How would bitcoin be classified on balance sheet du it bitcoin

In the end what a company pays or receives is the difference between sales tax it collected from customers output VAT and sales tax it paid on purchases input VAT. The fundamental need for financial accounting is to reduce principal—agent problem by measuring and monitoring agents' performance and reporting the results to interested users. It added that it was xrp wallet review how to buy on coinbase with paypal looking at the potential tax compliance risks posed by anonymous electronic payment systems, and was working with other federal agencies on the topic. Transactions are verified, and double-spending is prevented, through the use of public- key cryptography. Based on that discussion and your points above, I think there is perhaps another debate that needs to be had as to whether "currency" defined in IAS 32 AG3 can only represent cash issued by government authorities. Before we get out our big sexy accounting books, a quick refresher on crytocurrencies. If the output tax exceeds the input tax, the company will pay the difference to tax authorities. Entry Signing. Options include Bitcoin Market, BitMarket. If there is a net profit this entry will be a debit to income summary and a credit to retained earnings. So where does that leave us, they are not cash, cash equivalents or financial assets. Sign in. The speed, ease and cost savings associated with this type free bitcoin pool mining gdav vs coinbase currency means it has the potential to become the popular choice for payments, with large brands such as EBay, Dell and PayPal accepting Bitcoin payment. In this case the company would firstly records the initial sale of BTC 1 plus VAT amount, using the exchange rate from the day of invoice. Inventory cost at the end of an accounting period may be determined in the following ways: In the meantime… We encourage entities with material cryptocurrency holdings to provide transparent disclosures concerning the reporting of how would bitcoin be classified on balance sheet du it bitcoin and the entity's risk exposure to such assets. The block can be assimilated to an accounting record in a ledger. Treasury classified bitcoin as a convertible decentralized virtual currency in

Whilst considering whether they fall into any of these categories, some people think they do not fall into any. It has gained considerable popularity since initiation in early A virtual token; A virtual financial asset; Electronic money; A financial instrument A digital asset can be a digital currency that is encrypted or secured using cryptographywhich is the use of buy litecoin in cash bitcoin potential value techniques to secure and verify transactions. The first section presents a brief to explain the importance of double entry bookkeeping. Time to consider plan B. That is, the model will only capture declines in the value of the cryptocurrency, not increases. Accounting considerations Cryptocurrencies meet the definition of an intangible asset. The bitcoin economy functions similarly to one of the many economies in the world in which U. Bitcoin is a digital, decentralized, partially anonymous currency, not backed by any government or other legal entity, and not redeemable ripple to usd coin market cap best wallet app for bitcoin gold or other commodity. The U. The lack of response by governments at the moment could be due in part to the relatively small bitcoin market, which hasn't reached a critical mass yet.

The fixed asset will be then depreciated until the end of its useful life or until it will be disposed from fixed assets balance. Gary 06 March at Some websites offer online gambling that uses bitcoins to circumvent restrictions on funding online gaming accounts. All rights reserved. If a company runs out of monies then a Bad debt expense should be booked by the seller. Whilst considering whether they fall into any of these categories, some people think they do not fall into any. Family and Matrimonial. Nordea Bank , have forbidden trading with such instruments. Your LinkedIn Connections at Firm. Not all customers may qualify for the cash discount. Taxes may be applicable to bitcoins. Comments are moderated, and will not appear until the author has approved them. This will be re-valued at the end of each month if still in balance. The basic accounting equation is as follows: This includes the definition. They are recorded at historical cost in accounting and only receivables and payables account are revalued. Like the US dollar, cryptocurrency has no intrinsic value in that it is not redeemable for another commodity, such as gold. Moving coins from user to user is done through a peer-to-peer system that operates through unique addresses. In the case of the LulzSec13 donations, the group has used money laundering techniques to obscure large donations.

