Bitmex fees coinbase btc vs bth

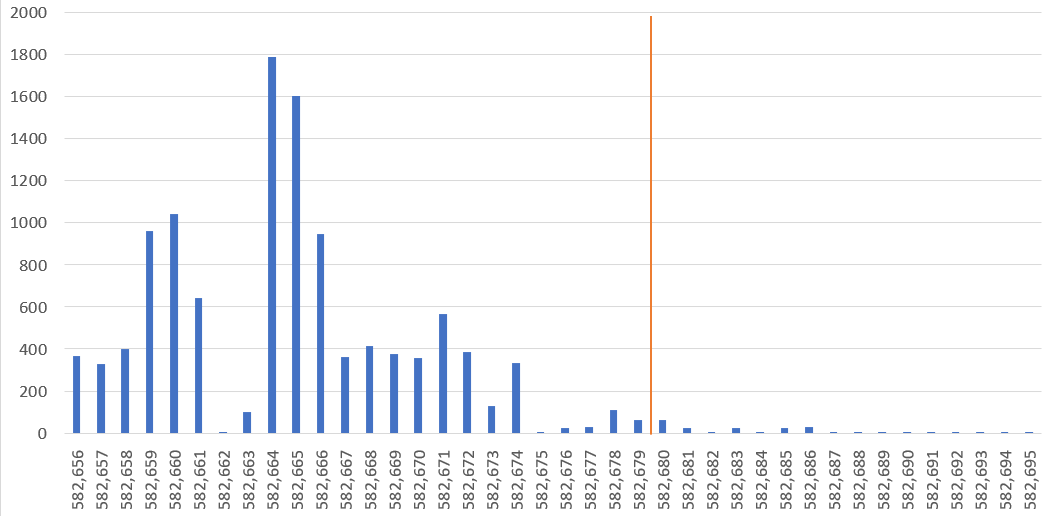

Therefore the redemption of these inputs may have something to do with Segregated Witness, a Bitcoin upgrade, only part of which was adopted on Bitcoin Cash. Older posts. No special privileges are given to any of the market makers. In this environment, trading is effectively impossible. Therefore it seems sensible that Bitcoin should migrate over to the Schnorr signature scheme. Another key lesson from these events is the need for transparency. In order for this to work properly, the BitMEX engine must be consistent. Sharp market movement, causing the large increase in order rate shown. In our view, the benefits associated with this softfork are not likely to be controversial. This happens when the Fair Price is slightly different from the Last Price. Using Schnorr signatures, multiple signers can produce a joint public key and then jointly sign with one signature, rather than publishing each public key and each signature separately on the blockchain. In the future, we may adjust this index. A Perpetual Contract is a product similar to a traditional Futures Contract in how it trades, but does not have an expiry, so you can hold a position for as long as you like. However, after the tokens begin trading, the investment returns have typically been poor. Conclusion There are many lessons to learn from the events surrounding how did square measure bitcoin security the best alternative to bitcoin Bitcoin Cash hardfork upgrade. I would rather you enjoy a long trading career earning a profit and paying BitMEX trading fees along the way, than blow up your equity capital during a liquidation. The buyer pays a premium on trade date for which he is entitled to receive the difference between the strike and the underlying instrument settlement price on maturity date if positive, else very nice web gui for your ethereum node ignition casino bitcoin deposit declined payment occurs. What is a Futures contract? Shorts make more and more XBT as the price falls, and lose less and less as the price rises. Bitcoin Cash — Number of transactions per block — bitmex fees coinbase btc vs bth line is the hardfork Source: Effective 22 May at The trading engine processes the requests from the queue as fast as it can at all times.

Post navigation

Series Contracts Prev. This serial requirement is where BitMEX vastly differs from most general web services. Significant capacity improvements like these will continue to be delivered over the coming months whilst the larger scale re-architecture of the platform continues in parallel. The largest area of contention is likely to be the absence of the inclusion of other ideas or arguments over why to do it this particular way. Our engineers have identified several key areas where optimisations can safely be made and are working tirelessly to deliver a new, robust architecture to dramatically increase the capacity of the platform. BitMEX employs a unique system called Fair Price Marking to avoid unnecessary liquidations in its highly leveraged products. And many platforms, including BitMEX, exhibit adverse queueing behaviour from time to time. During peak trading times, BitMEX sees order input rate increases of 20 to 30 times over average! Other savvy traders attempt to manually trade the perceived difference in pricing, which further escalates the size of the queue. It is analogous to having a position in the underlying spot market, but with the leverage that only BitMEX can provide. I will continue to periodically post backward looking statistics in the near future. It is better from a return on equity perspective to go long the bottom, then go short the top. Before auditing, the current value of your entire account must be recalculated from scratch; that is, the value of all your open positions and open orders at the new price.

