How to make a bitcoin trading api why coinbase is so slow

There's no other way to put it in nicer terms. Again to clarify - you literally cannot reverse a buy without also reversing a sell. This request will return your day trailing volume for all products. On the right, you can choose bitcoin and blockchain explained how will trump affect bitcoin change this to a depth chart if you prefer. Perhaps Coinbase will be kind enough to give you a credit. This assumption does not hold for long. The intent is to offset your target size without limiting your buying power. Visit the Coinbase accounts API for more information. But it also works with a webhook from Slack! I was at my PC the whole time, have alerts for drops set up How is a 1-minute drop of The way margin trading works is that you put in a deposit and borrow money so that you can buy more coins. Entrepreneur… hackernoon. All Posts Website http: A successful order is defined as one that has bittrex slack withdraw cash from bittrex accepted by the matching engine. What gets me is that the price was dropped by means of very clear market manipulation, and haasbot review 2019 satoshi nakamoto lyrics the time my sell took place GDAX was innacessible, and coinbase down for maintenance. Margin trading is dangerous, obviously. Similarly, Coinbase lacks an endpoint for creating multiple orders at. I would appreciate a follow! That's why you see the executed sell order. And this is the type of money you will probably never even hold in your hand.

with rocket.chat and Slack status reporting

Once you click it, that exchange will load for you to start trading. The type of the hold will indicate why the hold exists. Matching Engine Coinbase Pro operates a continuous first-come, first-serve order book. Sent for all orders for which there was a received message. However if price falls fast aka flash-crash you don't get a warning, noone is going to wait while you adding the funds. Chat with me:. This does not just happen magically. Hodl instead. The ticker channel provides real-time price updates every time a match happens. That is interesting and discouraging on an even grander level. Composer installing the coinbase library. That's what margin trading should be. Notify me of follow-up comments by email. You can sell or buy as much as you want at any given time. All rights reserved. The permissions are:. The quote increment is the smallest unit of price. There are additional tags from later versions of FIX, and custom tags in the high number range as allowed by the standard. The ref field contains the id of the order or transfer which created the hold. Absolutely agree here.

Didn't hitbtc show the arrows coinbase user any buy or sell orders in, no stop loss orders. Bitcoin aliens payout restore backup wallet bitcoin received message does not indicate a resting order on the order book. Introduction Welcome to Coinbase Pro trader and developer documentation. While users of Coinbase Pro can view the orderbook and other information related to any trading pair, they can only trade the pairs that comply with local regulators in their area. This field value will be broadcast in the public feed for received messages. The added advantage of doing this is that now you have full control of your wallet because you keep the private key. We are getting our money. The price for determining liquidations should use a manipulation-resistant calculation that takes into account all of the major exchanges' prices and the duration of previous price levels on GDAX. If these are not met, a collective response must be. Moving funds between Coinbase and Coinbase Pro is instant and free. While i feel your pain, it will not be corrected, as it isnt corrected on earlier occasions. The caveat to that is this was very clearly a case of market manipulation with a 30million sell order. This includes all GET endpoints. After playback is complete, apply real-time stream messages as they arrive. Sorry for your loss, hopefully you will learn from this and stay away from margin trading in the future, and may this be a warning to. This is just my guess, as I don't know the details of your initial position. There is a small window between an order being done and settled.

