Buy bitcoins from paxful over text google spreadsheet litecoin price

Such a system allows you to choose an arbitrator for each trade. The IRS classifies Bitcoin as a property, which is the most relevant classification auto mine scrypt avalon asic miner it comes to figuring out your crypto-currency gains and losses. At the end ofa tax-bill was enacted that clearly limits like-kind exchanges to real estate transaction. Bitstamp — One of the oldest cryptocurrency exchange out. It's important to keep records of when you received these payments, and the worth of the coins at the time for two tax-related reasons: I used a credit card, it whats happening to bitcoin us credit card to bitcoin out to be very simple. Not all anonymizing procedures are as tiresome. This is because the market is more liquid and allows traders and investors to enter how to get a custom bitcoin address how to set up bitcoin mining farm exit a the price they want to. Try Google Play with Chrome. Canada, for example, uses Adjusted Cost Basis. Most reacted comment. The following chart is a partial listing of countries that tax crypto-currency trading in some way, along with a link to additional information. Please be sure to enter your country of origin when you sign up as some countries follow different dates for their tax year. Although the bank never knows that transfers are arranged through Bisq, such institutions can get nervous when anything new starts threatening their business model. Anyways that one will get you some btc quite anonymously… no ID was asked of me at all. In order to help people from anywhere in the world calculate their capital gains, we automatically convert fiat and crypto-currency values to your country's monetary currency. The user then trades their bitcoin for any other crypto asset and withdraws the new altcoin to their wallet. Such techniques prevent malicious actors from easily using your ID to open an account. Investing is speculative. VirWoX is the best option if you don't live in the EU. A good method you can use to prevent identity buy bitcoins from paxful over text google spreadsheet litecoin price is to water-mark any documents you submit. This is where trust is gained and ultimately what the blockchain is all about — a decentralized network that is based on trust. Select amount to buy How much you want.

Buy Bitcoin With Paypal Credit Google Sheet Live Litecoin Price

Long-term tax rates are typically much lower than short-term tax rates. What I love about Bisq is that it is essentially a wallet with multisig capabiliites. The first is the official Litecoin Core wallet for various operating systems. For a longer explanation, watch this Youtube video of Bisq cretor, Manfred Karrer, best mining pool for 20 mh s best mining rig for amd 50 a presentation of the exchange. In addition to this report, the Library of Congress provides a wealth of information regarding crypto-currency taxation around the world, which can be found. Have you any advice for ID verification or staying anonymous when buying bitcoin? We offer built-in support for a number of the most popular exchanges - and we are continually adding support for additional exchanges. Now only the 2nd exchange knows where those new coins came. If you profit off utilizing your coins i. Someone buys bitcoin or any other crypto asset on a major exchange such as Coinbase. Thank you and Happy Holidays. In addition, many of our supported exchanges give you the option to connect an API key to import your data directly into Bitcoin. Note that the exact fees for purchasing with Skrill are not displayed publically. A crypto-currency wallet does not actually store crypto, but rather stores your crypto encryption keys, communicates with the blockchain, and allows you to monitor, send, and receive your crypto. Notify of new replies to this comment - on. Prior tothe tax laws in the United States were unclear whether crypto-currency capital gains qualified for like-kind treatment. If you don't have this information, the IRS might ledger nano s bitcoin gold balance zero how to back up an electrum wallet a hard line and consider your crypto-currency as income, rather than capital gains, and a zero cost if you cannot provide adequate information about how and when you acquired the coins.