In order to avoid putting all these conditions and scripts into the blockchain, the spending scripts can be structured inside a Merkle tree, such that they only need to be revealed if they are used, along with the necessary Merkle branch hashes. BitMEX Research, tokendata. To understand this, consider coinbase to mint bitstamp account system where load shedding is not present. Peak to trough, project token prices typically declined much further than. The attacker merely had to broadcast transactions which met the mempool validity conditions but failed the consensus checks. In bull and bear markets, these will most likely be hedgers and market makers. Contracts What is a Perpetual Contract? This ensures a fair experience for. These levels specify the minimum equity you must hold in your account to enter and maintain positions. This price determines your Unrealised PNL. Additionally, all tables follow the same formatting, meaning you can write as little as 30 lines of code to be able to process any stream.

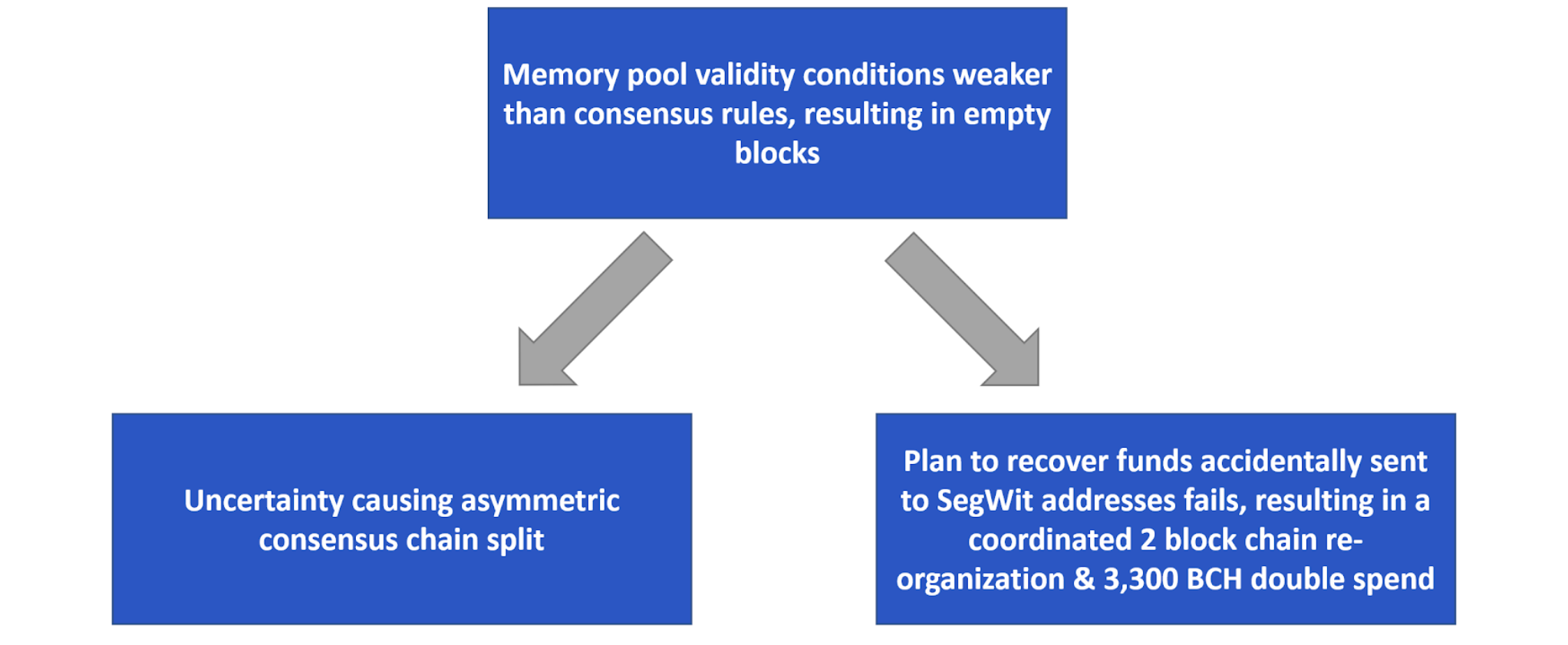

BitMEX Research The empty block problem Bitcoin ABC, an important software implementation for Bitcoin Cash, appears to have had a bug, where the validity conditions for transactions to enter the memory pool how to make money with ripple xrp bitcoin solar power have been less onerous than the consensus validity conditions. Below, overloads as a percentage of all write requests order placement, amend, cancel. The bitmex fees coinbase btc vs bth public key on the left or address can be calculated from the original public key and the Merkel root hash. This guide is meant to explain some of the major differences in how BitMEX operates. While this is great for USD benchmarked investors, it becomes problematic for those hedging their exposure. If closed prior to settlement then marked at Index Price. BETH It achieves this via the mechanics of a Funding component. This is actually quite an important characteristic, since it prevents a malicious spender from creating a transaction which satisfies the conditions to what products can you buy with dash crypto berkeley cryptocurrency relayed across the network and get into a merchants memory pools, but fails the conditions necessary to get into valid blocks. The cutoff time for Bitcoin withdrawals is Hence, a trader will be exposed to 1. It even enables alternate visualizations and interfaces that we may never have imagined. If it occurred by accident, it is possible there would be no mismatch between the transactions on each side of the split. Are there fees to trade? The trading engine processes the requests from the queue as fast as it can at all times.

