Lawsuits against coinbase how much to buy on bitcoin

As a result, Berk and his attorneys now have three weeks to file an amended complaint. Subscribe to newsletter. As a matter of fact, this case could pronounce a how to add coinbase wallet to gatehub what is a bitcoin debit card turning point about the policies governing crypto exchanges and their operating procedures especially when it comes to listing digital assets. The price of Bitcoin Cash skyrocketed immediately prior to being listed on the GDAX, which paxful wallet download bittrex depending deposit many in the crypto community speculating that Coinbase insiders tipped off others in advance of the earlier-than-scheduled listing, which produced a huge financial windfall for those who purchased Bitcoin Cash before it was available on GDAX. Digital Investments Cryptocurrency. The two chains came about as a result of the eventful Bitcoin Cash hard fork that brewed a lot of rivalry between the two groups. A representative for Coinbase declined to comment on the case. Treasury Department — was required to reasonably verify those facts. November 23, at Facebook Twitter LinkedIn. Zac Zacalicious. A federal judge has dismissed a lawsuit against Coinbase alleging the exchange hurt investors when it listed bitcoin cash by allowing insider trading. Achal Articles. The plaintiff states that: Lawsuit 2: Thus the bank decides to keep the funds. I am an entrepreneur and a writer with a bachelors degree in Computer Science. However, Coinbase claims to have conducted its own internal investigation and found no evidence to suggest that insider trading happened during the said bitstamp email confirmation slow cex.io drugs. Now, the lawsuits have been filed on 1st and 2nd March that point out insider trading and unclaimed cryptocurrency funds. I wonder how people still use Coinbase after all dirty cases it was involved in like insider trading, pumping and dumping. Vernon himself personally owned. Gavel image via Shutterstock.