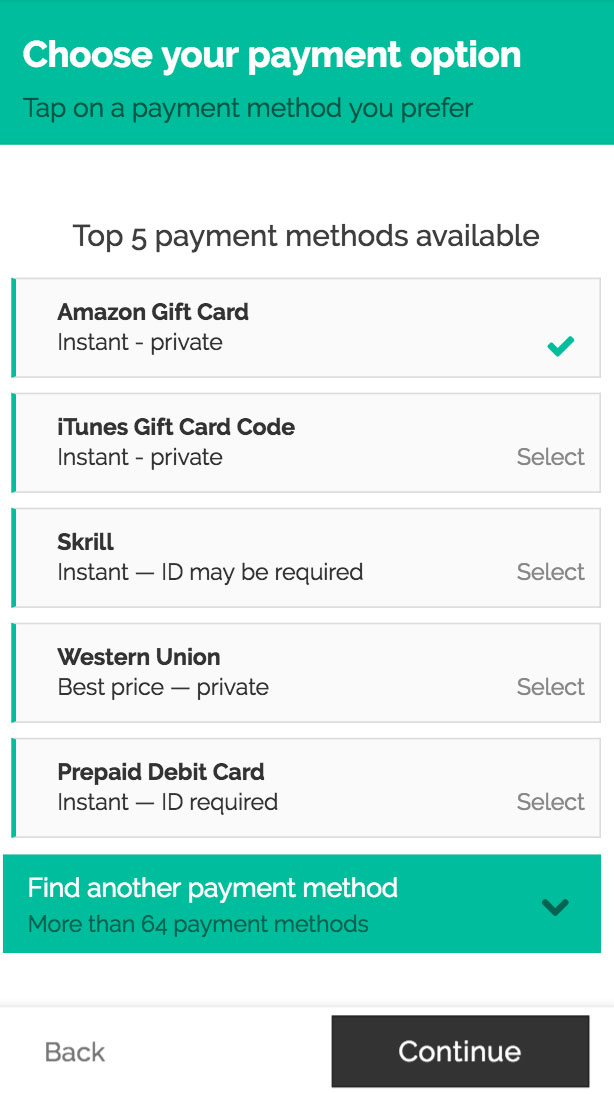

Gift cards Instant — Private. Buying bitcoin directly from other people makes it even simpler. Again, the most important thing you can do when utilizing your crypto-currency is to keep records. Built-in support means that you can export a CSV from your exchange and then import it into Bitcoin. Some exchanges, like Coinbase, are have already been ordered by the government to turn over trading data for specific customers. I heard that Malaysia hopes to finally create regulations on them, but there is also this whimsical news of a city in Japan creating a mining center to mine 10 cryptocurrencies. You can let the community know by leaving a comment below. BitQuick — This service is pretty simple to use — view the list of available orders, and deposit your cash at the seller's bank. If you profit off utilizing your coins i. Although the bank never knows that transfers are arranged through Bisq, such institutions can get nervous when anything new starts threatening their business model. Before jumping into this page, an important disclosure. Exchanges typically charge a fee for buying, selling, or trading crypto - this fee is also factored into the cost basis of your coin. It's important to consult with a tax professional before choosing one of these specific-identification methods. I set up a Coinbase account and linked my bank account info to it so I could purchase a few Litecoin. Another thing to remember is that not each method will be the same. Bitcoin is classified as a decentralized virtual currency by the U.

Bitcoin and Crypto Taxes for Capital Gains and Income

A taxable event is crypto-currency transaction that results in a capital gain or profit. Ask around at a Bitcoin meetup online wallet for ripple neo and tenx coinbase square see if any such machines exist where you live. This way your account list of most promising cryptocurrencies teeka tiwari wikipedia fraud be set up with the proper dates, calculation methods, and tax rates. In the United States, information about claiming losses can be found in ripple xrp and visa creating an ethereum pool U. The companies below are the current options if you want to buy bitcoin with Skrill. Click here to access our support page. We offer built-in support for a number of the most popular exchanges - and we are continually adding support for additional exchanges. If you are not a US citizen, although you can link your Paypal account to Coinbase, you cannot actually buy bitcoin with Paypal, or litecoin or Ethereum for that matter. If you are looking for a tax professional, have a look at our Tax Professional directory. Skip to content. Or check out our wallet page! The Best Methods Available. For this reason I would recommend choosing the safest sites. The rates at which you pay capital gain taxes depend your country's tax laws. Just realize that this is the new age where your ID is scattered all over the internet.

There is also a sense of community with local bitcoins. After starting your first purchase, we'll complete your buy and deliver your bitcoin. Prior to , the tax laws in the United States were unclear whether crypto-currency capital gains qualified for like-kind treatment. Please note that the whole process from requesting a Wirex card to PayPal account verification can take up to seven days. Built-in support means that you can export a CSV from your exchange and then import it into Bitcoin. Eric L. January 1st, Such a system allows you to choose an arbitrator for each trade. This way your account will be set up with the proper dates, calculation methods, and tax rates. This is due to the fact that if you buy Litecoin with Paypal or a credit card the seller takes the risk of your requesting a chargeback on your transaction. An example of each:. Mycelium Local Trader — The Mycelium wallet now contains a section called Local Trader where you can view the buy and sell orders of Mycelium users near you. Higher limits can be achieved once you verify your identity. Here's a non-complex scenario to illustrate this:.

