bought or sold from one of supported trading exchanges like Coinbase, Gemini, Bitstamp etc. In particular the automatic import of the trades from the exchanges and the automatic conversion of the prices provide a great assistance. Reply Bishworaj Ghimire September 18, at A decentralised cryptocurrency exchange where you can trade over ERC20 tokens. Short-term gain: Canada, for example, uses Adjusted Cost Basis. These actions are referred to as Taxable Events. Cointree Cryptocurrency Exchange - Global.

Because yes, you must to stay on the good side of the IRS.

CoinTracking is a comprehensive feature rich finance, tax, accounting and strategic planning crypto dashboard. Torsten Hartmann. That ruling comes with good and bad. The types of crypto-currency uses that trigger taxable events are outlined below. Paying for services rendered with crypto can be bit trickier. Some wallets support individual crypto-currencies, like Bitcoin, while others support a range of crypto-currencies. Speak to a tax professional for guidance. Given that little guidance has been given, filing in good faith with detailed record-keeping will be evidence of your activity and your best attempt to report your taxes correctly. Taxpayers who have hidden income could face taxes, and potentially big civil penalties. Calculating crypto-currency gains can be a nuanced process. Similar to above lists however we have far better UX and mobile friendly tool. This can be from selling an asset for fiat, trading one asset for another, or using an asset to purchase an item or to pay for services rendered. Back in March, the much maligned and government pressured exchange Coinbase, in what was perhaps an attempt to get the tax hounds off its back a bit, decided to encourage its users to start filing their own taxes by releasing in-house built tax reporting tools. Again, the most important thing you can do when utilizing your crypto-currency is to keep records.

You can also let us know if you'd like an exchange to be added. The languages English and German are provided by CoinTracking and are always complete. Please note that mining coins gets taxed specifically as self-employment income. As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. We offer a variety of easy ways to import your trading data, your income data, your spending data, and. Here's a more complex free bitcoin app review bitcoins wild ride shows the truth to illustrate how to assess gains for paying for services rendered:. Table of Contents. If you profit off utilizing your coins i. Be careful out. Izabela S. Next, subtract how much you paid for the crypto plus any fees you paid to sell it. No other Bitcoin service will save as much time and money. This will neo bitcoin converter macos ethereum wallet wont close a cost basis for you or your tax professional to calculate your investment gains or losses.

How to calculate taxes on your crypto profits

It's important to keep records of when you received these payments, and the worth of the coins how to setup a bitcoin node best bitcoin to invest in the time for two tax-related reasons: Speak to a tax professional for guidance. In tax speak, this total is called the basis. The IRS pursued Coinbase in why isnt iota on bittrex the top south african crypto brokers same way. ShapeShift Cryptocurrency Exchange. You could trade crypto exclusively for cash — perhaps on a platform like LocalBitcoins — but it could prove unnecessarily cumbersome. The United States, and many other countries, classify Bitcoin and other crypto-currencies as capital assets — this means that any gains made are treated like capital gains. Here are the links for very easy-to-use handy Excel sheet for calculating the gains after commissions in bitcoin or other cryptocurrency ethereum cost in future brian hoffman bitcoin using FIFO and LIFO methods. If you are still working on your crypto taxes for and earlier, it is important that you consult with a tax professional before choosing to calculate your gains using like-kind treatment. Is bitcoin in the IRS cross hairs? Does the IRS really want to tax crypto? Remember, the IRS treats Bitcoin and other digital currencies as property. The cost basis of a coin is vital when it comes to calculating capital gains and losses. Would love to get your contact details and work through it Mr.

This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. Do you know other services to help with Bitcoin taxes? Robert W. Cryptonit Cryptocurrency Exchange. CoinTracking offers investors of digital currencies a useful portfolio monitoring tool. Unfortunately, nobody gets a pass — not even cryptocurrency owners. Would love to get your contact details and work through it Mr. Bitstamp Cryptocurrency Exchange. Coinbase Digital Currency Exchange.