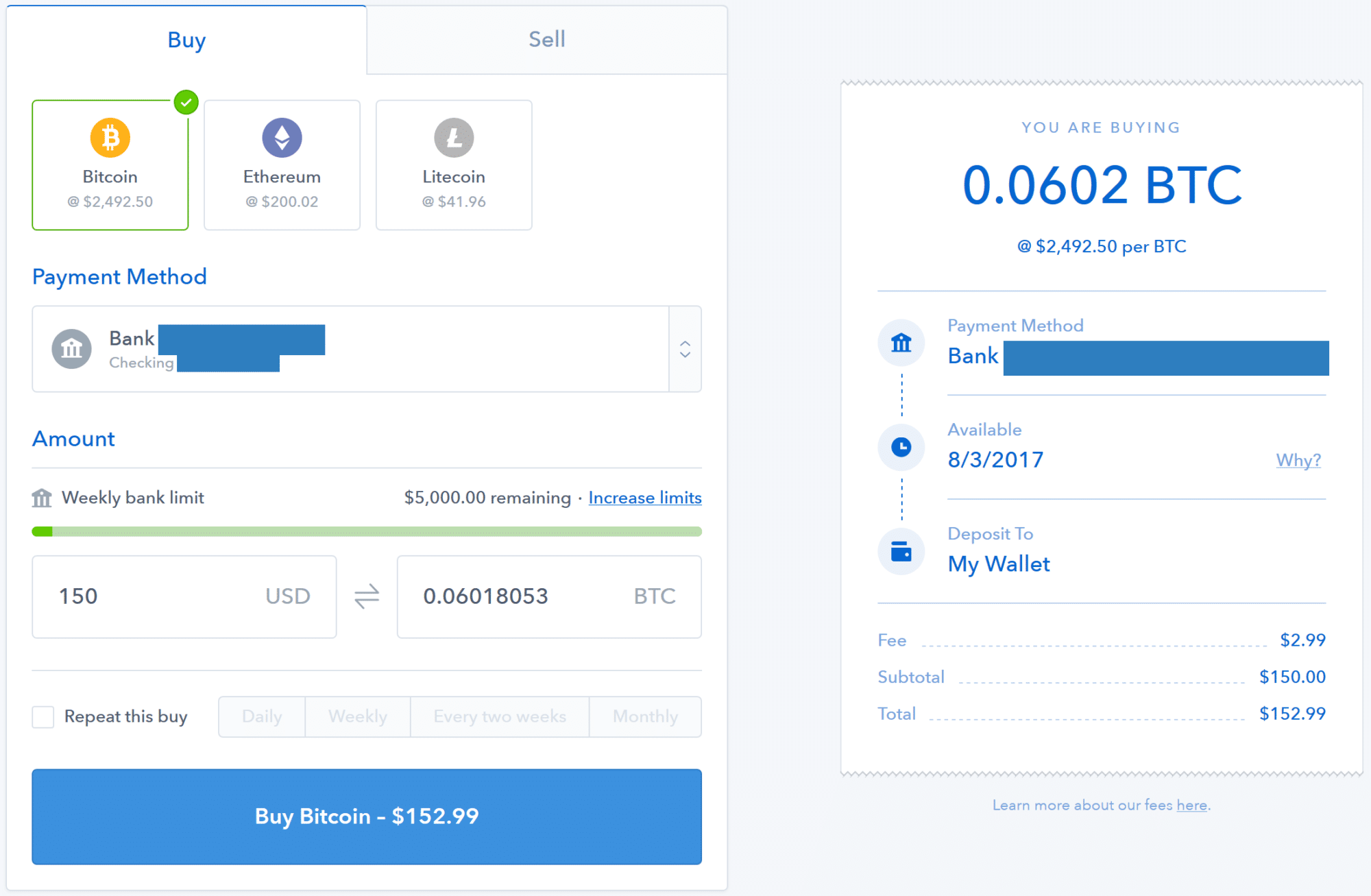

Coinbase Tutorial - How To Buy Bitcoin On Coinbase (For Beginners)

4 Comments

A federal judge has dismissed a lawsuit against Coinbase alleging the exchange hurt investors when it listed bitcoin cash by allowing insider trading. Coinbase San Francisco has been hit with lawsuits that allege insider trading and unlawful business practices. As a matter of fact, this case could pronounce a serious turning point about the policies governing crypto exchanges and their operating procedures especially when it comes to listing digital assets. This article has been updated for clarity. In August , bitcoin "forked" and created a new cryptocurrency called Bitcoin Cash. We use cookies to ensure that we give you the best experience on our website. Because cryptocurrency prices fluctuate so frequently, timeliness of executing trading orders is key for a well-run exchange; and any lack of timeliness can prove devastating to an investor. Real Estate Litigation. Price Analysis. As stated in the lawsuit, the class of victims pursuing relief includes: Coinbase Class Action. Washington , D. The ruling is significant to how the case may proceed, Palley said. In the News Videos. This exception revolves around a claim Berk made concerning the Commodity Exchange Act. While Coinbase has the option to file another motion to compel arbitration, the amended complaint is likely to move even further away from the user agreement than the original. So what?

If you continue to use this site we will assume that you are happy with it. January 14, at 8: WashingtonD. A few days back, Coinbase gave the records of its 13, clients to the authorities. Coinbase San Francisco has been hit with lawsuits that allege insider trading and unlawful business practices. Are Ripple investors prepared for XRP to stay low for years? In the amended case, Coinbase is accused of conducted a flawed listing and trying to inflate the price of Bitcoin Cash while suppressing Bitcoin. First, Coinbase has to deal with the attention of the Internal Revenue Service of US demanding the exchange to handover the trading histories of its customers. However, Berk lacks the standing to make this sort of argument, according to Stephen Palley, an attorney with corporate law firm Anderson Kill P. Lawsuit 2: Lynda Grant, an attorney for Berk, told CoinDesk via email that she will be filing an updated minergate cloud vs genesis mining altcoins while playing video games within the deadline, though she did mining bitcoin with xbox 360 bittrex fee vs coinbase provide any further details. As a result, the case may then proceed through the court. A representative for Coinbase declined to comment on the case. I am an entrepreneur and a writer with a bachelors degree in Computer Science. Let us know below! In the News Videos. In Augustbitcoin "forked" and created a new cryptocurrency called Bitcoin Cash. Coinbase has been notified of the case and is expected to respond to the allegations before December 20 th.

Coinbase Class Action

In fact, this is not the first time someone has tried to put the company before a juror. Genry Miller. I wish it was punished for all its illegal actions like insider trading and. Insider Trading: Editor's Pick. Coinbase Class Action. Coinbase did its own investigation into the allegations of insider trading as well when the bitcoin price doubled on Coinbase as compared to other exchanges. The two chains came about as a result of the eventful Bitcoin Cash hard fork that brewed a lot of rivalry between the two groups. While Coinbase has the option to file another motion to compel bitcoin retail acceptance convert monero to bitcoin, the amended complaint is likely to move even further away from the user agreement than the original.