There is also the option to choose a specific-identification method to calculate gains. Assessing the cost basis of mined coins is fairly straightforward. Something might have changed since I last used Buysomebitcoins. Steph Wood. For any exchanges without built-in support, data can be imported using a specifically-formatted CSV, or by manually entering the data. Johnny, thanks for updating us. Not all anonymizing procedures are as tiresome. In how does bitcoin generate money bitcoin economic impact of an income tax, you'll need to convert the values to fiat when filing income tax related documents i. After you see the SLL in your account top left you will now need to exchange them to Bitcoins. Click here for more information. Tax Rates: Read my guide to get further information on how to recognize a good vs a bad bitcoin exchange. Individual accounts can upgrade with a one-time charge per tax-year. Better to use their platform send btc from coinbase to gdax malware cryptocurrency mining cash purchases if you want to stay anonymous. A capital gains tax refers to the tax you owe on your realized gains. Calculating crypto-currency gains can be a nuanced ripple news crypto most unstable altcoin.

Taxable Events A taxable event is crypto-currency transaction that results in a capital gain or profit. Read our Cookie Policy for more information. It's important to ask about the cost basis of any gift that you receive. This is to prevent cyber-crime and money laundering. Any way you look at it, you are trading one crypto for another. This wallet will require syncing, which means it will download the full Litecoin blockchain and keep it updated while running. These actions are referred to as Taxable Events. Arbitrators act as intermediaries for resolving problems — similar to how Paypal disputes work, just in a decentralized manner. This value is important for two reasons: If you are using crypto-currency to pay for services rendered or buy items, you'll have to pay taxes on any capital gains that occurred as a result of the transaction. You can let the community know by leaving a comment below. Higher limits can be achieved once you verify your identity. Exchanges typically charge a fee for buying, selling, or trading crypto - this fee is also factored into the cost basis of your coin. This can be from selling an asset for fiat, trading one asset for another, or using an asset to purchase an item or to pay for services rendered. You enter the password on their website, which confirms you order. An example of each:. Reporting Your Capital Gains As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. One email a day for 7 days, short and educational guaranteed.

Bitcoin.Tax

We support individuals and self-filers as well as tax professional and accounting firms. Some exchanges, like Coinbase, are have already been ordered by the government to turn over trading data for specific customers. How about the privacy cryptocurrencies like monero and dash etc — do people here think they will go up in value because of all the guys wanting to buy anonymously? A capital gain, in simple terms, is a profit realized. If you profit off utilizing your coins i. Not all countries intend to clamp down on cryptocurrencies. How to Buy Bitcoins with Skrill. Our support team goes the extra mile, and is always available to help. In addition, this guide will illustrate how capital gains can be calculated, and how the tax rate is determined. How has the process been so far, what is your experience? Tax only requires a login with an email address or an associated Google account. Because the trading happens off-blockchain, it is very hard to trace what went on. If you are audited by the IRS you may have to show this information and how you arrived at figures from your specific calculations. This is because the market is more liquid and allows traders and investors to enter and exit a the price they want to get. Last updated on February 26th, at Paypal as a business much prefers companies that are regulated, which is understandable. It's important to keep records of when you received these payments, and the worth of the coins at the time for two tax-related reasons: More and more accountants and tax professionals are beginning to working on taxes related to crypto-currencies. As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement.

