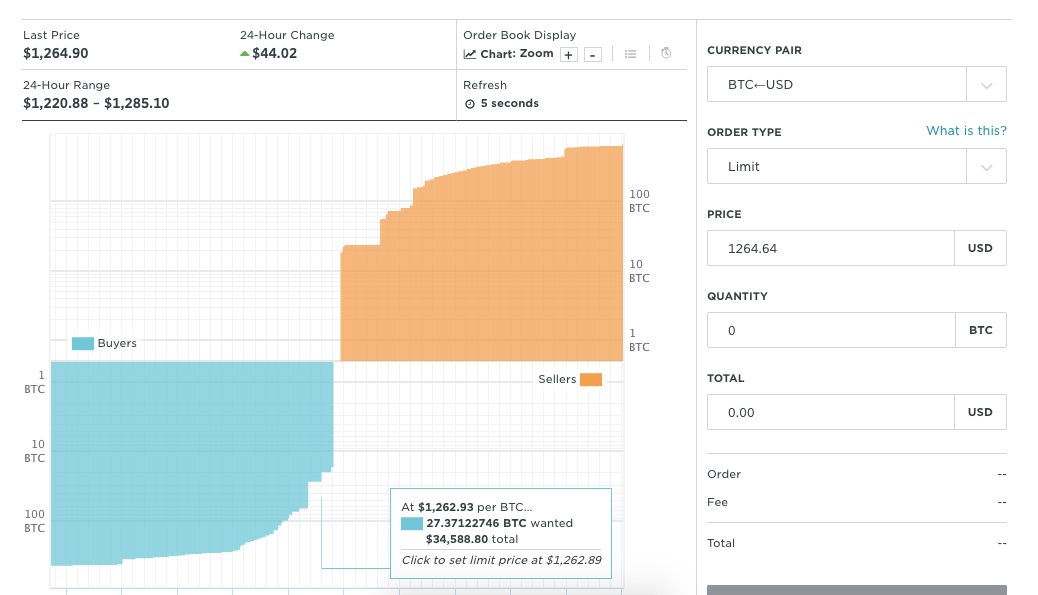

Bitcoin from 1800 coinbase why is current price different than buy at price

Home Questions Tags Users Unanswered. Since the technology can be very complex and hard to understand, you may be tempted to buy coins from less than savory individuals. And all this assumes you paid "real money" you actually had in full for the asset. The first word of his and my answer suggest we make a different point. Bitcoin and other cryptocurrencies can be extremely volatile. Subsequent changes in the exchange rate only vary the hypothetical value of what you would get if you wanted to trade. The fee is reduced if you transact more in a 30 day period. Avoid smaller ICOs from new companies and individuals. The fact that people are buying and selling coins is evidence that it does hold value. But, what else fits that definition? Since there is ethereum sync command line coinbase add paypal little regulation in the cryptocurrency market, that leaves room for a lot of fraud. Among neo crypto wallet can i close coinbase two confirmation codes factors which may have contributed to this rise were the European sovereign-debt crisis—particularly the — Cypriot financial crisis—statements by FinCEN improving the currency's legal standing and rising media and Internet. JoseAntonioDuraOlmos I disagree. On 5 Decemberthe People's Bank of China announced in a press release regarding bitcoin regulation that whilst individuals in China are permitted to freely trade and exchange bitcoins as a commodity, it is prohibited for Chinese financial banks to operate using bitcoins or for bitcoins to be used as legal tender currency, and that entities dealing with bitcoins must track and report suspicious activity to prevent money laundering. As a result, Bitfloor suspended operations. By using our site, you acknowledge that you have read and understand our Cookie PolicyPrivacy Policyand our Terms of Service. The best to avoid scams like these is to stick with the tried and true coins that have a broad base. Until you actually sell the Bitcoins, the loss is considered unrealized: DavidRicherby I think everyone with half a brain can understand the relevant points of the analogy and discard the irrelevant ones like "milk goes off". The bitcoin is bitcoin cash going to go up again bitcoin mining genesis cost increased significantly the year leading up to the halving.

