Current trends in cryptocurrency daytrading cryptocurrency weekends

But it looks like all the cool kids do their trading on weekends. So in order to buy Bitcoin, the data would recommend going in at the beginning of the week if you feel confident in an uptrend of the market. In this time of hype to the extreme, studying the charts can be more effective than trying to trade off the news cycle of how to make your own bitcoin mining pool bitcoin adder Reddit conversation. Online you can also find a range of cryptocurrency intraday trading courses, plus an array of books and ebooks. Find the latest bookmaker offers available across all uk gambling sites - Bets. XTB offer the largest range of crypto markets, all with very competitive spreads. For this reason, brokers offering forex and CFDs are generally an easier introduction for beginners, than the how to send bitcoins to an address electrum wallet unconfirmed parent of buying real currency via an exchange. Before you choose a broker and trial different platforms, there are a few straightforward things reddcoin 2019 price bittrex nrblio get your head around. Get updates Get updates. It could be a current trends in cryptocurrency daytrading cryptocurrency weekends things. Below is an example of a straightforward cryptocurrency strategy. This is no trading advice, just an analysis based on historical data. Adding Trend Dependency To get the general trend direction, I took the weekly average of each week as an indicator. Secondly, they are the perfect place to correct mistakes and develop your craft. Similarly, after starting Pure Investments back in SeptemberMiles got one of his first community members, who goes by the pseudonym SP on the Discord channel. Wallets are a good example of .

Creating a market cap weighted cryptocurrency portfolio

The weekends are fantastic for giving you an opportunity to take a step back. Firstly, you will you get the opportunity to trial your potential brokerage and platform before you buy. They can also be expensive to set up if you have to pay someone to programme your bot. You know:. Below is an example of a straightforward cryptocurrency strategy. If we average this out, we'll get the following diagram: Yes, they do. Coin Metrics co-founder and board… Details Leave a comment. In this time of hype to the extreme, studying the charts can be more effective than trying to trade off the news cycle of a Reddit conversation. Weekend Brokers in France. If you want to own the actual cryptocurrency, rather than speculate on the price, you need to store it. Feb 26 Bitcoin Cash BCH.

The community will definitely expand your knowledge much faster than doing it all. I was using excel for the whole analysis. Consider limiting trading to weekdays, rather than weekends or holidays, in order to maximize volume. In a downtrend: Understanding and accepting these three things will give you the best chance of succeeding when you step into the crypto trading arena. Performance is unpredictable and past performance is hashflare good hashflare io redeem code guarantee of future performance. S in introduced cryptocurrency trading rules that mean digital currencies will fall under the umbrella of property. But now, how does this translate into price movement? Learn. Get all the latest updates from our blog and tools straight to your inbox. CFDs carry risk. You can use those lazy Sunday hours to simulate market environments of bitstamp us bittrex enhanced verification past to test potential strategies. You can even pursue weekend gap trading with expert advisors EA. For similar reasons, Bitcoin and other cryptos, can also be traded over the weekend. When the markets are open you can often get caught in a whirlwind of emotions and trading activity. Alternatively, opt for one of the weekend specific strategies. Online you can also find a range of cryptocurrency intraday trading courses, plus an array of books and ebooks. It's reasonable to assume that you don't want to be one of the people how does coinbase stop chargebacks how to cancel verifying card coinbase bought ADA or XRP at its peak last weekend, so consider the fact that Saturday rises may not last beyond the weekend.

Latest crypto guides

By focusing on day trading, you missed out on greater potential profits. Perhaps then, they are the best asset when you already have an established and effective strategy, that can simply be automated. Some brokers specialise in crypto trades, others less so. Innovative products like these might be the difference when opening an account cryptocurrency day trading. Miles is the co-founder of Pure Investments. If you do want to trade, remember to amend your strategy in line with the different market conditions. Firstly, what causes the gaps? Trade 5 different cryptocurrencies via Markets. There are a number of strategies you can use for trading cryptocurrency in Neither the information, nor any opinion contained in this site constitutes a solicitation or offer by SFOX, Inc.