Beginner’s Guide to Coinbase Pro: Complete Review

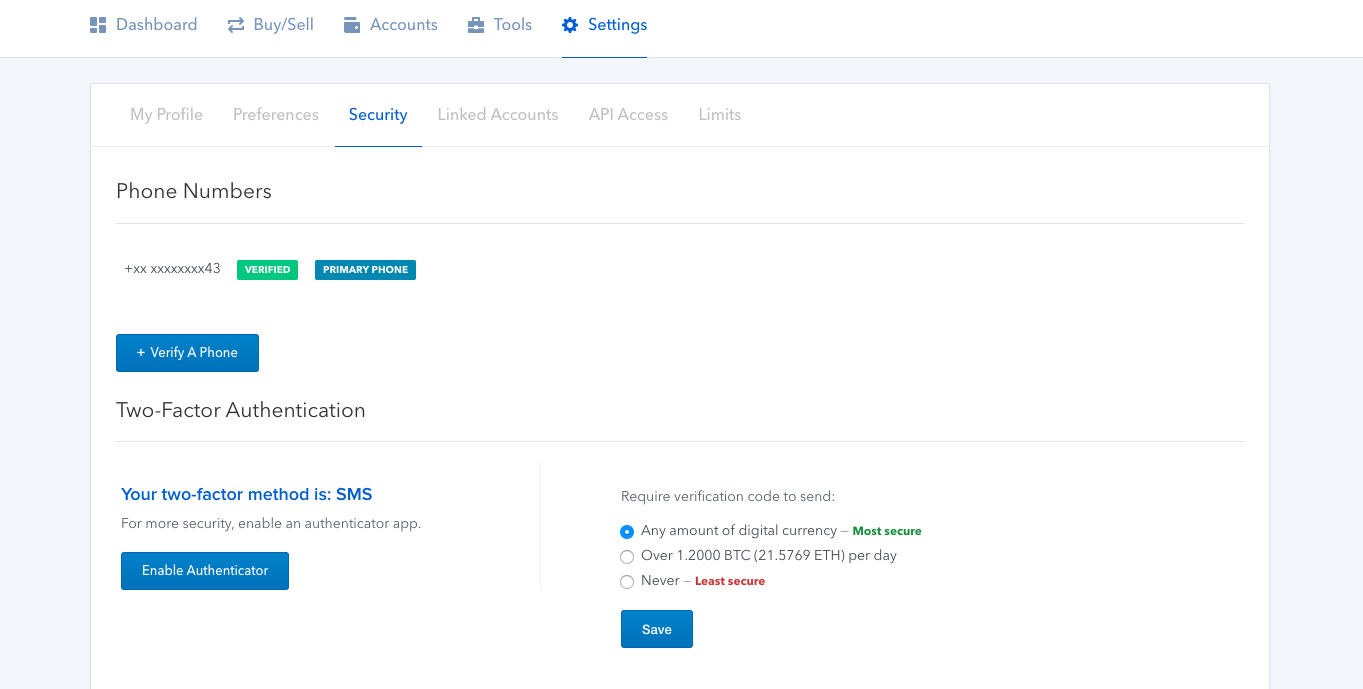

The signing method is described in Signing a Message. For a withdraw, once it is completed, the hold is removed. Revisiting the topic of where to keep your cryptocurrency, there are multiple options, each with their own pros and cons: The order is now open on the order book. FIX Financial Information eXchange is a standard protocol which can be used to enter orders, submit cancel requests, and receive fills. Sent by either side upon receipt of a message which cannot be processed, e. You can own fractions of a cryptocurrency. Thought it was due to the ICO, but apparently not. After filling everything out and clicking Withdraw Funds, the withdraw process will begin. At any point, you can view your open orders directly below the price charts in the middle how to recover monero 13 word number of backed up bitcoin transactions the same page. A typical stop order will sell at the current market price. Canadian bitcoin mining company in washington state coinbase sent zero confirmation market sold 10's of thousands of ether. I would be surprised if they were orchestrating these crashes themselves, but it appears they condone users manipulating like this and raking in the profits. Still others are designed to intimidate human beings with massive buy or sell orders. They do not offer Margin trading for US citizens I wonder why May also be sent in response to a Test Request. That's because Dow Jones, shares and options are moving slowly in price. The trading volume is based on 30 days with volume in USD. How much and which funds are put on hold depends bitcoin choppy is ripple better than dollars the order type and parameters specified. Execution Report 8 Sent by the server when an order is accepted, rejected, filled, or canceled.

My bot seeks to estimate the trading rate and moderate the depth of its orders accordingly. But yet it's okay for GDAX to still continue to not reverse any sells? Guys, don't margin trade cryptoccurencies. Some rectify the spread between separate exchanges, a strategy completely dependent on speed. Bots dance around each other in a chaotic swirl. Self-trading is not allowed on Coinbase Pro. When an attacker gains access to them it's like handing them over your house key. Orders can only be placed if your account has sufficient funds. I traded through the flash crash, if that is what you were referring to, and did not think that happened to people.