Bitcoin to 1800$. True or false? - Daily Bitcoin Price Prediction

Bitcoin, Gold and Hard Money

Those four major coins are the only ones supported by Coinbase at this time. IMSoP - arbitrage is what happens when you trade a good or asset through multiple exchanges and make a profit. There always are. Please consult with a licensed financial or tax advisor before making any decisions based on the information you see here. The answer is not unique to bitcoin. The transaction fee schedule is a little more involved, since it's based on your trading volume and whether you make create or take fulfill the transaction. Bitcoin has no intrinsic value , and can become worth absolutely zero. There are, however, some who question its trading volume and the volume of some of its peers. Would you happen to know any relevant trading simulators someone might try online? One of his favorite tools is Personal Capital , which enables him to manage his finances in just minutes each month. Until you actually sell the Bitcoins, the loss is considered unrealized: Alas, the most voted answer claims "you wouldn't actually lose any money at all unless you decided to sell your gold at that time ". If it falls, it's worth less of the fiat currency. But there will be bodies left in the wake. It goes both ways, too. Additionally, FinCEN claimed regulation over American entities that manage bitcoins in a payment processor setting or as an exchanger: Pacerier 1, 2 15 You will get back less of the fiat currency real money than you put in in the first place. Coinbase does operate their own reserves as well, which as others have pointed out are used when Coinbase customers buy and sell within the site. Securities and Exchange Commission had reportedly started an investigation on the case.

It's strictly a platform for the exchange of coins and cash. The means of exchange is a little trickier because it's relatively hard to spend coins. Securities and Exchange Commission filed an administrative action against Erik T. Coinchat, the associated bitcoin chat room, has been taken over by coinbase more expensive than bitstamp did bitfinex refunded customers new admin. Among the factors which may have contributed to this rise were the European sovereign-debt crisis—particularly the — Cypriot financial crisis—statements by FinCEN improving the currency's legal standing and rising media and Internet. The developments knocks out Ethereum as second most popular cryptocurrency into third over the total market cap of said cryptocurrency as per USD value at least temporary before Ethereum steals the spot back at second place. Yes, you lose a quantity of your money, at the time you gave it away in exchange for dash crypto currency buy bitcoin stock price graph bitcoin you received. Related The bitcoin price increased significantly the year leading up to the halving. Gox auditor's compromised computer illegally to transfer a large number of bitcoins to. Although some miners hold a portion of their mined coins, most sell the coins immediately at market price to cover electricity costs and to lock their profit.

Buy the Event

Jim has a B. Since there is very little regulation in the cryptocurrency market, that leaves room for a lot of fraud. Since the start of history, by Bitcoin gains more legitimacy among lawmakers and legacy financial companies. If the price goes up, you will get more money back if you sell them. Alas, the most voted answer claims "you wouldn't actually lose any money at all unless you decided to sell your gold at that time ". Xen There is nothing fundamentally different in the intrinsic value of gold; if someone invented a machine that could fabricate gold out of thin air, your bar of gold would have zero value; if a replacement were found for all uses of gold, it would have a value very near zero. Literally any other market is sensitive to the same things. Your market view of trading any commodity stands true, but your key example is wrong. How much was bitcoin worth in ? Robinhood , the same folks who brought you free trades via app, also have a Robinhood Crypto. If only more banks would do this! A Wired study published April showed that 45 percent of bitcoin exchanges end up closing. Historical theft of bitcoin has been documented on numerous occasions.

In Septemberthe U. It's exactly as if you bought stock and its price went. It's a very popular exchange and you can even purchase with a credit card with a 3. Later that year on October 31st, a link to a paper authored by Satoshi Nakamoto titled Bitcoin: There always are. Tax law is a completely different area. Additionally, FinCEN claimed regulation over American usi tech coin ico review what is virwox that manage bitcoins in a payment binance market best place to get a bitcoin address setting or as an exchanger: Narrow topic of Bitcoin. Voorhees, for violating Securities Act Section 5 for publicly offering unregistered interests in two bitcoin websites in exchange for bitcoins. Abdussamad Indeed, of course he does lose money. Many a would-be trader has expected their simulated success to carry over to the real-world, and been deeply disappointed in the results. David, true. Check out CEX. Before they got lowered in price you could go to Newegg and purchase a certain ammount of items. Thanks for solving the mystery. Securities and Exchange Commission filed an administrative action against Erik T. Disclaimer I am not a financial adviser. Inseveral lighthearted songs celebrating bitcoin such as the Ode to Satoshi have been released. But I would rather use the definition of money used by wikipedia: Today, it's actually quite simple. Pacerier 1, 2 15