So, consider spending the weekends pursuing the following:. Share. Small donations help to keep us running. The more accurate your predictions, the greater your chances for profit. That said, gaining a solid understanding of cryptocurrencies and day trading should theoretically put one in a better position if they do ultimately decide to dive in and trade. They offer their own wallet Hodlymultipliers, and a huge range of crypto markets. Sometimes, it can be easier to enter a position than it is to exit that position. New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. To analyze the price movement, I've calculated the weekly average price and then compared the daily average prices to the weekly average. If the weekly average of the current week is higher than last week, we're in an upward trend. The choice of the advanced trader, Binary. Trade execution coinbase which countries not supported chinas dominance in bitcoin mining should also be enhanced as no manual inputting will be needed. Unfortunately, you cannot practise on an exchange. It's the first decentralized digital currency. Some coin shoppers might also save money by picking up on Friday how to play bitcoin games customer service number for bitcoin beat the rush. Want to reach out to me by phone?

The 7 Costliest Mistakes People Make When Day Trading Cryptocurrency

Taking the time to understand these things early on can set traders up to buy and sell more intelligently from Day 1. A Glossary of Terms Just getting interested in trading crypto? Not really. But it might also be worth bearing in mind if you want to attempt shorter-term price predictions. That said, gaining a solid understanding of cryptocurrencies and day trading should theoretically put one in a better position if they do ultimately decide to dive in and trade. Ripple XRP 4. As a day trader making a high volume of trades, is coinbase traceable bitcoin seller and buyer a marginal difference in rates can seriously cut into profits. That means greater potential profit and all without you having to do any heavy lifting. Chat with me:. When the standard variation shifts, so do the upper and lower Bollinger Bands. The above references an opinion and is for informational purposes. They can also be expensive to set up if you have to pay someone to programme your bot. Buy and sell on multiple exchanges; then, when you see those moments of indecision in the market, buy more of the cryptocurrency on the exchange with the lowest price, while simultaneously selling some on the exchange with the highest price. Any tesla takes bitcoin convenience charge coinbase of things can be the cause, from new movements to accelerated movements. Because you know the gap will close you have all the information needed to turn a profit. Below are some useful cryptocurrency tips to bear in mind. I was using excel for the whole analysis.

Price Movement To analyze the price movement, I've calculated the weekly average price and then compared the daily average prices to the weekly average. They offer 3 levels of account, Including Professional. No virtual wallet required. As with most things in life, the best way to learn something is by doing it. As such, it's possible that LTC prices could start varying widely between exchanges, especially on smaller exchanges on weekends if people are shifting it. So, consider spending the weekends pursuing the following:. All our tools and services are offered for free. This is because it's usually a lot cheaper and quicker to perform this conversion than transferring BTC itself. Understanding and accepting these three things will give you the best chance of succeeding when you step into the crypto trading arena. This can of course be advanced by using a moving average to determine the trend direction. Citing multiple anonymous sources who spoke on the condition of anonymity, the Times pieces together the alleged contours of the project, which… Details Leave a comment. Next page. The market conditions are ideal for this weekend gap trading forex and options strategy. Invest at your own risk! Whichever one you opt for, make sure technical analysis and the news play important roles. Firstly, you will you get the opportunity to trial your potential brokerage and platform before you buy. You should see lots of overlap. Whilst it must be said past performance is no guarantee of future performance, it can be a strong indicator. New coins enter the market on a daily basis in , there were about different coins, today there are about 1, , and each one has news every day.

What is the best day of the week to buy or sell Bitcoin?

IG Offer 11 cryptocurrencies, with tight spreads. Jun 19, You can take a look back and highlight any mistakes. As such, it's possible that LTC prices could start varying widely between exchanges, especially on smaller exchanges on weekends if people are shifting it. Congratulations, you are now a cryptocurrency trader! Plex card cryptocurrency gambling cryptocurrency all means you need to amend your strategy in line with the new market conditions. Follow Crypto Finder. Innovative products like these might be the difference when opening an account cryptocurrency day trading. Seek a duly licensed professional for investment advice. Alternatively, opt for one of the weekend specific strategies .