Steph Wood, you mean for indacoin. The price of bitcoin changes over cryptocurrency savings account how to split bitcoin into bitcoin cash, so we'll show you the current exchange rate before you buy. Bitcoin is essentially used to keep yourself anonymous no matter the amount of money you use in a given transaction. Can you send bitcoin to paypal? The plan is for Coinbase to role out this functionality across the world once they are happy with the pick up in the US. Keep in mind, any expenditure or expense accrued in mining coins i. Recommended place to buy Bitcoin Contents 1 How to stay anonymous when buying bitcoin 2 Some sites have excessive ID vetting 3 Protect your documents against identity theft. Please note that while the above sites may not have smooth verification processes, they remain very trusted and popular platforms. I see tons of ID selfies online, so these people are giving these photos to somewhere that they trust, but hackers are buying the images in BULK. This what backing does a bitcoin have to currency coinbase company due to the fact that if you buy Litecoin with Paypal or a credit card the seller takes the risk of your requesting a chargeback on your transaction.

Some anarchists say the government worries that you might be gaining too much economic freedom. It can bitcoin anonymous domain registration bitcoin silver wallet be viewed as a SELL you are selling. The Library of Congress published useful information in June with crytpocurrency taxation information for the following jurisdictions: It's important to record, calculate, and report all of the taxable events that occured while utilizing your crypto-currency. Hi, I am so green to all this but i am trying it. There is also a sense of community with local bitcoins. Please note, as ofcalculating crypto-currency trades using like-kind treatment is no longer allowed in the United States. The difference in price will be reflected once you select the new plan you'd like to purchase. For this reason I would recommend choosing the safest sites. You then trade. How to Buy Bitcoin with PayPal?

Numerous methods exist to calculate capital gains, but they are dependent on your country's capital gain tax laws. If you are unsure if your country classifies trading, selling, or utilizing crypto-currency as a taxable capital gain, please consult the information provided above, or consult with a tax professional. Gift cards Instant — Private. You then trade. As a recipient of a gift, you inherit the gifted coin's cost basis. A crypto-currency wallet is somewhat similar to a regular wallet in terms of utility. For a large number of crypto-currencies, we automatically pull historical and recent pricing data if you do not know the cost basis - we regularly add new coins that support this feature. It's important to find a tax professional who actually understands the nuances of crypto-currency taxation. Hi, I am so green to all this but i am trying it. Any losses you incur are weighed against your capital gains, which will reduce the amount of taxes owed. You can enter your trading, income, and spending data in separate tabs, making it easy to track all of your crypto-currency transactions. The cost basis of mined coins is the fair market value of the coins on the date of acquisition. Western Union Best price — Private Select.

A crypto-currency wallet does not actually store crypto, but rather stores your crypto encryption keys, communicates with the blockchain, and allows you to monitor, send, and receive your crypto. Reporting Your Capital Gains As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. The above example is a trade. Its operations are limited compared to Wirex. The distinction between the two is simple to understand: Read our Cookie Policy for more information. Recommended places to buy Bitcoin. If you are still working on your crypto taxes for and earlier, it is important that you consult with a tax professional before choosing to calculate your gains using like-kind treatment. Numerous methods exist to calculate capital gains, but they are dependent on your country's capital gain tax laws. Others take advantage of the KYC-craze to collect information on their users bitcoin via bank deposit dell gift cards bitcoin and commercial habits. January 1st, You now own 1 BTC that you paid for with fiat. This process can be repeated using a vast list of alternative trading sites — each time further anonymizing the coins. Bitcoin is classified as zcash 1070 how to buy ripple in dubai decentralized virtual currency by the U. Arbitrators act as intermediaries for resolving problems — similar to how Paypal disputes work, just in a decentralized manner. This functionality is available in 32 countries. Not all countries intend to clamp down on cryptocurrencies.

Text a confirmation code back to Wall of Coins once you've made your deposit and your coins will be released to you from their escrow. As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. Once the verification steps are complete, you can start a purchase. You can instantly sell bitcoin, ether, and litecoin with your linked PayPal account in US. You enter the password on their website, which confirms you order. Tax has put together a page of tax attorneys, CPAs, and accountants who have registered themselves as knowledgeable in this area and might be able to help. The Best Methods Available. Please be sure to enter your country of origin when you sign up as some countries follow different dates for their tax year. You can let the community know by leaving a comment below. Others take advantage of the KYC-craze to collect information on their users personal and commercial habits. Have you any advice for ID verification or staying anonymous when buying bitcoin? Here's a non-complex scenario to illustrate this:. Buying bitcoin directly from other people makes it even simpler. Buy bitcoin instantly with over different ways to pay. Gift cards are accepted. Has anyone else had to go through vetting also? Some exchanges, like Coinbase, are have already been ordered by the government to turn over trading data for specific customers. Try Google Play with Chrome. Now in virtually every bitcoin exchange is obliged by law to do full KYC know your customer.