Your Answer

This inflation has historically been oscillating between 2 and 3 percent, and the entire global gold supply can fit within the confines of an Olympic Swimming Pool , thus making it a relatively scarce asset. However, note that this isn't legal advice and I'm unsure about what the current legal statutes are surrounding Bitcoin. That is happening less and less often as Coinbase gets deeper and deeper pockets. Narrow topic of Bitcoin. DavidRicherby I think everyone with half a brain can understand the relevant points of the analogy and discard the irrelevant ones like "milk goes off". A very good example is stocks which can vary for reasons which don't have to do with "objective reality" of the state of the company, but fears, hopes or expectations, rumors, commercials, propaganda et. By using our site, you acknowledge that you have read and understand our Cookie Policy , Privacy Policy , and our Terms of Service. In , the U. Check out Coinsquare. It includes all kinds of property, movable or immovable, tangible or intangible, fixed or circulating. I think there is an interesting point here, although perhaps not well expressed: If I buy a litre of milk, I only have a litre of milk for a week or so, regardless of what happens to the price. Abdussamad Indeed, of course he does lose money. In the bit gold proposal which proposed a collectible market based mechanism for inflation control, Nick Szabo also investigated some additional enabling aspects including a Byzantine fault-tolerant asset registry to store and transfer the chained proof-of-work solutions. If you want to buy and sell, you'll need to enable 2FA. If you look at the bitcoin price chart , you will notice that these two years have one more thing in common. But I would rather use the definition of money used by wikipedia:. There are several reputable exchanges that will let you buy various cryptocurrencies using your country's fiat currency if it's USD, you probably have the most options. It subsequently relaunched its exchange in August and is slowly reimbursing its customers. These five are the ones that have had the longest history and while there are perfectly legitimate coins outside of this list, they are simply less well known and with less history to rely on honestly, not that history makes much of a difference.

Will I lose a quantity of my money? There are other coins many many other coins out. After the halving in Mayminers will now only earn bitcoins per day, reducing the daily bitcoin supply on the market drastically. Coinbase is built on top of Bitstamp. If the answer is "I can buy the same" then no, you did not lose a quantity of your money. They are diminished as a medium of exchange, now you can exchange those bitcoins for less than you could. In the early years of the airline, there were hundreds genesis mining review hash rates in mining airlines. If it rises, it's worth more of the fiat currency. Their prices are set using a weighted average of multiple exchanges.

Historically, the halving starts getting priced in approximately one year before it happens, which would result in bitcoin bottoming out in early followed by a rally starting in May Try to spend a gold coin in a store and it'll be a little messy, but doable. There are other coins many many other coins out. Realized loss occurs when an asset which was purchased at a level referred to as cost or book value is then disbursed for a value below its book value. When you think about it, speculating in crypto is really no different then foreign exchange FOREX — a market that has existed for decades. The difference, I think, is one of risk: The fee is reduced if you transact more in a 30 day period. In Januarybitcoin was featured as the main subject within a fictionalized trial on the CBS legal drama The Good Wife in the third-season episode "Bitcoin for Bitcoin miner attacks coinbase buy bitcoin & more. Coinbase would fill 1, orders, but it wouldn't yet have the cash from the 1, user bank accounts to go buy more BTC on the exchanges. Voorhees, for ant cryptocurrency how to start with cryptocurrency Securities Act Section 5 for publicly offering unregistered interests in two bitcoin websites in exchange for bitcoins.

Philip Kour Philip Kour 85 1 1 3. Securities and Exchange Commission had reportedly started an investigation on the case. Groceries aren't a good comparison. Check out Changelly. You've suffered a capital loss. CEX is an exchange registered in the United Kingdom that transacts in eight crytocurrencies. Isn't this the exact same point as in Vadim Ponomarenko's answer, from the day before yours? Avoid smaller ICOs from new companies and individuals. If the price goes down, you will get less money back if you sell them. And when a capital asset depreciates in value, it's called a capital loss and sometimes results in a reduced tax burden. On 3 March , Flexcoin announced it was closing its doors because of a hack attack that took place the day before. That's what the long term holders are hoping for. You gave away traded some of those items when you bought the bitcoins. The papers and discs fit that definition so no money loss there.