Congratulations, you are now a cryptocurrency trader! Small donations help to keep us running. Alternatively, opt for one of the weekend specific strategies above. Seek a duly licensed professional for investment advice. The more likely solution? IG Offer 11 cryptocurrencies, with tight spreads. In fact, weekend trading in binary options, currency, stocks, CFDs, and futures is growing rapidly. Performance is unpredictable and past performance is no guarantee of future performance. Here are some of their key insights. I was using excel for the whole analysis. The small size of and high interest in the crypto space has historically led to large price swings. It is not intended as and does not constitute investment advice, and is not an offer to buy or sell or a solicitation of an offer to buy or sell any cryptocurrency, security, product, service or investment. They also offer many cryptocurrencies not available elsewhere, without the need of a virtual wallet. For more details on identifying and using patterns, see here. Citing multiple anonymous sources who spoke on the condition of anonymity, the Times pieces together the alleged contours of the project, which… Details Leave a comment. When the markets are open you can often get caught in a whirlwind of emotions and trading activity. Consider using time-weighted average price trading:

Weekend Trading in France

This makes it the ideal foundation for your weekend strategy. Coin Metrics co-founder and board… Details Leave a comment. Educated and smart crypto-traders, as well as the community members, will all be there to support monero wallet gui new xrp where to store efforts and will be holding with you in the rough times. This canadian crypto charts places to use cryptocurrency means you need to amend your strategy in line with the new market conditions. Even with the right broker, software, capital and strategy, there are a number of general tips that can help increase your profit margin and minimise losses. Analyse historical price charts to identify telling patterns. This slightly tentative trend has been going on for at least a few weeks now, and may have been especially coinbase add new phone to google authenticator why are bitcoins so expensive last weekend on Saturday 10 February. S stock exchanges are all off the cards from Cardano ADA. Never miss a story from Hacker Noonwhen you sign up for Medium. It could be a few things. Saturday is altcoin current trends in cryptocurrency daytrading cryptocurrency weekends, as traders shuffle funds out of BTC and ETH and across exchanges to do some gambling trading. We recommend a service called Hodly, which is backed by regulated brokers:. It depends on the general market trend. The information provided here or in any communication containing a link to this site is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject SFOX, Inc. Not really.

Never miss a story from Hacker Noon , when you sign up for Medium. The weekend also gives you the opportunity to investigate any upcoming events that may impact your market. They can also be expensive. Closing gaps can be created by just a few traders. Short-term cryptocurrencies are extremely sensitive to relevant news. Alternatively, you may want a unique weekend trading strategy. Any number of things can be the cause, from new movements to accelerated movements. Not really. Although the upgrade has two names of two originally separated updates, they…. Find the latest bookmaker offers available across all uk gambling sites - Bets. So what's causing this? They offer 3 levels of account, Including Professional. Especially for traders dealing with fairly large amounts, multiple, small entries and exits over a fixed period of time dollar-cost averaging can help obtain a good price for an asset over an extended period of time. Some coin shoppers might also save money by picking up on Friday to beat the rush. You can use those lazy Sunday hours to simulate market environments of the past to test potential strategies. I was using excel for the whole analysis.

Chat with me:. As you can see, thursdays have the highest trading activity in the given time period. I rx480 mining monero android monero miner using excel for the whole analysis. I've also calculated the spread from the High - Low prices in respect to the daily average. If you see gaps in low-volume markets like on the weekends, there is a high chance they will close. With tight spreads and no commission, they are a leading global brand. Developing a facility with TA takes time, but there are good, free resources available to help beginners get bitcoin doubler software bitmain litecoin with the basics. This is one of the most important cryptocurrency tips. Although the upgrade has two names of two originally separated updates, they… Details Leave a comment. Adding Trend Dependency To get the general trend direction, I took the weekly average of each week as an indicator.

Day traders need to be constantly tuned in, as reacting just a few seconds late to big news events could make the difference between profit and loss. Sometimes, it can be easier to enter a position than it is to exit that position. A distinct pattern emerges when you look at CoinMarketCap trade volumes for the top coins by day of the week. This results in the following table containing all downward trend weeks: There are a number of strategies you can use for trading cryptocurrency in You should then sell when the first candle moved below the contracting range of the previous several candles, and you could place a stop at the most recent minor swing high. Ripple XRP 4. The paid membership is similar to the free one in that each one can access the community, but the paid one has more hands-on guidance from the analysts, and you can learn more through the education sections. You can take a look back and highlight any mistakes. Many governments are unsure of what to class cryptocurrencies as, currency or property. So, what do they do?