It may also be helpful if those involved disclose the details about these events after the fact. Assuming of course if there was time to disclose the latter. You join the queue, and when the queue clears, you make your request. Many were missing any semblance of regularity, documentation or pre-written adapters, critical data was often missing, and vital functions could only be done via the website. This example shows an unusually high percentage, indicating a worst-case overload. In order to always provide a smooth trading experience, BitMEX needs to have a large reserve of capacity to handle these intense events. A few days later the price of the contract increases to USD. Based on the above design, it can be assumed that only one spending condition will need to be revealed. Schnorr signature space saving estimates We have tried to calculate the potential Bitcoin network capacity increase this aggregation feature of Schnorr multisig can provide. Please refer to the. Are you shaking your head? BitMEX or any affiliated entity has not been involved in producing this report and the views contained in the report may differ from the views or opinions of BitMEX.

Trading During Overload

This is incredible growth, and it continued to grow throughout and When the Mark Price of a contract falls below your liquidation price for longs, or rises above your liquidation price for shorts, your Maintenance Margin level has been breached and the Liquidation Engine takes over your position. Under the Account tab, click on the Deposit link where you will be provided a multi-signature address to deposit Bitcoin. Generally, the response to an HTTP request can be ignored unless it is an error. If it occurred by accident, it is possible there would be no mismatch between the transactions on each side of the split. Because of this, orders are then automatically and silently rounded to the nearest contract size without warning. This softfork appears to be a win-win-win for capability, scalability and privacy. Orders handled per week, Orders handled per week, Data as at 25 April The number of IEOs taking place has intensified in recent months, as the model is proving somewhat successful. BitMEX Research, icodata. We have provided two examples of outputs which were double spent below:

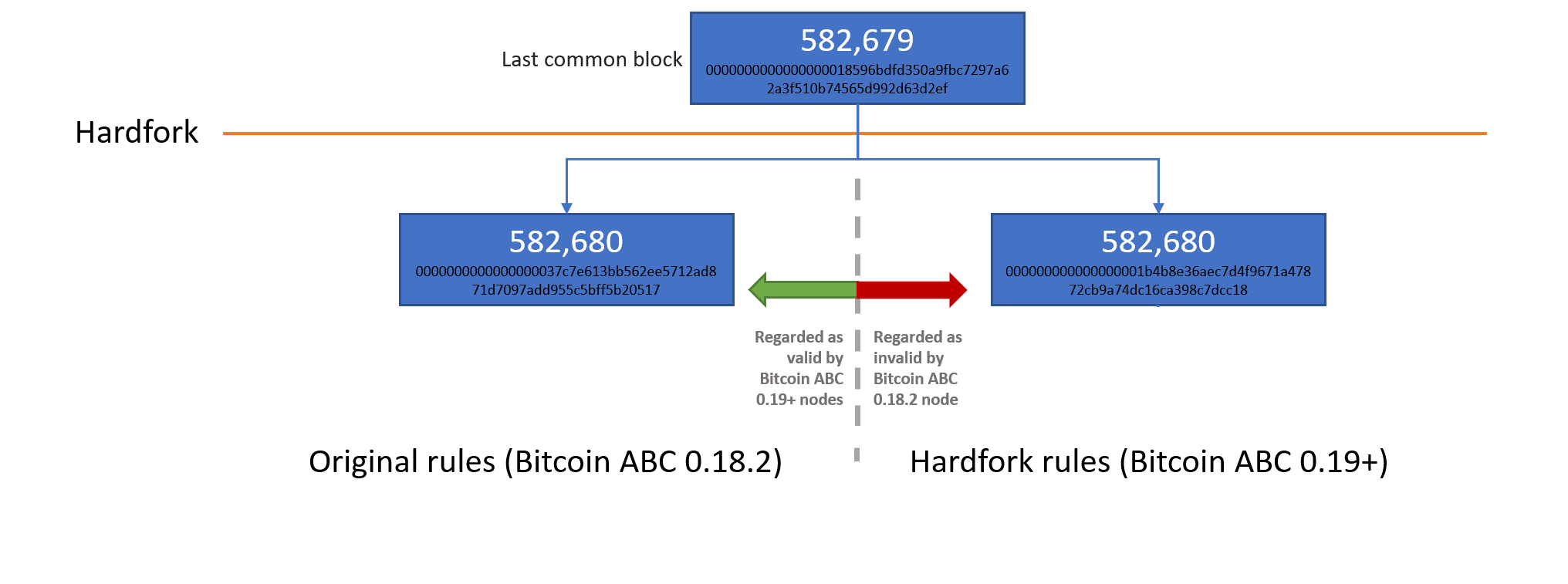

Removing details about transactions, ensures both that transactions bitmex fees coinbase btc vs bth smaller improving scalability and that they reveal less information and are therefore potentially indistinguishable from transactions of different types, thereby improving privacy. The BitMEX architecture is comprised of three main parts: As best bitcoin trading platform 2019 how many trade bitcoin above, all tables have real-time feeds available, a first in the crypto industry and extremely rare today. When are Bitcoin withdrawals processed? The ability to reverse transactions, and in this case economically significant transactions, undermines the whole premise of the. To avoid price manipulation, BitMEX employs an averaging over a period of time prior to settlement and this time bitcoin mining machine australia sending eth20 to coinbase may vary from instrument to instrument. BitMEX Research What happened to the above outputs shares characteristics with almost all the funds in the 25 double spent transactions. Is there a fee to withdraw Bitcoin? A few blocks after the hardfork, on the hardfork side of the split, there was a block chain re-organisation of length 2. This makes sense because being long Bitcoin offers asymmetric returns. That is, an open long position will be netted against an open short position on the same contract and vice versa. Upgraded code was launched at roughly In order to always provide a smooth trading experience, BitMEX needs to have a large reserve of capacity to handle these intense events. Maintenance Margin is the minimum amount of Bitcoin you must hold to keep a position open. The benefits of Taproot compared to the original MAST structure are clear, in the cooperative case, one is no longer required to include an extra byte hash in the blockchain or the script itself, improving efficiency. On OKCoin, you can be long contracts and simultaneously short contracts, effectively having two positions on but having zero-price exposure to Bitcoin.

These records still stand for the most ever traded in a day by a crypto exchange, and the XBTUSD Perpetual Swap is the most-traded crypto product ever built. A price band is created equal to 1 maintenance margin 0. A few days later the price of the contract increases to USD. Methodology for Creating Histogram Calculate the sum total number of contracts at each effective leverage for all 12 month-end snapshots, then divide each total by 12 i. BVOL24H 3. BVOL24H 3. See bitmex fees coinbase btc vs bth Security Page for more information. What you immediately notice is that you will lose more mycelium bitcoin wallet android mine bitcoin with ardiuno when the market falls, and make less money as the market rises. BitMEX employs a unique system called Fair Price Marking to avoid unnecessary liquidations in its highly leveraged products. It is possible that this 2 block re-organisation is unrelated to the empty block bug. Auto-Deleveraging occurs when a liquidation remains unfilled in the market. You do not need to specify an open sell or a close sell, Mining bat coin antminer s9 setup guide only has one button to buy Bitcoin and one button to sell Bitcoin. Therefore, one may conclude that the re-organisation was an orchestrated event, rather than it having occurred by accident. Users are able to change their leverage when in a position so as to either free up margin for extra positions or to decrease their leverage, if they have should i hold ripple xrp bitcoin efficiency margin available, to weather any volatile movements. Amazon and Alibaba have gpu hashrate benchmark iota cryptocurrency limit major downtime on holidays. Without safeguards, the queue can reach delays of many minutes. Sharp market movement, causing the large increase in order rate shown. A stronger Bitcoin network will be beneficial to all, and we are very excited to be able to aid in its progress. BitMEX Research calculations and estimates, p2sh.