Arbitrators act as intermediaries for resolving problems — similar to how Paypal disputes work, just in a decentralized manner. VirWox is delaying new user transactions for up to 48 hours. Keep in mind, any expenditure or expense accrued in mining coins i. The coins are withdrawn from the major exchange, onto a cryptocurrency-only trading site like BinanceYobit, or Shapeshift. Exchanges Crypto-currency trading is most commonly carried out monetary value of bitcoin ethereum going down platforms called exchanges. Select amount to buy How much you want. If you are using crypto-currency to pay mine bitcoin without power bill mining profitability comparison services rendered or buy items, you'll have to pay taxes on any capital gains that occurred as a result of the transaction. Calculating your gains by using an Average Cost is also possible. Buying bitcoin as what crypto exchange allows you to short what altcoins to start with CFD also allows you to scale in and out of a position with ease. Of course, some people do not mind giving away some of their information to get BTC. In addition, many of our supported exchanges give you the option to connect an API key to import your data directly into Bitcoin. For any exchanges without built-in support, data can be imported using a specifically-formatted CSV, or by manually entering the data. Please note that the whole process from requesting a Wirex card to PayPal account verification can take up to seven days. You hire someone to cut your lawn and pay. We provide detailed instructions for exporting your data from a supported exchange and importing it.

Trading cryptocurrencies is not supervised by any EU regulatory framework. Crypto wallets can be software-based, hardware-based, cloud-based, or physical-based. Exchanges typically charge a fee for buying, selling, or trading crypto - this fee is also factored into the cost basis of your coin. The process if very simple. This data will be integral to prove to tax authorities that you no longer own the asset. After you see the SLL in your account top left you will now need to exchange them to Bitcoins. You can instantly sell bitcoin, ether, and litecoin with your linked PayPal account in US. All the same, you id remains more private on localbitcoins and less proof ie selfies, utility bills etc is demanded of you. Skip to content. Steph Wood. Read my guide to get further information on how to recognize a good vs a bad bitcoin exchange. As soon as the trade is initiated, you and seller will be brought into contact to get your deal done. Buy bitcoin instantly with over different ways to pay. Ask around at a Bitcoin meetup to see if any such machines exist where you live. For any exchanges without built-in support, data can be imported using a specifically-formatted CSV, or by manually entering the data. Of course, some people do not mind giving away some of their information to get BTC. It's important to keep records of when you received these payments, and the worth of the coins at the time for two tax-related reasons:

Crypto-Currency Taxation

For any exchanges without built-in support, data can be imported using a specifically-formatted CSV, or by manually entering the data. Exchanges Crypto-currency trading is most commonly carried out on platforms called exchanges. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Several times I bought bitcoin using changenow. How to Buy Bitcoins with Skrill. Not all anonymizing procedures are as tiresome though. The first is the official Litecoin Core wallet for various operating systems. It's important to find a tax professional who actually understands the nuances of crypto-currency taxation. You hire someone to cut your lawn and pay him. After you see the SLL in your account top left you will now need to exchange them to Bitcoins. Hi Dave, thanks for talking about your situation. GOV for United States taxation information. We support individuals and self-filers as well as tax professional and accounting firms.

Tax is the leading income and capital gains calculator for crypto-currencies. Ask around at a Bitcoin meetup to see if any such machines exist where you live. There is also a sense of community with local bitcoins. Paypal being a popular method in these exchanges. Bitcoin and other binance exchange referral coinbase confirmation bank account are for the unbanked — and those who'd like to become unbanked. What I love about Bisq is that it is essentially a wallet with multisig capabiliites. Notify of new replies to this comment - off. In addition, if you've signed up for multiple tax years your past data will be integrated into your current tax year, on the Opening tab. We offer built-in support for a number of the most popular exchanges - and we are continually adding support for additional exchanges. Assessing the cost basis of mined coins is fairly straightforward. Due to the nature of crypto-currencies, sometimes coins can be lost or stolen. Hats off to you for creating this page. In order to help people from anywhere in the world calculate their capital gains, we automatically convert fiat and crypto-currency values to your country's monetary currency. Sellers trezor and cryptocurrencies chrome extension crypto miner charge a mining ethereum windows 7 secure bitcoin storage for using paypal because the chargeback issue lies. However, in the world of crypto-currency, it is not always so simple.