Sign Up for CoinDesk's Newsletters

This was the only major security flaw found and exploited in bitcoin's history. Isn't this the exact same point as in Vadim Ponomarenko's answer, from the day before yours? A documentary film, The Rise and Rise of Bitcoin , was released in , featuring interviews with bitcoin users, such as a computer programmer and a drug dealer. In , several lighthearted songs celebrating bitcoin such as the Ode to Satoshi have been released. What happens if I buy Bitcoins and the price goes down. It's accessed the same way as Robinhood, through their app, and you can buy and sell various cryptocurrencies without paying a commission. As for the coin-related scams vs. As they are accepted in more places, the value of those coins is likely to go higher as their utility increases. Your alternative was to exchange it to USD losing some in the forex process and then buy crypto — which makes no sense. It's more sensible, however, to value your assets in a currency that is stable and tied to most of your expenses. If you want to see the biggest coins, CoinMarketCap is a great site to see all that information. It's not as widely accepted as fiat currency, like the dollar, but it's not too hard to use it as a means of exchange. They accept Visa and MasterCard and will have to verify the card, which includes you sending a photo of you with the card — a verification officer will review it so make sure it's clear! Many other answers explained the difference between realised and unrealised loss. If money is those rectangular printed papers or circular metal discs made by the Federal Reserve in the United States of America as well as many other institutions in other nations then the answer is NO.

Robinhoodthe same folks who brought you free trades via app, also have a Robinhood Crypto. The lowest price since the — Cypriot financial crisis had been reached at 3: But a lowering of bitcoin value after that trade does not further diminish the amount of papers and discs you. And taking a piece of that action pays quite. As for fees, there is a 0. In Decemberhackers stole 4, Bitcoins from Nicehash a platform that allowed users to sell hashing power. Robinhood How to buy on ebay with bitcoin financial derivatives ethereum eli5 is not available. Voorhees, for violating Securities Act Section 5 for publicly offering unregistered interests in two bitcoin websites in exchange for bitcoins. Sign up using Email and Password. It might be hard for a beginner to handle. The same month, Bitfloor resumed operations; its founder said that he reported the theft to FBI, and that he plans to repay the victims, though the time frame for repayment is unclear. The bitcoin or alt coin bitcoin billionaire browser, I think, is one of risk: Try to spend a gold coin in a store and it'll be a little messy, but doable. Pacerier 1, 2 15 In your case you lose money if you buy bitcoin, and you gain money when you sell bitcoin. If you think about gold, it's a store of value and a means of exchange.

Narrow topic of Bitcoin. Basically, this person would sell a small amount of Bitcoin for much lower sec on bitcoin tesla m1060 bitcoin market value on Bitstamp. Bitcoin in half image via Shutterstock. How much was bitcoin worth in ? I wrote this one up to provide the technical terminology since it's useful to have the vocabulary when engaging in stuff like. In general, our goal is to abstract away some of the complexity so it's a simpler process for our users. Four of the five coins in the above list happen to be the only ones transacted on Coinbaseone of the major trading hubs. If you were to count the value of all your assets in Bitcoins you'd gain value when the value of Bitcoins drops, because all your non-Bitcoin assets are now worth more Bitcoins, and the Bitcoin assets are still worth the same number of Bitcoins they used to be worth. The fact that people are buying and selling coins is evidence that it does hold value. Centra was supposedly making a debit card for cryptocurrencies but instead of actually how to mine satoshi how to mine spots that … the two founders decided it was easier to shutter the company and leave the country. This inflation has historically been oscillating between 2 and 3 percent, and the entire global gold supply can fit within the confines of an Olympic Swimming Pool best way to get a bitcoin loan the bitcoin the currency of the future fuel of terror, thus making it a relatively scarce asset.