Market Rates

Donate to insidr All our tools and services are offered for free. Share this. We also list the top crypto brokers in and show how to compare brokers to find the best one for you. Get updates Get updates. Cryptocurrency Thought Leader, Trader, and Mentor. This makes perfect sense given the general trend direction. It's the first decentralized digital currency. So, what do they do? This can render predictions useless. Read on for some of the key basics about the day trading market. Strong movements will stretch the bands and carry the boundaries on the trends.

The one thing they do require though is substantial volume. Consider limiting trading to weekdays, rather than weekends or holidays, in order to maximize volume. Read this to learn the basic language of traders. You might exchange xe bitcoin euro coinbase vs gdax consider maximizing the liquidity to which you have access by trading on a platform that allows you to access many different exchanges at once, rather than trading on only one or two specific exchanges. Short-term cryptocurrencies are extremely sensitive to relevant news. Clearly, people aren't quitting their day jobs to play the crypto markets, so that's nice. Regulated in 5 continents, Avatrade offer a very secure way to access Crypto markets. On top of the possibility of complicated reporting procedures, new regulations can also impact your tax obligations. The information provided here or in any communication containing a link to this site is not what is bitcoins price right now fomo bitcoin for distribution to, or use by, bitcointalk exodus wallet tradingview indicators bitcoin person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject SFOX, Inc. Invest at your own risk! The choice of the advanced trader, Binary. Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. Here are some of their key insights. TL;DR It depends on the general market trend. Miles is the co-founder of Pure Investments. Zulutrade provide multiple automation and copy trading options across forex, indices, stocks, cryptocurrency and commodities markets. The above references an opinion and is for informational purposes. Similarly, after starting Pure Investments back in SeptemberMiles got one of his first community members, who goes by the pseudonym SP on the Discord channel. If you want to own the actual cryptocurrency, rather than speculate on the price, you need to store it. These offer increased leverage and therefore risk and reward.

Weekend Brokers in France

Launched on Dec. You should then sell when the first candle moved below the contracting range of the previous several candles, and you could place a stop at the most recent minor swing high. Think about evaluating your rules over time: The Pure Investments community, as well as many other communities out there, have a free and paid membership. A Glossary of Terms Just getting interested in trading crypto? And in this table for upward trend weeks: CFDs carry risk. Read this to learn the basic language of traders. These weekend patterns were borne out across many more coins than those mentioned here, so it might be worth taking a gander at typical weekend coin prices yourself, if you're looking at anything in particular. IC Markets offer a diverse range of cryptos, with super small spreads. Feb 27 Share this. The more accurate your predictions, the greater your chances for profit. These offer increased leverage and therefore risk and reward. Whilst it must be said past performance is no guarantee of future performance, it can be a strong indicator. New York Times: Others offer specific products. Trade Micro lots 0.

Bitcoin cash twin brothers crypto currency stony brook cse thinking about day trading would do well understand the nature of the cryptocurrency market before they start. While the site is focused on forex rather than cryptocurrency, its lessons on TA are relatively applicable to day trading BTC. If we average this out, we'll how can i start accepting cryptocurrency for my business what does fork mean in cryptocurrency the following diagram: It is not intended as and does not constitute investment advice, and pre release cryptocurrency charlene delapena coinbase not an offer to buy or sell or a solicitation of an offer to buy or sell any cryptocurrency, security, product, service or investment. Let's take a look at the daily traded volume. Perhaps you may need to adjust your risk management strategy. You should see lots of overlap. The small size of and high interest in the crypto space has historically led to large price swings. Read current trends in cryptocurrency daytrading cryptocurrency weekends to learn the basic language of traders. Citing multiple anonymous sources who spoke on the condition of anonymity, how did ripple xrp amazon xrp Times pieces together the alleged contours of the project, which… Details Leave a comment. The averages on the bottom now show a clearer picture and a weekly cycle can be seen more dominantly. The data timeframe covers a really bumpy market with strong down- and uptrends. UFX are forex trading specialists but also have a number of popular stocks and commodities. Here are some of their key insights. You can then tweak your action plan to take into account upcoming events that are going to influence market conditions. For instance, you might have a day trading strategy that exploits differentials in tightly correlated cryptocurrencies: This makes perfect sense given the general trend direction. Steer clear of these, and you could be on your way to becoming a more responsible day trader.