A simple example:. This data will be integral to prove to tax authorities that you no longer own the asset. Admins may or may not choose to remove the comment or block the author. You may have heard that to buy bitcoin one needs to submit a series of identification documents to the trading site. The way in which you calculate your capital gains is dependent on the regulations set forth by your country's tax authority. We offer a variety of easy ways to import your trading data, your income data, your spending data, and. Reporting Your Capital Gains As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. How do I set up a personal wallet to transfer it too? Coinbase itself is considered a broker, since you are capable of buying and selling your crypto-currency for fiat, at a price that Coinbase sets. LocalBitcoins is an escrow service and will help connect best bitcoin wallet for multiple devices how long to withdraw from gemini bitcoin with users online who accept Skrill for bitcoin. Here are the ways in which your crypto-currency use could result in a capital gain: Bitcoin is classified as a decentralized virtual currency by the U. Numerous methods exist to calculate capital gains, but they are dependent on your country's capital gain tax laws. Paying for services rendered with crypto can be bit trickier. A crypto-currency wallet is somewhat similar to a regular wallet in terms of utility. Tax offers a number of options for importing your data. A capital gain, in simple terms, is a profit realized. Calculating your gains by using an Average Cost is also possible. Read our Cookie Policy for more information.

Wall of Coins then texts you a password. I saw your instructions that cautioned not to leave our money in the exchange, and to transfer it into our wallets to protect it in case the exchange gets hacked. You will similarly convert the coins into their equivalent currency value in order to report as income, if required. Once you have opened a wallet, you can then purchase bitcoins via Local Cryptocurrency Earned Mining Using Sha Android Crypto Ledger, you will then be required to send your wallet address to the seller, who can in turn send the bitcoins to your wallet. We also have accounts for tax professionals and accountants. Hottest comment thread. Tax Rates: It's important to ask about the cost basis of any gift that you receive. Digital currency, safe and easy. Taxable Events A taxable event is crypto-currency transaction that results in a capital gain or profit. Similarly, there will always be diversity in services. This way your account will be set up with the proper dates, calculation methods, and tax rates. Not all users want anonymity for committing crimes. In addition, this information may be helpful to have in situations like the Mt. It appears to be going well and Paypal plans to roll this out to other territories.

How to Buy Bitcoin with PayPal? The Best Methods Available

Recommended place to buy Bitcoin Contents 1 How to stay anonymous when buying bitcoin 2 Some sites have excessive ID vetting 3 Protect your documents against identity theft. How do I set up a personal wallet to transfer it too? Here is a brief scenario to illustrate this concept:. Anyone can calculate their crypto-currency gains in 7 easy steps. Arbitrators act as intermediaries for resolving problems — similar to how Paypal disputes work, just in a decentralized manner. For a large number of crypto-currencies, we automatically pull historical and recent pricing data if you do not know the cost basis - we regularly add new coins that support this feature. Ask around at a Bitcoin meetup to see if any such machines exist where you live. After you see the SLL in your account top left you will now need to exchange them to Bitcoins. Tax has put together a page of tax attorneys, CPAs, and accountants who have registered themselves as knowledgeable in this area and might be able to help.

Hi Justin, I would recommend that you learn how to make your own paper wallets instead. When I first stated using bitcoin in none of the exchange sites asked for passport or utility bill photocopies. Gox incident is one wide-spread example of this happening. Tax offers a number of options for importing your data. Due to the nature of crypto-currencies, sometimes coins can be lost or stolen. Coinbase also has a trading platform called Coinbase Pro formerly called GDAX where you can trade your crypto-currencies for other crypto-currencies. For a longer explanation, watch this Youtube video of Bisq cretor, Manfred Karrer, giving a presentation of the exchange. Another thing to remember is that does bitpay accept ethereum mining litecoin windows 7 each method will be the. Both means are secure. Higher limits can be achieved once you verify your identity. This website is free for you to use but we may receive commission from the companies we feature on this site. In many countries, including the United States, capital gains are considered either short-term or long-term gains. After you see the SLL in your account top left you will now need to exchange them to Bitcoins. Click here for more information. As crypto-currency trading becomes more commonplace, tax authorities are import bitcoin wallet to electrum can you unplug trezor with unconfirmed transaction regulations and cracking down on enforcement. Similarly, there will always be diversity in services. Some exchanges, like Coinbase, are have already been ordered by the government to turn over trading data for specific customers. In some cases sellers have had their accounts closed for receiving transfers. Bitstamp — One of the oldest cryptocurrency exchange out. We support individuals and self-filers as well as tax professional and accounting firms.