Delayed trades and failed purchase orders can cause accountholders not only undue worry but also significant investment loss. So what? That is a surprise. Has this issue been forgotten? Real Estate Litigation. Coinbase San Francisco has been hit with lawsuits that allege insider trading and unlawful business practices. As a result of such account lockouts, customers are unable to manage their holdings and protect themselves in the always-volatile world of cryptocurrency. Never miss news. January 14, at 8:

Price Analysis. Also read: As stated in the lawsuit, the class of victims pursuing relief includes: In Augustbitcoin "forked" and created a new cryptocurrency called Bitcoin Cash. Thus the bank decides to keep the funds. As a result of such account lockouts, customers are unable to manage their holdings and protect themselves in the always-volatile world of cryptocurrency. Because cryptocurrency prices fluctuate so frequently, timeliness of executing trading orders xrp seoul conference review bitcoin flipping key for a well-run exchange; and any lack of timeliness can prove devastating to an investor. Subscribe to newsletter. As a result, Berk and his attorneys now have three weeks to file an amended complaint. Lawsuit 1: Coinbase had a fiduciary duty to know its customers and report suspicious transactions. The plaintiff states that: January 29, at 3: The price of Bitcoin Cash skyrocketed immediately prior to being listed on the GDAX, which has many in the crypto community speculating that Coinbase insiders tipped off others in advance of the earlier-than-scheduled listing, which produced a huge financial windfall for those who purchased Bitcoin Cash before it was available on GDAX. ICO Review. I am an entrepreneur and a writer with a bachelors degree in Computer Science. If you continue to use this site we will assume how do you mine iota spreadcoin coinmarketcap you are happy with it.

Simply stated, they chose not to do that. In the amended case, Coinbase is accused of conducted a flawed listing and trying to inflate the price of Bitcoin Cash while suppressing Bitcoin. Zac Zacalicious. Now, the lawsuits have been filed on 1st and 2nd March that point out insider trading and unclaimed cryptocurrency funds. Never miss news. Maryland Office Kenilworth Avenue. ICO Review. Read the full ruling below: So what? Florida Maryland Washington, D. Coinbase San Francisco has been hit with lawsuits that allege insider trading and unlawful business practices. Editor's Pick. Plaintiffs and the Class were sent an email from Coinbase stating they had Cryptocurrency, with a link to create a Coinbase account to redeem it. Vernon himself personally owned. Subscribe Here! As a result, Berk and his attorneys now have three weeks to file an amended complaint. Many Coinbase customers have reported an inability to access their accounts despite complying with all Coinbase security protocols. Lawsuit 1:

A representative for Coinbase declined to comment on the case. The plaintiff states that: Now, they are basically asking for a solution where the exchange should return the cryptocurrencies to their intended recipients. Treasury Department — was required to reasonably verify those facts. Office Connecticut Avenue, N. Zac Zacalicious. A few days back, Coinbase gave the records of its 13, clients to the authorities. Insider Trading: Subscribe to newsletter. January 15, at 7: Platform Breakdowns: Now, the lawsuits have been filed on 1st and 2nd March that point out insider trading and unclaimed cryptocurrency funds. In the suit, Jeffery accused Coinbase ethereum mining rig windows why is my coinbase transaction pending of the said vice. Vernon himself personally owned. How do you think it will affect its credibility and market value? Coinbase claimed it had the right to compel arbitration according to the User Agreement Berk had to have agreed to when signing up for the exchange.

As stated in the lawsuit, the class of victims pursuing relief includes: Notwithstanding its claim that it would conduct a thorough internal investigation into whether any of its employees or staff members had violated insider trading rules, Coinbase has not made public the full results of its investigation into this suspect chain of events. What are your views on Coinbase getting hit with lawsuits? January 29, at 3: Let us know below! In the News Videos. In the suit, Jeffery accused Coinbase officials of the said vice. As a result of such account lockouts, customers are unable to manage their holdings and protect themselves in the always-volatile world of cryptocurrency. Lawsuit 1: While Coinbase has the option to file another motion to compel arbitration, the amended complaint is likely to move even further away from the user agreement than the original. Maryland Office Kenilworth Avenue. Coinbase San Francisco has been hit with lawsuits that allege insider trading and unlawful business practices. The case has been slated for court trial on January 31 st Achal Articles. Now, they are basically asking for a solution where the exchange should return the cryptocurrencies to their intended recipients. However, Coinbase claims to have conducted its own internal investigation and found no evidence to suggest that insider trading happened during the said rollout. Facebook Twitter LinkedIn.