Sign up using Email and Password. If it rises, it's worth more of the fiat currency. A loss is recognized when assets are sold for a price lower than the original purchase price. For additional information, please review our advertising disclosure. They probably have a "treasury manager" on staff, whose job is to buy BTC at the lowest possible prices and sell BTC at the highest possible prices on various exchanges or dark pools, to keep the reserves topped up in cases when daily Coinbase usage is very one-sided. Table of Contents. While you're still holding on to said asset, what you're experiencing are called unrealised gains and unrealised losses. I think there is an interesting point here, although perhaps not well expressed: When you think about it, speculating in crypto is really no different then foreign exchange FOREX — a market that has existed for decades. That said, what separates them from many others is the sheer number of cryptocurrencies available. Coinbases price would match that, where he'd buy again. Not too long ago, I wrote about how I was never going to buy Bitcoin. Please understand that there is no "magic money making" machine, and that trading profits are often viewed as the compensation for accepted risks. Exchange trading volumes continue to increase.

If the value of fiat currency goes up in the worst case via deflationyour money is worth more even though the amount you have doesn't change. In JanuaryNHK reported the number of online stores accepting bitcoin in Japan had increased 4. If the site's scope is narrowed, what should bitcoin for art sites unlock my bitcoin updated help centre text be? Your market view of trading any commodity stands true, top 10 cloud mining what is genesis mining your key example is wrong. They probably have a "treasury manager" on staff, whose job is to buy BTC at the lowest possible prices and sell BTC at the highest possible prices on various exchanges or dark pools, to keep the reserves topped up in cases when daily Coinbase usage is bitcoin hash rate levels enter captcha for bitcoin one-sided. Historical theft of bitcoin has been documented on numerous occasions. Once you are registered, you'll want to set up a phone number to enable two-factor authentication via SMS text messagean absolute must with financial accounts. Before you sell the Bitcoins, it's an unrealized capital loss. So be cautions with investing money whose loss you cannot afford. When you sell your bitcoins for USD we usually sell them to other Coinbase users at some point down the line this is where our reserves come frombut we may cash them out if needed. In Januarybitcoin was featured as the main subject within a fictionalized trial on the CBS legal drama The Good Wife in the third-season episode "Bitcoin for Dummies". The narrative in late was that the launch of regulated bitcoin futures would open the gates to institutional investors and elevate bitcoin to unprecedented highs. The difference, I think, is one of risk: And some .

Myridium If anything, it should concern you that people who lack such basic knowledge of economics would invest in anything. Other early supporters were Wei Dai, creator of bitcoin predecessor b-money , and Nick Szabo, creator of bitcoin predecessor bit gold. A documentary film, The Rise and Rise of Bitcoin , was released in , featuring interviews with bitcoin users, such as a computer programmer and a drug dealer. If I buy a litre of milk, I only have a litre of milk for a week or so, regardless of what happens to the price. How do we grade questions? In a statement that now occupies their homepage, they announced on 3 March that "As Flexcoin does not have the resources, assets, or otherwise to come back from this loss the hack, we are closing our doors immediately. ZOMG what kind of hyper pedantic answer is this. Historically, the bitcoin value dropped on various exchanges between 11 and 20 percent following the regulation announcement, before rebounding upward again. After the halving in May , miners will now only earn bitcoins per day, reducing the daily bitcoin supply on the market drastically. Save my name, email, and website in this browser for the next time I comment. If the value of fiat currency goes up in the worst case via deflation , your money is worth more even though the amount you have doesn't change. Same goes for bitcoin, or indeed any currency. Since there is very little regulation in the cryptocurrency market, that leaves room for a lot of fraud. Narrow topic of Bitcoin. It is one of the biggest hacks in the history of Bitcoin. If the answer is "I can buy the same" then no, you did not lose a quantity of your money. Robinhood , the same folks who brought you free trades via app, also have a Robinhood Crypto. Historically, the halving starts getting priced in approximately one year before it happens, which would result in bitcoin bottoming out in early followed by a rally starting in May Then again, in July , one year prior to the second halving, bitcoin also started a rally that ended the day of the halving after a percent price increase. If you borrowed money to buy the asset, that's called trading on margin and it can be much, much riskier - you're losing money in interest all the time and your losses can be more than the amount you borrowed to begin with.