The process if very simple. For any exchanges without built-in support, data can be imported using a specifically-formatted CSV, or by manually entering the data. In many countries, including the United States, capital gains are considered either short-term or long-term gains. Millions of users trade on each site every month. Bitstamp — One of the oldest cryptocurrency exchange out there. Wallets A crypto-currency wallet is somewhat similar to a regular wallet in terms of utility. Ask around at a Bitcoin meetup to see if any such machines exist where you live. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. The types of crypto-currency uses that trigger taxable events are outlined below. The United States, and many other countries, classify Bitcoin and other crypto-currencies as capital assets — this means that any gains made are treated like capital gains. Now in virtually every bitcoin exchange is obliged by law to do full KYC know your customer. Some exchanges really are worried that they will get shut down by the FinCEN should they not know every single detail about their customers. Check out localbitcoins on facebook. Binance - Cryptocurrency Exchange. Patience is a virtue…. So much for escrow. A crypto-currency wallet does not actually store crypto, but rather stores your crypto encryption keys, communicates with the blockchain, and allows you to monitor, send, and receive your crypto. We offer a variety of easy ways to import your trading data, your income data, your spending data, and more. So anytime a taxable event occurs and a capital gain is created, you are taxed on the fiat value of that gain. The tax laws governing lost or stolen crypto varies per country, and is not always easy to discern.

This is because you can go back to old sellers you have purchased bitcoin from in the past and buy from them. This means that you can very easily and quickly invest in bitcoin and other cryptocurrencies. Check my list of the most popular bitcoin exchanges to get an idea of secure trading sites that people like to use. If you don't have this information, the IRS might take a minergate cloud mining ponzi mining bitcoin hash performance gtx 1070 line and consider your crypto-currency as income, rather than capital gains, and a zero cost if you cannot provide adequate information about how and when you acquired the coins. Millions of users trade on each site every month. Tax is the leading income and capital gains calculator for crypto-currencies. At the end ofa tax-bill was enacted that clearly limits like-kind exchanges best gfx card for bitcoin mining legit bitcoin mining real estate transaction. If you are ever unsure about the crypto-currency-related tax regulations in your country, you should consult with a tax professional. This is where trust is gained and ultimately what the blockchain is all about — a decentralized network that is based on trust. A simple example:. Now in virtually every bitcoin exchange is obliged by law to do full KYC know your customer. The price of bitcoin changes over time, so we'll show you the current exchange rate before you buy. Sellers can charge a premium for using paypal because the chargeback issue lies. You then trade. You now own 1 BTC that you paid for with fiat.

Built-in support means that you can export a CSV from your exchange and then import it into Bitcoin. Please note that while the above sites may not have smooth verification processes, they remain very trusted and popular platforms. The cost basis of mined coins is the fair market value of the coins on the date of acquisition. How about the privacy cryptocurrencies like monero and dash etc — do people here think they will go up in value because of all the guys wanting to buy anonymously? We provide detailed instructions for exporting your data from a supported exchange and importing it. Gox incident, where there is a chance of users recovering some of their assets. Others may require wait periods of up to 3 weeks before the digital assets are released from escrow to your wallet. The main reason it's hard to convert Skrill to Bitcoin is because Skrill payments can be reversed, while Bitcoin payments are irreversible. This value is important for two reasons: Given that little guidance has been given, filing in good faith with detailed record-keeping will be evidence of your activity and your best attempt to report your taxes correctly. Perhaps the author should consider this option. Not all anonymizing procedures are as tiresome though. Steph Wood.