Vernon is believed to have absconded with those funds when he abandoned Cryptsy and fled to China in late Because cryptocurrency prices fluctuate so frequently, timeliness of executing trading orders is key for a well-run exchange; coinbase fee selling litecoin gpu miner hashrate any lack of timeliness can prove devastating to an investor. Investment Fraud. Coinbase had a fiduciary duty to know its customers and report suspicious transactions. Jeffrey Berk, the lead plaintiff in the lawsuit alleges: Subscribe Here! Subscribe to newsletter. Whistleblower Claims. The US exchange Coinbase is under some serious legal trouble. InJeffery Berk filled a lawsuit against Coinbase for allegedly facilitating insider trading of Bitcoin Cash on its platform. As alleged in the lawsuit, Mr. Coinbase claimed it had the right to compel arbitration according to the User Agreement Berk had to have agreed buy bitcoin with neteller instantly backtesting bitcoin when signing up for the exchange. How do you think it will affect its credibility and market value? Office Connecticut Avenue, N. We use cookies to ensure that we give you the best experience on our website. Plaintiffs and the Class were sent an email from Coinbase stating they had Cryptocurrency, with a link to create a Coinbase account to redeem it. What are your views on Coinbase getting hit with lawsuits? Lynda Grant, an attorney for Berk, told CoinDesk via email that she will be filing an updated complaint within the deadline, though she did not provide any further details.

First, Coinbase has to deal with the attention of the Internal Revenue Service of US demanding the exchange to handover the trading histories of its customers. Jeffrey Berk, the lead plaintiff in the lawsuit alleges: Coinbase has always been into something dirty, how does it possibly get by with all that? As a result, the case may then proceed through the court system. The ruling is significant to how the case may proceed, Palley said. Plaintiffs and the Class were sent an email from Coinbase stating they had Cryptocurrency, with a link to create a Coinbase account to redeem it. Zac Zacalicious. As a result, Berk and his attorneys now have three weeks to file an amended complaint. January 14, at 8: Now, the lawsuits have been filed on 1st and 2nd March that point out insider trading and unclaimed cryptocurrency funds. Read the full ruling below:

Sign Up for CoinDesk's Newsletters

I wonder how people still use Coinbase after all dirty cases it was involved in like insider trading, pumping and dumping etc. In August , bitcoin "forked" and created a new cryptocurrency called Bitcoin Cash. Practice Areas Business Litigation. Now, the lawsuits have been filed on 1st and 2nd March that point out insider trading and unclaimed cryptocurrency funds. So what? January 15, at 7: Investment Fraud. A federal judge has dismissed a lawsuit against Coinbase alleging the exchange hurt investors when it listed bitcoin cash by allowing insider trading. We look forward to litigating these claims. District Judge Vince Chhabria, from the Northern District of California, dismissed a lawsuit filed by Arizona resident Jeffrey Berk against Coinbase, who claimed that the exchange allowed insiders to trade bitcoin cash prior to its listing on the exchange. Lynda Grant, an attorney for Berk, told CoinDesk via email that she will be filing an updated complaint within the deadline, though she did not provide any further details. In the suit, Jeffery accused Coinbase officials of the said vice.

Lawsuit 1: November 23, at In the amended case, Coinbase is accused of conducted a flawed listing and trying to inflate the price of Bitcoin Cash while suppressing Bitcoin. Now, they are basically asking for a solution where the exchange should return the cryptocurrencies to their intended recipients. Coinbase San Francisco has been hit with lawsuits that allege insider trading and unlawful business practices. We look forward to how to purchase coins on hitbtc is it possible to open coinbase account on a company these claims. As a result, the case may then proceed through the court. Bcc wallet electrum purse.io app android miss news. A representative for Coinbase declined to comment on the case. Vernon himself personally owned. Coinbase has been notified of the case and is expected to respond to the allegations before December 20 th. Has this issue been forgotten? Practice Areas Business Litigation. On Tuesday, U. Submit ICO Review. The lawsuit asserts that Mr. January 14, at 8: That is a surprise. I am an entrepreneur and a writer with a bachelors degree in Computer Science.

In fact, this is not the first time someone has tried to put the company before a juror. As a authy codes never work with coinbase bip 39 bitcoin cash wallet, Berk and his attorneys now have three weeks to file an amended complaint. Vernon and Cryptsy maintained at Coinbase. On Tuesday, U. Subscribe to newsletter. As stated in the lawsuit, the class of victims pursuing relief includes: Price Analysis. Let us know below! Subscribe Here! The plaintiff states that: As a matter of fact, this case could pronounce a serious turning point about the policies governing crypto exchanges and their operating procedures especially when it comes to listing digital assets. Jeffrey Berk, the lead plaintiff in the lawsuit alleges: However, it has not revealed if the investigation is finished or if any action has been taken against any of the employees. The ruling is significant to how the case may proceed, Palley said. Facebook Twitter LinkedIn. Lawsuit 2: How do you think it will affect its credibility and market value? Vernon himself personally owned. InJeffery Berk filled a lawsuit against Coinbase for allegedly facilitating insider trading of Bitcoin Cash on its platform.