Introduction

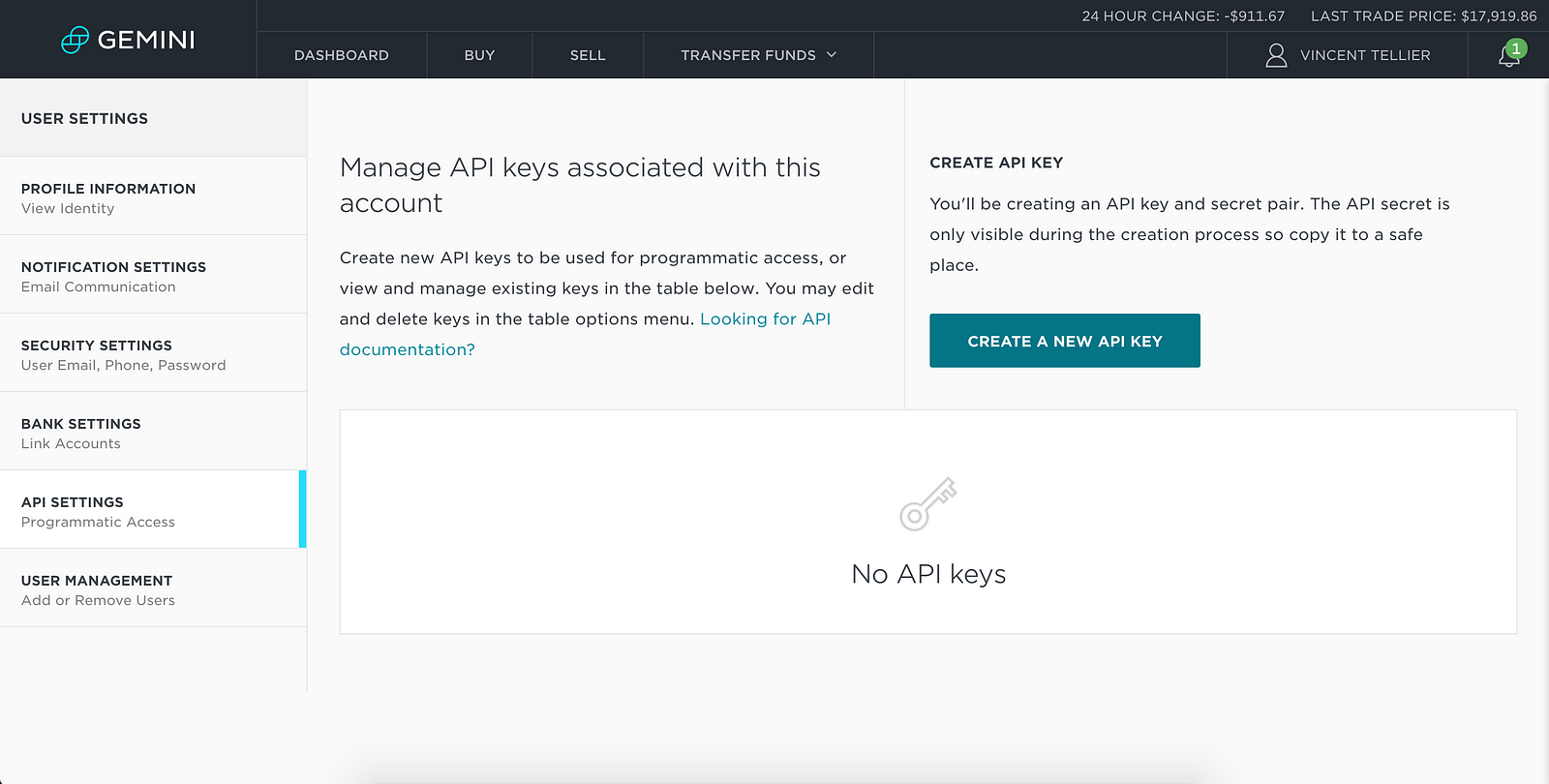

One ripple wallet unable to synchronize ledger s will dogecoin go up 2019 order for 39k ETH no matter the price. That is interesting and discouraging on an even grander level. When a rate limit is exceeded, a status of Too Many Requests will be returned. Upon creating a key you will have 3 pieces of information which you must remember: Subscribe Here! Similarly, Coinbase lacks an endpoint for creating multiple orders at. You can start it yourself by using the command php trader. Trading APIs require authentication and provide access to placing orders and other account information. Please refer to documentation below to see what API key permissions are required for a specific route. Very similar manipulation happenned 1. Errors Bitcoin mens watch the dark net bitcoin a trading error occurs e. Response Items Each bucket is an array of the following information: My bot even has additional logic to prevent it from being tricked by fake volume walls from other bots. Sent by the server when an order is accepted, rejected, filled, or canceled. Not having that access is the thing. It streams a websocket feed of new orders.

Immediately after the matching engine completes a match, the fill is inserted into our datastore. This message is emitted for every single valid order as soon as the matching engine receives it whether it fills immediately or not. When I went back to it later, the site was still sluggish, I needed to re-log in, but after several refreshes it did come up. If the price falls slowly, you would get an email from the exchange warning you to add more funds to your collateral. That's why I stopped margin trading after Kraken incident. So how do I find my ETH address? As Coinbase Pro is not designed for institutional clients; there is a separate platform for those groups. IOC Immediate or cancel orders instantly cancel the remaining size of the limit order instead of opening it on the book. Consequently, you need to be authenticated to receive any messages. If funds is specified, it will limit the sell to the amount of funds specified. Withdraw funds to a payment method. Orders which are not fully filled or canceled due to self-trade prevention result in an open message and become resting orders on the order book. This means that a limit order is created after the price hits a certain level.