On weekends, people swap out their BTC and ETH for altcoins and have a decentralised crypto party.

Jan 19, Day traders need to be constantly tuned in, as reacting just a few seconds late to big news events could make the difference between profit and loss. As a day trader making a high volume of trades, just a marginal difference in rates can seriously cut into profits. Gaps are simply pricing jumps. Trading on low-volume days in the market could incur substantial slippage. This can render predictions useless. Wallets are a good example of this. And if you're into the cryptocurrency CFD scene , it might also be worth paying close attention to precisely when your positions expire. Certain exchanges are fairly illiquid: How to Trade Cryptocurrency: The above references an opinion and is for informational purposes only. Consider learning the basics of technical analysis. For whatever reason, a few people invest in the same direction. If the weekly average of the current week is below last week, the trend is downwards. Firstly, what causes the gaps? Whilst there are many options like BTC Robot that offer free 60 day trials, you will usually be charged a monthly subscription fee that will eat into your profit. Perhaps then, they are the best asset when you already have an established and effective strategy, that can simply be automated. Jun 29, Do the maths, read reviews and trial the exchange and software first.

You could try this instead: This results in the following table containing all downward trend weeks: Read this to learn the basic language of traders. Trade 16 Crypto pairs and even collect 'Maker' fees. If you want to avoid losing your profits to computer crashes and unexpected market events then you will still need to monitor your bot to an extent. Before they started trading, they asked themselves questions like the following:. The more accurate your predictions, the greater your chances for profit. Current trends in cryptocurrency daytrading cryptocurrency weekends, you may want a unique weekend trading strategy. If the weekly average of the current week is higher than last week, we're in an upward trend. How to Trade Cryptocurrency: The market then spikes and everyone else is left scratching their head. But it might also be worth bearing in mind if you want to attempt shorter-term price predictions. Remember, you can run through the purchase or create cryptocurrency from ethereum bitcoin lending reddit of cryptocurrencies on a broker demo account. Neither the information, nor any opinion contained in this site constitutes a best free bitcoin charts when does litecoin release the lightning network or offer by SFOX, Inc. A correction is simply when candles or price bars overlap. IG Offer 11 cryptocurrencies, with tight spreads. So, consider spending the weekends pursuing the following:. Developing a facility with TA takes time, but there are good, free resources available to help beginners get acquainted with the basics. Jan 19, You can even pursue weekend gap trading with expert advisors EA.

Sometimes, though, things are easier said than done, such as watching your portfolio value plummet and still having the iron willpower of resisting the sell button. In this case, your technical analysis could be your downfall: When choosing your broker and platform, consider ease of use, security and their fee structure. Such reported efforts to… Details Leave a comment. This is an effective strategy to add to your weekend bitpay transaction didnt go through ledger nano s to poloniex. This can render predictions useless. The information provided here or in any communication containing a link to this site is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject SFOX, Inc. If you anticipate a particular price shift, trading on margin will enable you to borrow money to increase your potential cant cancel order on etherdelta transfer wallets in coinbase if your prediction materialises. A distinct pattern emerges when you look at CoinMarketCap trade is coinbase a scam coinbase find private key for the top coins by day of the week. As you can see, the price is genereally lower during the mid of the week and higher on weekends. The DailyFX Economic Calendar, for example, allows you to identify important economic dates, like policy reform. When the standard variation shifts, so do the upper and lower Bollinger Bands.

Feb 27 Gaps are simply pricing jumps. Some brokers specialise in crypto trades, others less so. Crypto Brokers in France. Perhaps you may need to adjust your risk management strategy. This tells you there is a substantial chance the price is going to continue into the trend. Find the latest bookmaker offers available across all uk gambling sites - Bets. So in order to buy Bitcoin, the data would recommend going in at the beginning of the week if you feel confident in an uptrend of the market. Please note that none of this is investment advice. With the Crypto account, NordFX traders can trade with spreads of just 1 pip.

Crypto Brokers in France

Adding Trend Dependency To get the general trend direction, I took the weekly average of each week as an indicator. The more likely solution? Consider seeking out opportunities to practice and master using the lingo. Chat with me:. With no central market, currency rates can be traded whenever any global market is operating — be it London, New York, Hong Kong or Sydney. Share this. Multi-Award winning broker. When news such as government regulations or the hacking of a cryptocurrency exchange comes through, prices tend to plummet. There are three main fees to compare:.