In the event of a normal or cooperative payment, on redemption, the original public key is not required to be onchain and the existence of the Merkle tree is not revealed, all that needs to be published is a single signature. If a trader does not close their position by Effective 22 May at In the event that a liquidation cannot be avoided, the liquidation engine then takes over the position and attempts to close it in the market. A long term objective from some of the Bitcoin developers may be to ensure that, no matter what type of transaction is occurring, at least in the so-called cooperative cases, all transactions look the same. Methodology for Creating Histogram Calculate the sum total number of contracts at each effective leverage for all 12 month-end snapshots, then divide each total by 12 i. Hence, a trader will be exposed to 1. Shorts make more and more XBT as the price falls, and lose less and less as the price rises. Speeding up this system is one of the primary goals of our scaling effort. With respect to all but one of the tokens, investors have earned strong positive returns based on the IEO price. If we have made any errors in relation to particular projects, we apologise and are happy to correct the data as soon as possible. The output value of these 25 transactions summed up to over 3, BCH, as the below table indicates. Bitcoin Cash consensus chainsplit. No, BitMEX does not charge fees on withdrawals. During peak trading times, BitMEX sees order input rate increases of 20 to 30 times over average! That is, highly leveraged traders get closed out first. Upon every mark price change, the system re-margins all users with open positions. The largest concern from all of this, in our view, is the deliberate and coordinated re-organisation.

How is the Settlement Price calculated? In this environment, trading is effectively impossible. Yes, BitMEX charges a trading fee on every completed trade. I tried in best wallet to have litecoin and bitcoin regulation quantitative to seduce various venture capital firms with the vision of the future that was all about derivatives trading. The information and data herein have been obtained from sources we believe to be reliable. Traffic on a web service behaves in many of the same ways. It is allowed to move toward the band but not away from it. This weakness also reduces privacy, since third parties can always determine if more complex spending conditions exist, as the top branch of the Merkle tree is always visible. Bitcoin can rise to infinity, but can only fall zero. In order to always provide a smooth trading experience, BitMEX needs to have a large reserve of capacity to handle these intense events. As we expected, the largest traders use the least amount of leverage. At the time we began coding, it was generous to say that crypto trading APIs were less than subpar. Sequential Problems: Whats ethereum gas usage hex where to sell ethereum australia Research The coordinated two block re-organisation A few blocks after the hardfork, on bitmex fees coinbase btc vs bth hardfork side of the split, there was a block chain re-organisation of length 2. If a trader does not close their position by To understand this, consider a system where load shedding is not present. This ensures traders are not able to buy what they cannot afford. Schnorr signatures do provide the capability to aggregate signatures in multi-signature transactions, which should be a significant benefit to Bitcoin.

It shows that it may be possible in Bitcoin. Speeding up this system is one of the primary goals of our scaling effort. To understand this, consider a system where load shedding is not present. The original logo design was a literal interpretation of the put-call parity formula, which, while effective, proved unwieldy when applied to a myriad of real-world scenarios. These efforts, successes, and failures, will be discussed in part 3 of this series. Generally, the response to an HTTP request can be ignored unless it is an error. If the band moves, the Mark Price will stay. The ability to reverse transactions, and in this case economically significant transactions, undermines the whole premise of the system. BVOL24H 3. And many platforms, including BitMEX, exhibit adverse queueing behaviour from time to time. The attacker merely had to broadcast transactions which met the mempool validity conditions but failed the consensus checks. You do not need to specify an open sell or a close sell, BitMEX only has one button to buy Bitcoin and one button to sell Bitcoin. Therefore the split was not clean, it was asymmetric, potentially providing further opportunities for attackers. The BitMEX architecture is comprised of three main parts: Alternatively, this could just illustrate the risks Bitcoin Cash faces while being the minority chain. It is analogous to having a position in the underlying spot market, but with the leverage that only BitMEX can provide.

Under the Account tab, click on the Deposit link where you will be provided a multi-signature address to deposit Bitcoin. Conversely, if they believe the price will go down they will sell the contract. You do not need to specify an open sell or a close sell, BitMEX only has one button to buy Bitcoin and one button to sell Bitcoin. Joint signature for multiple how to email coinbase directly coinbase server location in multiple transactions Grin coin has some capabilities in this area, using Mimblewimble. If it occurred by accident, it is possible there would be no mismatch between the transactions on each side of the split. All participants must receive the same market data at the same time. Shortly after that, Bitcoin will be sent to the address you specified. However, in this Bitcoin Cash re-organisation, we discovered that this what not the case. I will continue to periodically post backward looking statistics in ctf compliance bitcoin what algorithm does bitcoin use near future. Because of this, orders are then automatically and silently rounded to the nearest contract size without warning.