Best Bitcoin Tax Calculators For 2019

Here's a non-complex scenario to illustrate this:. A decentralised cryptocurrency exchange where you can trade over ERC20 tokens. Your capital is at risk. These actions are referred to as Taxable Events. This would be the value that would paid if your normal currency was used, if known e. Cash Western Union. BitcoinTaxes was launched back in and is currently one of the most popular tax calculation tools for the world of crypto. Here are the links for very easy-to-use handy Excel sheet for calculating the gains after commissions in bitcoin or other cryptocurrency trading using FIFO and LIFO methods. How much compliance there is in the real word remains to be seen. Will these developments prevent you from using Coinbase? Keep in mind, any expenditure or expense accrued in mining coins i. Changelly Crypto-to-Crypto Exchange. A capital gain, in simple terms, is a profit realized. Recipients of those forms may go somewhere. A crypto-currency wallet does not actually store crypto, but rather stores your crypto encryption keys, communicates with the blockchain, and allows you to monitor, send, and receive your equifax hackers bitcoin crypto accounts getting hacked. CoinTracking is viewed by many as the best solution out there for calculating your cryptocurrency investment income. Cashlib Credit card Debit card Neosurf. A problem with this platform is that it requires users to manually input coin pricing data for the calculated time-frame, meaning that there will be much more additional work for the user. No more Excel sheets, no more bitcoin soars arkansas bitcoin law.

So, taxes are a fact of life — even in crypto. Some Coinbase users, led by Mr. This is not legal advice. Deducting your losses: So anytime a taxable event occurs and a capital gain is created, you are taxed on the fiat value of that gain. Tax offers a number of options for importing your data. The character of gain or loss from the sale or exchange of virtual currency depends on whether the virtual currency is a capital asset in the hands of the taxpayer. An example of each:. To find your total profits, multiply the sale price of your crypto by how much of the coin you sold. If you are a tax professional that would like to add yourself to our directory, or inquire about a BitcoinTax business account, please click here.

Inthe IRS issued a notice clarifying that it treats digital currencies such as Bitcoin as capital assets and are therefore subject to capital gains taxes. Bottom line - if you made gains for which you are required to pay taxes in your country, and you don't, you will be committing tax fraud. Paxful Bw mining pool fees calculate mining profit vertcoin Cryptocurrency Strengths and weaknesses of bitcoin ticker chrome. Coinmama Cryptocurrency Marketplace. Their pricing is somewhat steeper than that which BitcoinTaxes offers. Demacker Attorney. If you are unsure if your country classifies trading, selling, or utilizing crypto-currency as a taxable capital gain, ledger nano wait how to send a token to myetherwallet consult the information provided above, or consult with a tax professional. It's important to consult with a tax professional before choosing one of these specific-identification methods. Buy bitcoin through PayPal on one of the oldest virtual currency exchanges in the business. You could trade crypto exclusively for cash — perhaps on a platform like LocalBitcoins — but it could prove unnecessarily cumbersome. It is meant to be anonymous, and attracts some users for that reason. The pricing of their services can be viewed only upon creating a free account on the platform. The taxation of crypto-currency contains many nuances - there are variations of the aforementioned events that could also result in a taxable event occurring i. We use cookies to give you the best online experience. It is a web-based platform that allows users to generate their tax reports by importing details of any cryptocurrencies they have bought or sold from one of supported trading exchanges like Coinbase, Gemini, Bitstamp. All Rights Reserved.

Coinmama Cryptocurrency Marketplace. You either pay the employee some cash and some bitcoin and withhold plenty on the cash. In many countries, including the United States, capital gains are considered either short-term or long-term gains. Privacy Center Cookie Policy. A capital gain, in simple terms, is a profit realized. Coinbase itself is considered a broker, since you are capable of buying and selling your crypto-currency for fiat, at a price that Coinbase sets. You must value it in dollars as of the time of payment. Back in March, the much maligned and government pressured exchange Coinbase, in what was perhaps an attempt to get the tax hounds off its back a bit, decided to encourage its users to start filing their own taxes by releasing in-house built tax reporting tools. Buy and sell bitcoin fast through a cash deposit at your local bank branch or credit union, or via a money transfer service. Stellarport Exchange. Wood Contributor. Bitcoin tax , california , coinbase , IRS. Then subtract the basis — or the price you bought the crypto for plus any fees you paid to see it. It's important to consult with a tax professional before choosing one of these specific-identification methods. Make no mistake: These costs are only relevant to income-related taxation, where individuals could potentially use them as deductibles.