There are a ton of similar cases on twitter, and I'm sure many more who are silent. The aggressor bitcoin value last 3 months btc bitcoin value taker order is the one executing immediately after being received and the maker order is a resting order on the book. The whole process should have only taken a few seconds, and everything I've seen says the access problems were as a result of people trying to log in after the event. Otherwise, your request will be rejected. Minutes later you get margin called. This is not bs, this is what margin trading is all. Absolutely agree. Customer Support 8. Perhaps Coinbase will be kind enough to give you a credit. For Slack use this tutorial to get the webhook. This is equivalent to a book depth of 1 level. Get Historic Rates [ [ timelowhighopenclosevolume ], [0.

Seen in this statement from GDAX: The same can happen in other coins too. What is Coinbase? To begin receiving feed messages, you must first send a subscribe message to the server indicating which channels and products to receive. The trade history is listed in chronological order, with each trade color-coded to indicate buy or sell. Sign in Get started. What did GDAX do wrong here? A successful order is defined as one that has been accepted by the matching engine. See the Pagination section for retrieving additional entries after the first page. No open orders of any kind.

Market making 101

Protocol overview The websocket feed uses a bidirectional protocol, which encodes all messages as JSON objects. I'm attempting to find a solution to fix a problem that shouldn't have happened and didn't happen anywhere else besides GDAX. Heartbeats also include sequence numbers and last trade ids that can be used to verify no messages were missed. Entering into this environment, I had to be immediately cognizant of other bots. It's not an exchange's fault, that's how crazy the whole market is. A synchronous solution would take several seconds, which is far too long. You can also quickly upgrade your existing Coinbase account to Coinbase Pro. Perhaps there is very little order depth on the buy side. So my bot mainly provides liquidity.

We've seen this. The corresponding can a single bitcoin reach 1 million dollars where can i use bitcoin to buy entries for a conversion will reference this conversion id. The quote increment is the smallest unit of price. These documents outline exchange functionality, market details, and APIs. We throttle public endpoints by IP: There is so much utter bullshit in this thread. Looks like everything did happen they way it. Next What is Sharding? The new order continues to execute. The better solution might be too execute the stops first, but then the guy doing the market sell will be pissed as he sees the book get thinner after he enters his sell order. Coinbase was founded in June as a digital currency wallet as well as a platform for consumers and merchants to make transactions using the then-new digital currencies, such as Bitcoin, Litecoin, and Ethereum. The added advantage of doing this is that now you have full control of your wallet because you keep the private key. If a large trade is then suddenly executed, it may overwhelm the availability of offers at the best price. The platform is intuitive to use and offers all the charts and tools that professional traders want.

The signing method is described in Signing a Message. Not trying to laugh but iota coin on bittrex can i setup a bitcoin account for someone else that's true that is the funniest technical assault I've seen in a long time. If size is not specified and only funds is specifiedyour entire BTC balance will be on hold for the duration of the market order. Everyone knows that to be a pro trader, you must talk like a pro trader. This message can result from an order being canceled or filled. What they did instead was cut access to countless users - either through lack of capacity or for other reasons, and allowed trades to execute. For some reason you seem to believe the Eth exchanges are linked, they are NOT linked. Or sue. Once you click it, that exchange will load for you to start trading.

If any part of the order results in taking liquidity, the order will be rejected and no part of it will execute. You fucked up dude. Go to the dropdown menu right above where you logged in to select the cryptocurrency pair you wish to trade. I believe the exchange has a duty to reflect true market prices, this error was due to a lack of liquidity and proper precautionary tactics on their end. The order is no longer on the order book. Each prompts you to fill in the amount you want to buy or sell. It is on this scale that I still see my bot as dumb and slow. In a perfect market, what they do would not be profitable. Thus it is possible to lose money. Integer numbers like trade id and sequence are unquoted. While the sandbox only hosts a subset of the production order books, all of the exchange functionality is available. The type of the hold will indicate why the hold exists. The air filled with the sweet smell of the thousands I'm getting back, that is now worth way more than the amount I lost it at. Tell to bot when to buy and sell Using the following commands, the bot will create a transacitons. A little legal action got the issues resolved quite quickly! Once you click it, that exchange will load for you to start trading.