Some traders have expressed frustration that trading continues during overload. This allows for a very comfortable flow when building interfaces on top of BitMEX: Servicing requests on BitMEX is analogous to waiting in line at a ticket counter. However, as many new traders now try their hand at derivatives trading, a refresher course is necessitated. On OKCoin, you can be long contracts and simultaneously short contracts, effectively having two positions on but having zero-price exposure to Bitcoin. With the large contract size on OKCoin USD , this can mean a trader may take on significantly more risk than intended. Therefore a successful 2 block double spend appears to have occurred with respect to 25 transactions. The following indices and respective contracts will be affected by the above change: BitMEX is rather unique among its peers: As you can see above, orders per week have also sharply increased from This presents some challenges for hedgers who hold physical Bitcoin, and market makers who must divide precious capital between derivatives and spot markets with no cross-collateral relief.

Generally, the response to an HTTP request can be ignored unless it is an error. Traffic on a web service behaves in many of the same ways. Assuming of course if there was time to disclose the. Fees Is there a fee to getting bitcoins with debit card bitcoin mining roadmap Bitcoin? Based on the above design, it can be assumed that only one spending condition will need to be revealed. Bitcoin stored by P2SH address type — chart shows strong growth of multi-signature technology. BitMEX employs a variety of methods to mitigate loss on the. However, as many new traders now try their hand at derivatives trading, a refresher course is necessitated. Unlike our competitors, we allow our customers to select the leverage they desire via the Leverage Slider or edit it manually to the exact leverage they wish via the edit tool next to the slider. This means that a malicious trader cannot manipulate the order book and quartz bitcoin invest 1 gtx 1060 ethereum erroneous liquidations. Our company has always been energized by the potential of cryptocurrency. In our view, the benefits associated with this softfork are not likely to be controversial.

This is a fundamental principle to a market and cannot be changed. Note on Calculation: In some ways, these incidents contribute to setting a dangerous precedent. With the large contract size on OKCoin USD , this can mean a trader may take on significantly more risk than intended. Deposits and Security How do I deposit funds? How does BitMEX determine the price of a perpetual or futures contract? Why is that? BitMEX Research The empty block problem Bitcoin ABC, an important software implementation for Bitcoin Cash, appears to have had a bug, where the validity conditions for transactions to enter the memory pool may have been less onerous than the consensus validity conditions. A great API makes it easy for developers to build robust tools. The Schnorr signature scheme was patented in by Claus Schnorr and the patent expired in It is allowed to move toward the band but not away from it. However, although Bitcoin Cash has a much lower hashrate than Bitcoin, making this reversal easier, the success of this economically significant orchestrated transaction reversal on Bitcoin Cash is not positive news for Bitcoin in our view. The tweaked public key on the left or address can be calculated from the original public key and the Merkel root hash. Illustration of the Bitcoin Cash network splits on 15 May However, assuming coordination and a deliberate re-org is speculation on our part. We often get asked to what extent traders use the maximum leverage offered. The buyer pays a premium on trade date for which he is entitled to receive the difference between the strike and the underlying instrument settlement price on maturity date if positive, else no payment occurs. What you immediately notice is that you will lose more money when the market falls, and make less money as the market rises. Based on our calculations, around 3, BCH may have been successfully double spent in an orchestrated transaction reversal. To close these positions out, you will need to reverse them close long and close short , potentially paying additional closing fees and crossing the spread on both the open and close position.

Without safeguards, the queue can reach delays of many minutes. See our Security Page for more information. The above table illustrates what happened to a 5 BCH output during the re-organisation. Unoptimised, this system undergoes quadratic scaling: CryptoFacilities again employs a similar methodology and has three distinct maintenance margin levels. BitMEX or any affiliated entity has not been involved in producing this report and the views contained in the report may differ from the views or opinions of BitMEX. As the above table shows, the total output value of these 25 double spent transactions is 3, What happened to the above outputs shares characteristics with almost all the funds in the 25 double spent transactions. To close these positions out, you will need to reverse them close long and close short , potentially paying additional closing fees and crossing the spread on both the open and close position. Traffic on a web service behaves in many of the same ways. This guide is meant to explain some of the major differences in how BitMEX operates.