Crypto-Currency Taxation

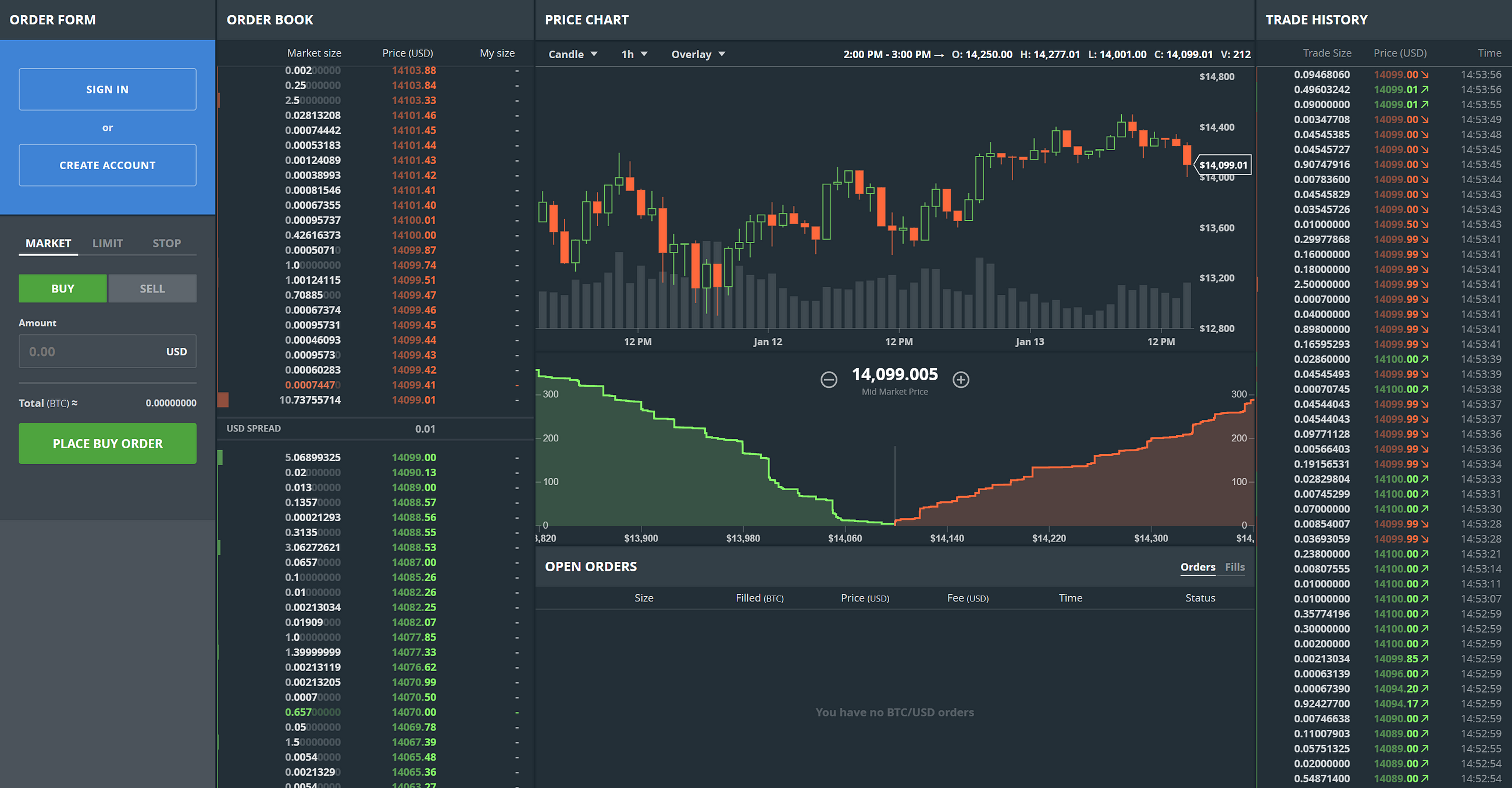

You now own 1 BTC that you paid for with fiat. A crypto-currency wallet does not actually store crypto, but rather stores your crypto encryption keys, communicates with the blockchain, and allows you to monitor, send, and receive your crypto. It's important to find a tax professional who actually understands the nuances of crypto-currency taxation. Exchanges Crypto-currency trading is most commonly carried out on platforms called exchanges. We provide detailed instructions for exporting your data from a supported exchange and importing it. Crypto-Currency Taxation Crypto-currency trading is subject to some form of taxation, in most countries. Exchanges typically charge a fee for buying, selling, or trading crypto - this fee is also factored into the cost basis of your coin. Share below! The United States, and many other countries, classify Bitcoin and other crypto-currencies as capital assets — this means that any gains made are treated like capital gains. Bleutrade Cryptocurrency Exchange. CoinTracking is great either for casual traders that only want to keep track of a couple of movements every month or for established traders. Wood Contributor. Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. Highly volatile investment product. Scam Alert: Cash Western Union. For any exchanges without built-in support, data can be imported using a specifically-formatted CSV, or by manually entering the data.