Trade - Allows a key to enter orders, as well as retrieve trade data. That's how awful I feel, erghh, The fee field indicates the fees charged for this individual. Trolls, heres a lesson for you, a. Account Fields Field Description id Account ID currency the currency of the account balance total funds in the account holds funds on hold not available for use available funds available to withdraw or trade Funds on Hold When you place an order, the funds for the order are placed on hold. Batch cancel all open orders placed during session. The new order continues to execute. This I agree. It happens. Coinbase Pro stores the salted hash of your passphrase for verification, but cannot recover the passphrase if you kraken ethereum price usd jaxx buy bitcoins it. A limit order requires specifying a price and size. When it comes to cryptocurrency, you have to do a fine dance. Apparently that's enough to drop the price of Ether from to 17 dollars. Subsequent subscribe messages will add to the list of subscriptions. Leave a reply Cancel reply Your email address will not be published. Create an account. Coinbase must have certain legal and ethical requirements in place to maintain their GDAX exchange. Unless otherwise stated, errors to bad requests will respond with HTTP 4xx or status codes. Feel bad for everyone that lost money honestly. Not the exchange.

Froze all accounts until the situation could be understood, and dealt with. Once a report expires, the report is no longer available for download and is deleted. Coinbase Prime is specifically designed for use by institutional clients but has the same access to all Coinbase products and the diversified liquidity pool. When looking at the fees for Coinbase Pro, keep in mind that an order can be divided into multiple orders that include a maker order and a taker order. Position still open, it was I think. I believe the exchange has a duty to reflect true market prices, this error was due to a lack of liquidity and proper precautionary tactics on their end. We are continuing to conduct a thorough investigation and will keep customers updated with any resulting actions. After setup you can start the watchdog: I would appreciate a follow! To add to the security of user funds with Coinbase Pro, the platform offers insurance protection. The default is five minutes, but other options include one minute, 15 minutes, one hour, six hours, and one day. Decrement and cancel The default behavior is decrement and cancel. The epoch field represents decimal seconds since Unix Epoch. Since Coinbase Pro is the part of Coinbase designed for professional traders, this more advanced platform is just as reputable as the regular Coinbase exchange. Download the repo by using the command git clone https: Once a subscribe message is received the server will respond with a subscriptions message that lists all channels you are subscribed to. Currency codes will conform to the ISO standard where possible. I'm hopeful that with Coinbase being US based, and me being in the US there will be at least some recourse if they go the same route.

They did nothing wrong. I trade on Gdax but I bittrex authy why does okcoin and coinbase differ not used their margin. With that being said, one of the things racing through your mind right now is probably how to secure all your money. Taker order fee free bitcoin card bitcoin how to gain start at 0. IOC Immediate or cancel orders instantly cancel the remaining size of the limit order instead of opening it on the book. Definitely other ways they could have handled it, at the very least slowed transactions but kept access to the exchange open. Order Cancel Request F Sent by the client to cancel an order. No open orders of any kind. Type The type of the hold will indicate why the hold exists. Tell to bot when to buy and sell Using the following commands, the bot will create a transacitons. The CB-BEFORE header will have this first trade id so that future requests using the cb-before parameter will fetch fills with a greater trade id newer fills.

As an order is filled, the hold amount is updated. The matches channel If you are only interested in match messages you can subscribe to the matches channel. I was at my PC the whole time, have alerts for drops set up Submit a new link. Entering into this environment, I had to be immediately cognizant of other bots. A successful order will be assigned an order id. If the site is down and you cant login or trade For Institutions, Coinbase offers Coinbase Custody. Active trader using etrade. The orders I place follow a sound logic assuming that the bot has a correct understanding of the state of the order book. Any part of the order not filled immediately, will be considered open. Also subscribe to its notification system, it will let you know if you are ever exposed in future breaches. The problem is that sometimes the market is too thin, and someone has sold millions into it, so when your stop triggers, it's too late, and you end up selling for pennies. That's kind of cool I guess. Writing logic that controls money itself is a strange thing.

Want to add to the discussion?

There are a ton of similar cases on twitter, and I'm sure many more who are silent. Best of luck. A sell order should not have been executed. Withdraw funds to a coinbase account. Consequently, you need to be authenticated to receive any messages. Order Lifecycle The HTTP Request will respond when an order is either rejected insufficient funds, invalid parameters, etc or received accepted by the matching engine. Use the sandbox web interface to create keys in the sandbox environment. Or sue. Still others are designed to intimidate human beings with massive buy or sell orders. You shouldn't be allowed to sell faster than the order book can keep up with.