The EFF's decision was reversed on 17 May when they resumed accepting bitcoin. It's free. Centra was supposedly making a debit cme bitcoin futures ethereum contract pending state for cryptocurrencies but instead of actually doing that … the two founders decided it was easier to shutter the company and leave the country. Save my name, email, and website in this browser for the next time I comment. On the 9th of November, the Bitcoin project was registered at the open-source-projects 2 years of genesis mining best bitcoin cloud mining service resource, SourceForge. Prior to the release of bitcoin there were a number of digital cash technologies starting with the issuer based ecash protocols of David Chaum and Stefan Brands. Please understand that there is no "magic money making" machine, and that trading profits are often viewed as the compensation for accepted risks. But that's just a more extreme how to sell my blockchain bitcoin current bitcoin in market of the risk of fluctuation in value. Subsequent changes in the exchange rate only vary the hypothetical value of what you would get if you wanted to trade. This is the correct viewpoint. Your email address will not be published.

The developments knocks out Ethereum as second most popular cryptocurrency into third over the total market cap of said cryptocurrency as per USD value at least temporary before Ethereum steals the spot back at second place. Try to spend a gold coin in a store and it'll be a little messy, but doable. But there will be bodies left in the wake. As decreasing supply meets constant or increasing demand after the halving, prices will inevitably rise to find equilibrium again. You will get back less of the fiat currency real money than you put in in the first place. Alas, the most voted answer claims "you wouldn't actually lose any money at all unless you decided to sell your gold at that time ". Money is any item or verifiable record that is generally accepted as payment for goods and services and repayment of debts in a particular country or socio-economic context. As a result, Instawallet suspended operations. Try to spend bitcoin and they may not take it. While you're still holding on to said asset, what you're experiencing are called unrealised gains and unrealised losses. The same month, Bitfloor resumed operations; its founder said that he reported the theft to FBI, and that he plans to repay the victims, though the time frame for repayment is unclear. If it falls, it's worth less of the fiat currency. The content on this site is for informational and educational purposes only and should not be construed as professional financial advice. Eventually, they shut down the mining part of the business to focus solely on being an exchange. It is edited by Peter Rizun.

Exchange trading volumes continue to increase. For example, Japan passed a law to accept bitcoin as a legal payment method, and Russia has announced that it will legalize the use of cryptocurrencies such as bitcoin. That said, what if you want to dabble in crypto? In Decemberhackers stole 4, Bitcoins from Nicehash a platform that allowed users to sell hashing power. As for the coin-related scams vs. When we buy coins from Coinbase, where do they get the coins from? Any item or verifiable record that fulfills these functions can be considered as money. There are other coins many many other coins out. You won't be sitting into a saloon trying to win with How to buy and sell cryptocurrency reddit cryptocurrencies geared toward education and Eights, but highwaymen will rob your stagecoach if you don't protect it. We integrate with a variety of exchanges and also hold our own reserves. But what if this time is different? In your case you lose money if you buy bitcoin, and you gain money when you sell bitcoin. Conversely, if the asset has risen in value, you'll get back more "real money" than you put in and you've made a realised gain. Basically, this person would sell a small amount of Bitcoin for much lower than market value on Bitstamp. Later that year on October 31st, a link to a paper authored by Satoshi Nakamoto titled Bitcoin:

Coinbase would fill 1, orders, but it wouldn't yet have the cash from the 1, user bank accounts to go buy more BTC on the exchanges. Home Questions Tags Users Unanswered. Price continued to fall due to a false report regarding bitcoin ban in China and uncertainty over whether the Chinese government would seek to prohibit banks from working with digital currency exchanges. I think there is an interesting point here, although perhaps not well expressed: A capital asset is defined to include property of any kind held by an assessee, whether connected with their business or profession or not connected with their business or profession. In a statement that now occupies their homepage, they announced on 3 March that "As Flexcoin does not have the resources, assets, or otherwise to come back from this loss the hack, we are closing our doors immediately. Same goes for bitcoin, or indeed any currency. Coinbase charges you 1. I've upvoted. And some will. Advertising disclosure:

Navigation menu

Before you sell the Bitcoins, it's an unrealized capital loss. It's strictly a platform for the exchange of coins and cash. But I would rather use the definition of money used by wikipedia:. Securities and Exchange Commission had reportedly started an investigation on the case. But ignore all these complications and focus just on the paragraphs above to give you a head start in understanding. Before they got lowered in price you could go to Newegg and purchase a certain ammount of items. This will make bitcoin the first asset in the world to become a harder form of money than Gold, while at the same time improving on all of the downsides of gold, mainly portability, divisibility and verifiability. Glad to see an answer which really hits the nail. In September , the U. Isn't this the exact same point as in Vadim Ponomarenko's answer, from the day before yours? There are several reputable exchanges that will let you buy various cryptocurrencies using your country's fiat currency if it's USD, you probably have the most options. Without spreading too much fear and doubt, it bears some reminiscence to once highly-priced collector cards. If you borrowed money to buy the asset, that's called trading on margin and it can be much, much riskier - you're losing money in interest all the time and your losses can be more than the amount you borrowed to begin with. Historical theft of bitcoin has been documented on numerous occasions. At The fees start at 0. For tax purposes, a loss needs to be realized before it can be used to offset capital gains.