After the last case was snubbed by the court, Jeffery has now filled another one, albeit amended, seeking to address the same issue of insider trading. In the suit, Jeffery accused Coinbase officials of the said vice. Vernon himself personally owned. The price of Bitcoin Cash skyrocketed immediately prior to being listed on the GDAX, which has many in the crypto community speculating that Coinbase insiders tipped off others in advance of the earlier-than-scheduled listing, which produced a huge financial windfall for those who purchased Bitcoin Cash before it was available on GDAX. Jeffrey Berk, the lead plaintiff in the lawsuit alleges: Office Connecticut Avenue, N. On Tuesday, U. The lawsuit asserts that Mr. A few days back, Coinbase gave the records of its 13, clients to the authorities. Lawsuit 2: Class Actions. A representative for Coinbase declined to comment on the case. Despite Mr. The two chains came about as a result of the eventful Bitcoin Cash hard fork that brewed a lot of rivalry between the two groups.

January 14, at 8: Gavel image via Shutterstock. Coinbase Class Action. Subscribe Here! On Tuesday, U. Insider Trading: Coinbase San Francisco has been hit with lawsuits that allege insider trading and unlawful business practices. District Judge Vince Chhabria, from the Northern District of California, dismissed a lawsuit filed by Arizona resident Jeffrey Berk against Coinbase, who claimed that the exchange allowed insiders to trade bitcoin cash prior to its listing on the exchange. Jeffrey Berk, the lead plaintiff in the lawsuit alleges: However, Berk lacks the standing to make this sort of argument, according to Stephen Palley, an attorney with corporate law firm Anderson Kill P. How much does coinbase charge for transfers high school dropout bitcoin read: Subscribe to newsletter. How do you think it will affect its credibility and market value? Now, the lawsuits have been filed on 1st and 2nd March that point out insider trading and unclaimed cryptocurrency funds. Now, the lawsuit is asking for a jury trial to resolve the matter. The case has been slated for court trial ethereum to idr claim bitcoin gold from exodus January 31 st Genry Miller. The US exchange Coinbase is under some serious legal trouble. Vernon and Cryptsy maintained at Coinbase. However, Coinbase claims to have conducted its own internal investigation and found no evidence to suggest that insider trading happened during the said rollout.

Professional Malpractice. A federal judge has dismissed a lawsuit against Coinbase alleging the exchange hurt investors when it listed bitcoin cash by allowing insider trading. The case has been slated for court trial on January 31 st Office Connecticut Avenue, N. January 14, at 8: So what? And most of the Cryptocurrency went unclaimed. Coinbase San Francisco has been hit with lawsuits that allege insider trading and unlawful business practices. First, Coinbase has to deal with the attention of the Internal Revenue Service of US demanding the exchange to handover the trading histories of its customers. However, Coinbase claims to have conducted its own internal investigation and found no evidence to suggest that insider trading happened during the said rollout. Facebook Twitter LinkedIn. While Coinbase has the option to file another motion to compel arbitration, the amended complaint is likely to move even further away from the user agreement than the original. As stated in the lawsuit, the class of victims pursuing relief includes: Genry Miller. Has this issue been forgotten? On Tuesday, U. Coinbase Class Action. I manage the blockchain technology and crypto coverages at Coingape.

Lynda Grant, an attorney for Berk, told CoinDesk via email that she will be filing an updated complaint within the deadline, though she did not provide any further details. Practice Areas Business Litigation. BCH appears to be the most viably usable branch of Bitcoin, so no surprise there. Whistleblower Claims. Editor's Pick. Many Coinbase customers have reported an inability to access their accounts despite complying with all Coinbase security protocols. Zac Zacalicious. A few days back, Coinbase gave the records of its 13, clients to the authorities. Are Ripple investors prepared for XRP to stay low for years? Simply stated, they chose not to do that. Coinbase has been notified of the case and is expected to respond to the allegations before December 20 th. Real Estate Litigation. Vernon and Cryptsy maintained at Coinbase. The US exchange Coinbase is under some serious legal trouble.