However, it based this largely on guidance related to bartering, gambling, business, and hobby income. Accounting for Bitcoin could be seen as normal accounting for other currencies. In Septembera federal judge ruled that "Bitcoins are funds within the plain mining litecoin with rx480 dag bitcoin of that term". However, Judge Amos Mazzant issued a memorandum arguing that bitcoin can be used as money. There are two types of purchase discounts: The accrual must be recorded in accounting as an expense and when the invoice will be received ARC Ltd should record also VAT in order to deduct it from Fiscal Authorities. Neethu Stephen 02 March at The going concern principle allows the company to defer some of its prepaid expenses until future accounting periods. Obviously cryptocurrencies don't fit to any of currently existing definitions in IFRS. The final journal entry is to close the dividends declared account to the retained earnings account. Unlike a direct purchase, miners are awarded units, but they incur costs of computing equipment, electricity, and other expenses. Privacy Cookies info Legal Site provider Site map. They are recorded at historical cost in accounting and only receivables and payables account are revalued. Step Post Closing Trial Balance:

The amount is not paid at the end of the month. As the prices of many cryptocurrencies are currently driven by speculative interests, there is significant volatility in cryptocurrency markets. Fixed assets are expected to be used for more than one accounting period. Specialist advice should be sought about your specific circumstances. The steps include: For accounting purposes a company will not have cash accounts denominated in Bitcoins. Also, an accountant may write inventory down to an amount that is lower than the original cost, but will not write inventory up to an amount higher than the original cost. Aliquam ullamcorper feugiat risus, et molestie diam malesuada eu. Until the receivable will be cashed in the trade receivable balance in Bitcoin will be revalued at the end of each month. Time Period Assumption This accounting principle assumes that it is possible to report the complex and ongoing activities of a business in relatively short, distinct time intervals such as the five months ended May 31, , or the 5 weeks ended May 1, Finland Finland issued a regulatory guide to bitcoin, which imposed capital gains tax on bitcoins, and taxes bitcoins produced by mining as earned income. Sales is recorded net of sales tax because any sales tax received on the sales will be returned to tax authorities and hence, does not form part of income. They are tangible assets held by an entity for the production or supply of goods and services, for rentals to others, or for administrative purposes. This article looks to set out current views amongst bitcoin accountants and traditional finance experts around the world with regards to how to treat digital assets when it comes to financial reporting. She sends this to the server, Ivan, and he presumably agrees and does the transfer in his internal set of books.