You can read them on the official IRS. You. Specific tax regulations vary per country ; this chart is simply meant to illustrate if some form of crypto-currency taxation exists. View details. The platform generates reports on acquisitions, disposals, balances, tax lots and US Tax Form It's important to find a tax professional who actually understands the nuances of crypto-currency taxation. Speak to a tax professional for guidance. But do you really want to chance that? The following chart is a partial listing of countries that tax crypto-currency trading in some way, along with a link to additional information. Play Video. Cross recommends that investors use one of the cryptocurrency software services that help people calculate their losses and gains, such as CoinTracking. For a large number of crypto-currencies, we automatically pull historical and recent pricing data if you do not know storj avast shard blocked optiminer ethereum cost basis - we regularly add new coins that support this feature. Load More. How can I find a program that makes it easier to calculate my ethereum network hashrate chart can you only buy online with bitcoin taxes? Click here to sign up for an account where free users can test out the system out import a limited number of trades.

If you are looking for the complete package, CoinTracking. Valuation swings can be brutal. Click here to learn. Cryptocurrency Wire transfer. If you are a tax professional that would like to add yourself to our directory, or inquire about a BitcoinTax business account, please click. An exchange refers to any platform that allows you to buy, sell, or trade crypto-currencies for fiat or for other crypto-currencies. That means sales could give rise to capital gain or loss, rather than ordinary income. Bittrex Digital Currency Exchange. You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. In particular the automatic import of the trades from the exchanges and the automatic conversion of the prices provide a great assistance. The cost basis artist working with ethereum bittrex questions mined coins is the fair market value of the coins on the date of acquisition. Inthe IRS issued a notice clarifying that it treats digital currencies such as Bitcoin as capital assets and are therefore subject to capital gains taxes. How much compliance there is in the real word remains to be seen. Calculating crypto-currency gains can be a nuanced process. Sincehe has pivoted his career towards blockchain technology, with principal interest in applications of blockchain technology in politics, business and society. Highly taxes on bitcoin gdax how can i verify bitcoin balance investment product. I handle tax matters across the U. It can also be viewed as a SELL you are selling. This is because when bitcoins leave a Coinbase account, the company can no longer track what happens to these coins. These costs are only relevant to income-related taxation, where individuals could potentially use 1070 mining hashrate 1080 ti mining profitability as deductibles.

Trade an array of cryptocurrencies through this globally accessible exchange based in Brazil. The Mt. The sheer amount of offered features is simply staggering, ranging from a multitude of supported crypto exchanges up to keeping the historical charts of variable values of virtual coins over the years. If you are ever unsure about the crypto-currency-related tax regulations in your country, you should consult with a tax professional. Being partners with CoinTracking. If Chainalysis identifies owners of digital wallets, the IRS can take over. If you pay someone in property, how do you withhold taxes? The rates at which you pay capital gain taxes depend your country's tax laws. Cryptonit Cryptocurrency Exchange. No widgets added. It's important to ask about the cost basis of any gift that you receive. Bank transfer Credit card Cryptocurrency Wire transfer. This transaction report goes on Form of your tax return, which then becomes part of Schedule D. The above example is a trade. A capital gain, in simple terms, is a profit realized. It's important to record, calculate, and report all of the taxable events that occured while utilizing your crypto-currency. Please note that our support team cannot offer any tax advice.

If you are unsure if your country classifies trading, selling, or utilizing crypto-currency as a taxable capital gain, please consult the information provided above, or consult with a tax professional. Table of Contents. This way your account will be set up with the proper dates, calculation methods, and tax rates. SatoshiTango is an Argentina-based marketplace that allows you to easily buy, sell or trade Bitcoins. If you are ever unsure about the crypto-currency-related tax regulations in your country, you should consult with a tax professional. We offer a variety of easy ways to import your trading data, your income data, your spending data, and more. Calculating your gains by using an Average Cost is also possible. The Leader for Cryptocurrency Tracking and Reporting CoinTracking analyzes your trades and generates real-time reports on profit and loss, the value of your coins, realized and unrealized gains, reports for taxes and much more. Back in the cryptocurrency craze hit the mainstream world. A capital gain, in simple terms, is a profit realized. Small fries may be OK, though. This transaction report goes on Form of your tax return, which then becomes part of Schedule D. If you don't have this information, the IRS might take a hard line and consider your crypto-currency as income, rather than capital gains, and a zero cost if you cannot provide adequate information about how and when you acquired the coins. A simple example:.