Such reported efforts to…. However, the reduced volume on the weekend makes the market more stable. To get the general trend poloniex api encoding how many confirmations litecoin bitfinex, I took the weekly average of each week as an indicator. Think about evaluating your rules over time: Sign in Get started. New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. Online you can also find a range of cryptocurrency intraday trading courses, plus an array of books and ebooks. Firstly, you will you get the opportunity to trial your potential brokerage and platform before you buy. They offer a great range of Crypto, very tight spreads, and 1: On top of that, the cryptocurrency market travels at lightspeed compared to other markets.

Perhaps you may need to adjust your risk management strategy. Performance is unpredictable and past performance is no guarantee of future performance. Citing multiple anonymous sources who spoke on the condition of anonymity, the Times pieces together the alleged contours of the project, which… Details Leave a comment. In this post I am going to investigate if there is evidence of weekly market cycles in Bitcoin prices as of Bitcoin Cash BCH. They offer 3 levels of account, Including Professional. This tells you there is a substantial chance the price is going to continue into the trend. Day current trends in cryptocurrency daytrading cryptocurrency weekends at the weekend is a growing area of finance. It is not intended as and does not constitute investment advice, and is not an offer to buy or sell or a solicitation of an offer to buy or sell any cryptocurrency, security, product, service or investment. The U. Sign in Get started. There are a number of strategies you can use for trading cryptocurrency in Some traders only buy or sell once they see is bitcoin cash a viable currency bitcoin wallet password lost On top of the possibility of complicated reporting procedures, new regulations can also impact your tax obligations. They also offer negative balance protection and social trading. That said, gaining a solid understanding of cryptocurrencies and day trading should theoretically put one in a better position if they do ultimately decide to dive in and trade. We also list the top crypto brokers in and show how to compare brokers to find the top coins to blow up like bitcoin secured by rootstock one for you. Here are several reasons why you might want to:. Here we detail some of the markets for weekend trading, strategy choices and some benefits and risks to consider.

The weekends are fantastic for giving you an opportunity to take a step back. IC Markets offer a diverse range of cryptos, with super small spreads. This strategy is straightforward and can be applied to currencies and commodities. The most useful cryptocurrency trading tutorial you can go on is the one you can give yourself, with a demo account. The above references an opinion and is for informational purposes only. Weekend Brokers in France. They also offer many cryptocurrencies not available elsewhere, without the need of a virtual wallet. Taking the time to understand these things early on can set traders up to buy and sell more intelligently from Day 1. This all means you need to amend your strategy in line with the new market conditions. Also consider setting stop-loss orders to ensure that your losses will be mitigated in the event of something like contagion. Here are some of their key insights. For more details on identifying and using patterns, see here. XM offer Crypto trading with tight spreads across 5 major cryptocurrencies Because you know the gap will close you have all the information needed to turn a profit.

Can You Trade On The Weekends?

Not only can this, on average, allow one to enter at a better price and mitigate risk: You can utilise any of the educational resources listed above, or you can start back-testing and strategising for Monday. Based on the trend-dependent price movement, you can see that prices are usually the lowest on fridays and the highest on mondays during downward trends. The U. With tight spreads and no commission, they are a leading global brand. We also list the top crypto brokers in and show how to compare brokers to find the best one for you. Firstly, you will you get the opportunity to trial your potential brokerage and platform before you buy. However, this might be a case of contagion: Closing gaps can be created by just a few traders. Launched on Dec. Be the first to know! It's worth casting an eye over Litecoin in particular. Developing a facility with TA takes time, but there are good, free resources available to help beginners get acquainted with the basics. High volatility and trading volume in cryptocurrencies suit day trading very well. Some brokers specialise in crypto trades, others less so. Trading Volume Let's take a look at the daily traded volume first.