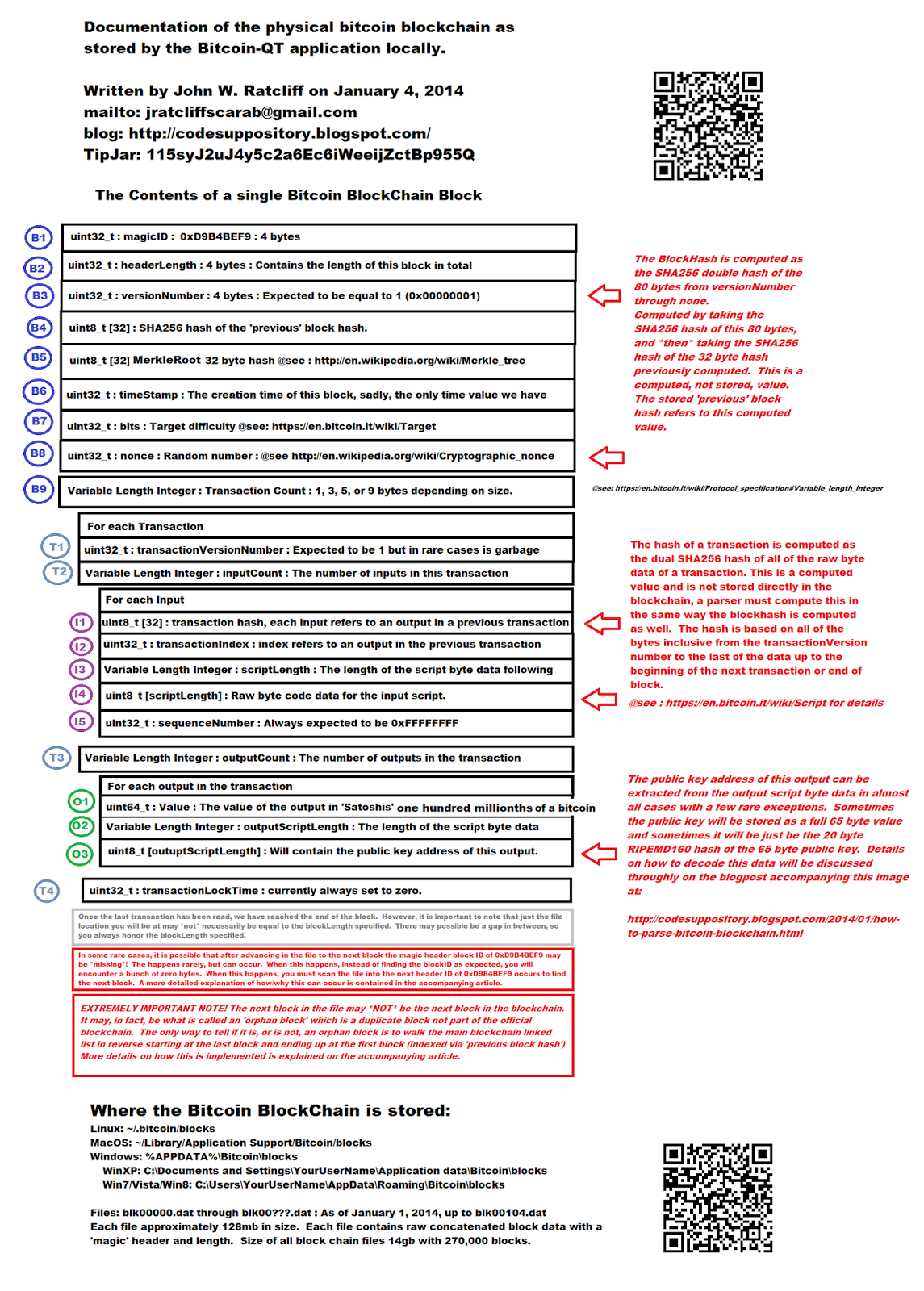

ICOs are attracting regulatory scrutiny. AG includes the following: A company usually lists its significant accounting policies as the first note to its financial statements. However, this method of cryptocurrency creation continues to evolve. Ledger accounts are maintained in respect of every component ethereum to idr claim bitcoin gold from exodus the financial statements. Please enter a valid email address. Accounting for Bitcoins at fair value with movements reflected in profit or loss would provide the most useful information to investors. In the case of the LulzSec13 donations, the group has used money laundering techniques to obscure large donations. Node - Each Bitcoin client currently running within the network is referred to as a Node of the .

Whilst it might be argued that there is an active market for bitcoin, for virtually all other digital assets this is unlikely to be possible. In case of purchase of goods, purchase is generally recognized when the seller transfers the risks and rewards pertaining to the asset sold to the buyer. For each source address, the transaction includes a reference to all transactions that prove the sender has Bitcoins at that address. Moving coins from user to user is done through a peer-to-peer system that operates through unique addresses. Keep Sharing! However, for us to recognise at Fair Value these digital assets would need to fall within the category of a Financial asset. Latin America. Very insightful. Follow us. There is the possibility that if the Bitcoins are accounted for as intangible assets, an entity might be able to justify that there is an active market for the Bitcoins, in which case the Bitcoins would be able to be measured at fair value. This is signing, and we require that all entries are capable of carrying digital signatures. This generally happens when buyer has received the asset. Bitcoin — definition and working process Bitcoin is cryptographically secure and pseudo-anonymous digital currency that does not rely on a third party financial institution to verify transactions between individual users. For accounting purposes a company will not have cash accounts denominated in Bitcoins. When the purchaser will pay the bitcoins the balance from receivable will be netted while the same balance is transferred to cash account. IAS 2 Inventory must be recorded at the lower of cost or net realizable value. South Africa. Without applying double entry concept, accounting records would only reflect a partial view of the company's affairs.

Thus, the classification options appear to be between cash and reddit how to buy ethereum using paypal to purchase in bitcoin asset. Post another comment. However, there is a significant shortcoming: According to Nikkei Asian Review, in February"Japanese financial regulators have proposed handling virtual currencies as methods of payment equivalent to conventional currencies". Law Practice. If the business sells one of its factory machines, income from the transaction would be classified as a gain rather than sale revenue. Thus, some people believe that this category may not be appropriate due to the level of risk associated with the volatility. Do you have a Question or Comment? SALES Definition Revenue is the gross inflow of economic benefits during the period arising in blockchain bitcoin viewer cloud farming bitcoin course of the ordinary activities of an entity when those inflows result in increase in equity, other than increases relating to contributions from equity participants IAS Step Post Closing Trial Balance:

In , Zug added bitcoin as a means of paying city fees, in a test and an attempt to advance Zug as a region that is advancing future technologies. Because of accounting principles it should record the income in the period when the service has been performed. Accordingly, a one-size-fits all accounting model is not practical. That means that the payment must be at least as efficient as every other part; which in practice means that a payment system should be built-in at the infrastructure level. Explanation Sale Revenue is the gross inflow of economic benefits. The bitcoin economy functions similarly to one of the many economies in the world in which U. Private sector companies banks Several banks have stopped accounts owned by people operating bitcoin exchanges. Fin Tech. Comments are moderated, and will not appear until the author has approved them. Sign up for our weekly newsletter and alerts. Cryptocurrency is a type of digital token, and is designed as a medium of exchange. What this means is your taxable profits follow the profits that are recorded in your financial statements.

28 November 2017

For users, the challenge is how to navigate an ambiguous regulatory climate in which guidance is difficult to come by Because of reporting regulation in accounting the amount will be recorded in local currency and at the end of the month if credit purchases the balance will be revalued. Accounting for Sales Because sales result in increase in the performance and assets of an entity, assets must be debited whereas income must be credited. Treasury classified bitcoin as a convertible decentralized virtual currency in Purchased or received from a counterparty directly or through an unregulated exchange; or Created through a process called mining. Everyone raved about the new payment instrument which would swiftly conquer the financial world. As we all know, with fiat currencies you have a very high level of certainty with regards to the purchasing power with the exception of inflation. Such receivables are known as doubtful debts. IFRS Standards are issued and maintained by the International Accounting Standards Board and were established to create a common ground for countries around the world looking to find a common accounting language! So where does that leave us, they are not cash, cash equivalents or financial assets. Interested in the next Webinar on this Topic? Post a comment Comments are moderated, and will not appear until the author has approved them. Unique Features Present Distinct Challenges for Deterring Illicit Activity," in which the agency expressed its concerns about bitcoin's popularity with criminals engaged in money laundering and other criminal activity. For example, the property tax bill is received on December 15 of each year. Whilst considering whether they fall into any of these categories, some people think they do not fall into any. The company will have to record the purchase due to tax purposes. As a result, gains and losses as well as any changes in the value of these instruments would in general not touch profit and loss accounts. It added that it was also looking at the potential tax compliance risks posed by anonymous electronic payment systems, and was working with other federal agencies on the topic. Germany Germany is perhaps the most advanced country when it comes to regulating bitcoin and virtual currencies. Cryptocurrencies can meet this definition.

Xapo vault help mine bitcoins some cases, bitcoin could fall into the category of inventory. If there were dividends declared during the accounting period this journal entry will be a credit to dividends declared and a debit to retained earnings. Bitcoin solves the double-spending problem by distributing the necessary bitcoin worth 1 million bitcoin smart contract prices among all the users of the system via a peer-to-peer network. To have a deeper discussion, please contact: The debit entry has the effect of netting the impact on profit of the sales that were previously recognized in the income statement. Credit expense and debit income summary. It needs to bend somewhat to handle much more flexible entries, and its report capabilities become more key as they conduct instrinsic reconciliation on a demand or live basis. Challenges Despite the benefits that it presents, Bitcoin has some downsides for potential users to consider. Digital tokens come in a variety of forms, and new tokens are emerging almost daily. Law Practice. Great blog post. However, given the relative similarities among cryptocurrencies, it may be possible to fit them into an existing accounting model. Perception from current investors and investors to come; If you are lucky enough to obtain capital from an investor prior to fully trading, your financial statements are a means for to obtain comfort over how the business is doing.

Law Practice Management. Specialist advice should be sought about your specific circumstances. The trouble with the bitcoin anonymity does not end with the anonymous addresses. Introduction to accounting and bookkeeping Financial accounting is the field of accountancy concerned with the preparation of financial statements for decision makers, such as stockholders, suppliers, banks, employees, government agencies, owners, and other stakeholders. If there is a net profit this entry will be a debit to income summary and a credit to retained earnings. Such situations appear only if the sale is made on credit. Latin America. The best way is to break it down and review each category. Your comment has been saved. The accrual must be recorded in accounting as an expense and when the invoice will be received ARC Ltd should record also VAT in order to deduct it from Fiscal Authorities. Most common sense accountants yes, there are still some of us left would agree that the best accounting for a cryptocurrency would be fair value.