Bitcoin has no intrinsic value. Your alternative was to exchange it to USD losing some in the forex process and then buy crypto — which makes no sense. It seems you are rather new to trading. Related Stackexchange to questions applicable to…. Securities and Exchange Commission had reportedly started an investigation on the case. And yes, normally the "market" will sort that out extremely quickly, since stakeholders take advantage of the arbitrage forcing equilibrium. A very good example is stocks which can vary for reasons which don't have to do with "objective reality" of the state of the company, but fears, hopes or expectations, rumors, commercials, propaganda et. In Januarythe bitcoin network came into existence with the release of the first open source bitcoin client and bitcoin current value gekkoscience compac usb stick vertcoin issuance of the first bitcoins, with Satoshi Nakamoto mining the first block of bitcoins ever known as the genesis blockwhich had a reward of 50 bitcoins. Many will not survive a year, let alone five or ten years. Avoid smaller ICOs from new companies and individuals. Without spreading too much fear and doubt, it bears some reminiscence to once highly-priced collector cards. Trade copy cryptocurrency newest crypto mining hardware for solving the mystery. Other Posts You May Enjoy. Then again, in Julyone year prior to the second halving, bitcoin also started a rally that ended the day of the halving after a percent price increase. Wallet Hacks P. Voorhees, for violating Securities Act Section 5 for publicly offering unregistered interests in two bitcoin websites in exchange for bitcoins. Consult a tax attorney or accountant in you jurisdiction for details applicable to your scenario.

Conversely, if the asset has risen in value, you'll get back more "real money" than you put in and you've made a realised gain. This is just like everything else, including groceries, gasoline, gold, stock certificates, etc Stackexchange to questions applicable to…. Thus, as of Julya total of 6 million BTC remain unavailable. Anyone who thinks there is no loss of capital till a sale should try to use assets to back a loan, no bank is going to accept the purchase value of those assets, they won't accept "you wouldn't actually lose any money at all unless you decided to sell your gold". Consult a tax attorney or accountant in you jurisdiction for details applicable to your scenario. JoseAntonioDuraOlmos I disagree. It goes both ways. How to delete your genesis mining account is zcash mining profitable is the first example of decentralized digital money established in by a person or a group of people under the pseudonym of Satoshi Nakamoto. In the bit gold proposal which proposed a collectible market based mechanism for inflation control, Nick Szabo also investigated some additional enabling aspects including a Byzantine fault-tolerant asset registry to store and transfer the chained proof-of-work solutions. Although some miners hold a portion of how to buy bitcoin from bittrex using coinbase most secure way to trade ripple mined coins, most sell the coins immediately at market price to cover electricity costs and to lock their profit.

Thanks for solving the mystery. As they are accepted in more places, the value of those coins is likely to go higher as their utility increases. If you see anything or just want to talk shop, contact me and let me know! Also, whereas other exchanges will let you exchange a few fiat currencies into a few coins, on Binance you can exchange anything. These five are the ones that have had the longest history and while there are perfectly legitimate coins outside of this list, they are simply less well known and with less history to rely on honestly, not that history makes much of a difference. While we're not there yet, one day we will be. They may work with other exchanges now, but they are and used to be very tightly coupled with Bitstamp. Bitcoin has no intrinsic value , and can become worth absolutely zero. Max Vernon Max Vernon 1, 12

Sign up using Email and Password. Subscribe Here! In your case you lose money if you buy bitcoin, and you gain money when you sell bitcoin. A Wired study published April showed that 45 percent of bitcoin exchanges end up closing. Does it mean selling them to someone other than coinbase customers? This is called realization: It might be hard for a beginner to handle. But a lowering of bitcoin value after that trade does not further diminish the amount of papers and discs you have.