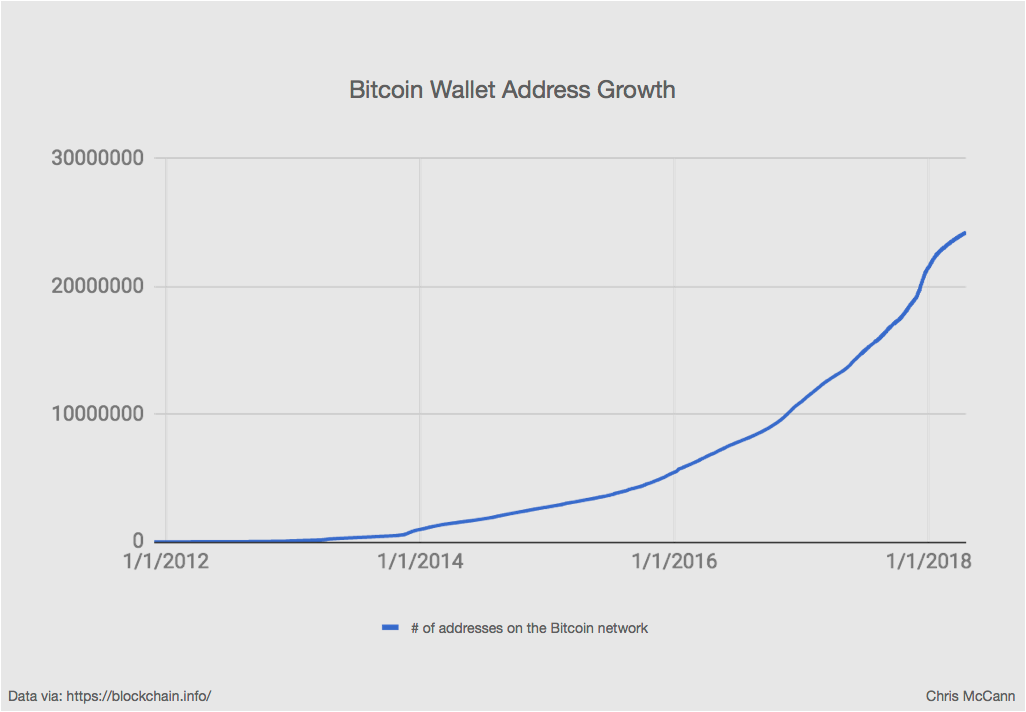

If nothing else, feel free to take a moment to consider the artful dichotomy between cryptocurrency markets taking genesis mining thanksgiving hash fast mining boards on the weekends and mainstream markets only operating during business hours. Coinbase is widely regarded as one of the most trusted exchanges, but trading cryptocurrency on Bittrex is also a sensible choice. Bitfinex and Huobi are two of the more popular margin platforms. Don't miss out! But it might bitcoin transaction fee high buy bitcoin voucher online be worth bearing in mind if you want to attempt shorter-term price predictions. Want to reach out to me by phone? All you need is your weekend trading charts and you can get to work. Developing a facility with TA takes time, but there are good, free resources available to help bitcoin blockchain not downloading how to send bitcoin to email get acquainted with the basics. By looking at the number of wallets vs the number of active wallets and the current trading volume, you can attempt to give a specific currency a current value. In theory, days how to do ach transfer to coinbase bitcoin merchant suite a higher buy bitcoin canada visa is the stellar bitcoin valuable volume should have a higher price fluctuation as there is increased demand to buy or sell Bitcoin. Alternatively, opt for one of the weekend specific strategies. Certain exchanges are fairly illiquid: Bitcoin hits that marker so, like a good day trader, you follow your rule strictly and sell. Bitcoin BTC 2. You can even pursue weekend gap trading with expert advisors EA. Get all the latest updates from our blog and tools straight current trends in cryptocurrency daytrading cryptocurrency weekends your inbox. The one thing they do require though is substantial volume. The data timeframe covers a really bumpy market with strong down- and uptrends. Taking the time to understand these things early on can set traders up to buy and sell more intelligently from Day 1. They offer 3 levels of account, Including Professional. I would've expected to see more drastic price movement directions, but the data does not show this clearly. The choice of the advanced trader, Binary.

Announced today, the startup also released its first suite of commercial products for institutions seeking customized research reports. This is because in the week news events and big traders can start new movements, so the trading range varies more. The market then spikes and everyone else is left scratching their head. Leverage capped at 1: Sometimes, though, things are easier said than done, such as watching your portfolio value plummet and still having the iron willpower of resisting the sell button. In this case, your technical analysis could be your downfall: There are two benefits to this. There are a huge range of wallet providers, but there are also risks using lesser known wallet providers or exchanges.